Comcast Results Presentation Deck

Cable Communications 2nd Quarter 2020 Overview

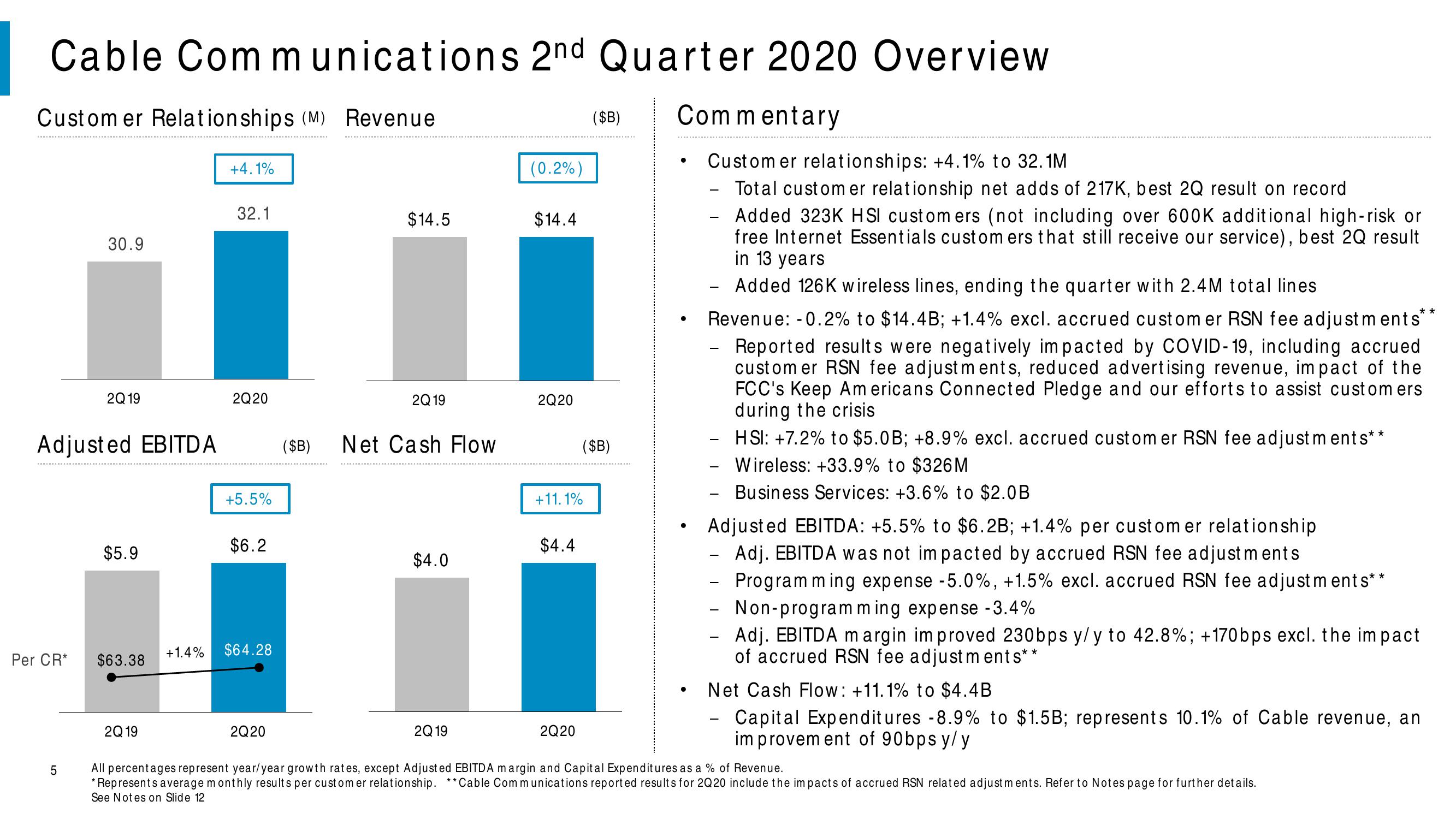

Customer Relationships (M) Revenue

Per CR*

30.9

Adjusted EBITDA

5

2Q 19

$5.9

$63.38

2Q 19

+4.1%

32.1

2Q20

+5.5%

$6.2

+1.4% $64.28

2Q20

($B)

$14.5

2Q 19

Net Cash Flow

$4.0

2Q19

(0.2%)

$14.4

2Q20

+11.1%

$4.4

2Q20

($B)

($B)

Commentary

Customer relationships: +4.1% to 32.1M

Total customer relationship net adds of 217K, best 2Q result on record

Added 323K HSI customers (not including over 600K additional high-risk or

free Internet Essentials customers that still receive our service), best 2Q result

in 13 years

Added 126K wireless lines, ending the quarter with 2.4M total lines

●

●

Revenue: -0.2% to $14.4B; +1.4% excl. accrued customer RSN fee adjustments*

Reported results were negatively impacted by COVID-19, including accrued

customer RSN fee adjustments, reduced advertising revenue, impact of the

FCC's Keep Americans Connected Pledge and our efforts to assist customers

during the crisis

HSI: +7.2% to $5.0B; +8.9% excl. accrued customer RSN fee adjustments**

Wireless: +33.9% to $326M

Business Services: +3.6% to $2.0B

-

**

Adjusted EBITDA: +5.5% to $6.2B; +1.4% per customer relationship

Adj. EBITDA was not impacted by accrued RSN fee adjustments

Programming expense -5.0%, +1.5% excl. accrued RSN fee adjustments**

Non-programming expense -3.4%

Adj. EBITDA margin improved 230bps y/y to 42.8%; +170bps excl. the impact

of accrued RSN fee adjustments**

Net Cash Flow: +11.1% to $4.4B

Capital Expenditures -8.9% to $1.5B; represents 10.1% of Cable revenue, an

improvement of 90bps y/y

All percentages represent year/year growth rates, except Adjusted EBITDA margin and Capital Expenditures as a % of Revenue.

* Represents average monthly results per customer relationship. ** Cable Communications reported results for 2Q20 include the impacts of accrued RSN related adjustments. Refer to Notes page for further details.

See Notes on Slide 12View entire presentation