Sonos Results Presentation Deck

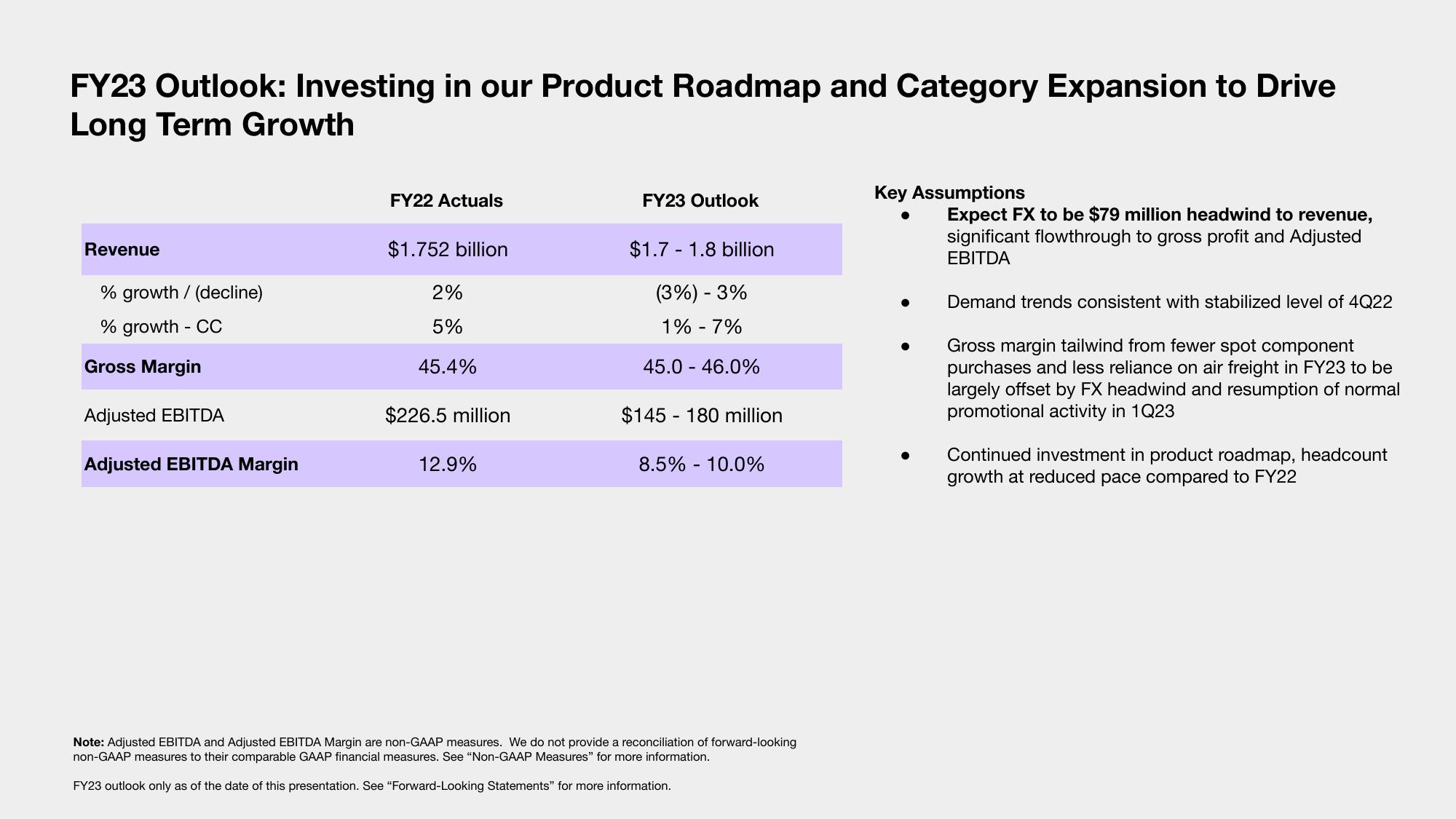

FY23 Outlook: Investing in our Product Roadmap and Category Expansion to Drive

Long Term Growth

Revenue

% growth / (decline)

% growth - CC

Gross Margin

Adjusted EBITDA

Adjusted EBITDA Margin

FY22 Actuals

$1.752 billion

2%

5%

45.4%

$226.5 million

12.9%

FY23 Outlook

$1.7 1.8 billion

(3%) -3%

1% - 7%

45.0 - 46.0%

$145 180 million

8.5% - 10.0%

Note: Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP measures. We do not provide a reconciliation of forward-looking

non-GAAP measures to their comparable GAAP financial measures. See "Non-GAAP Measures" for more information.

FY23 outlook only as of the date of this presentation. See "Forward-Looking Statements" for more information.

Key Assumptions

Expect FX to be $79 million headwind to revenue,

significant flowthrough to gross profit and Adjusted

EBITDA

● Demand trends consistent with stabilized level of 4Q22

Gross margin tailwind from fewer spot component

purchases and less reliance on air freight in FY23 to be

largely offset by FX headwind and resumption of normal

promotional activity in 1Q23

Continued investment in product roadmap, headcount

growth at reduced pace compared to FY22View entire presentation