Hilltop Holdings Results Presentation Deck

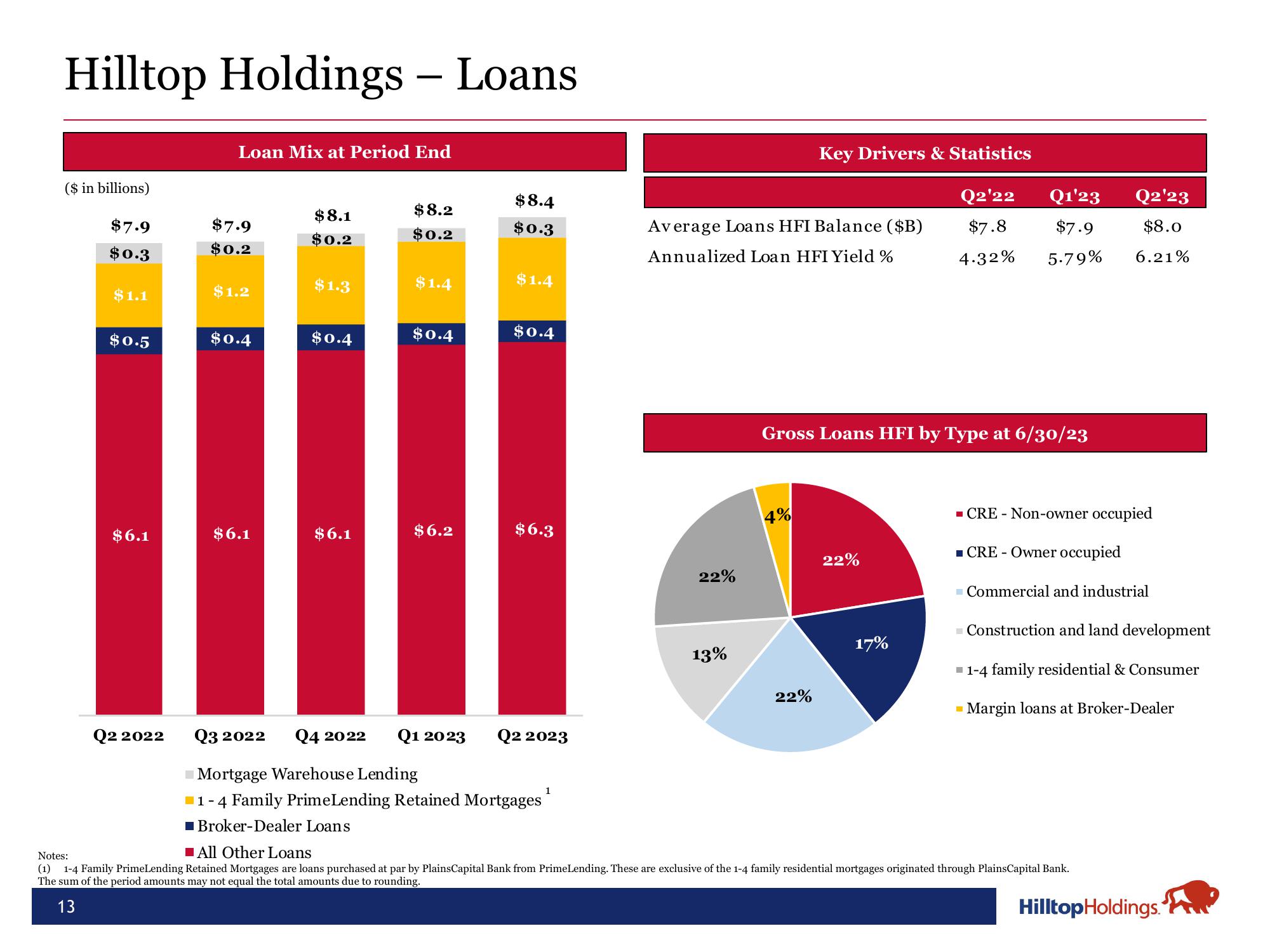

Hilltop Holdings - Loans

($ in billions)

$7.9

$0.3

$1.1

$0.5

$6.1

Loan Mix at Period End

$7.9

$0.2

$1.2

$0.4

$6.1

$8.1

$0.2

$1.3

$0.4

$6.1

$8.2

$0.2

$1.4

$0.4

$6.2

$8.4

$0.3

$1.4

$0.4

$6.3

1

Average Loans HFI Balance ($B)

Annualized Loan HFI Yield %

22%

13%

Key Drivers & Statistics

Q2'22

Q1'23

$7.8

$7.9

4.32% 5.79%

Gross Loans HFI by Type at 6/30/23

4%

22%

22%

17%

Q2'23

$8.0

6.21%

■CRE - Non-owner occupied

■CRE - Owner occupied

Commercial and industrial

Construction and land development

1-4 family residential & Consumer

Margin loans at Broker-Dealer

Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023

Mortgage Warehouse Lending

1-4 Family Prime Lending Retained Mortgages

■Broker-Dealer Loans

Notes:

■All Other Loans

(1) 1-4 Family PrimeLending Retained Mortgages are loans purchased at par by PlainsCapital Bank from PrimeLending. These are exclusive of the 1-4 family residential mortgages originated through PlainsCapital Bank.

The sum of the period amounts may not equal the total amounts due to rounding.

13

Hilltop Holdings.View entire presentation