Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

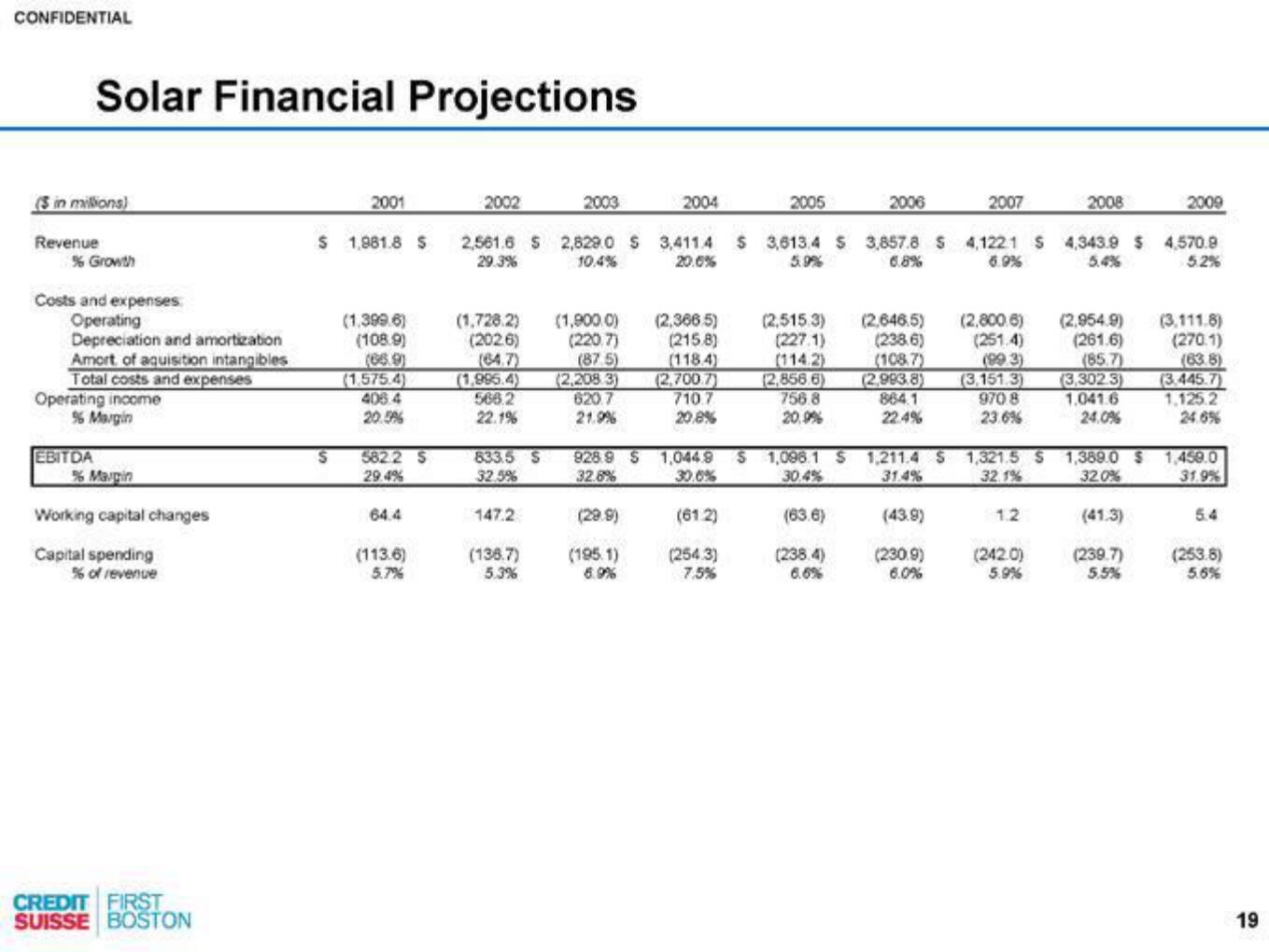

Solar Financial Projections

(3 in millions)

Revenue

% Growth

Costs and expenses:

Operating

Depreciation and amortization

Amort of aquisition intangibles

Total costs and expenses

Operating income

% Margin

EBITDA

% Margin

Working capital changes

Capital spending

% of revenue

CREDIT FIRST

SUISSE BOSTON

2001

$ 1,981.8 S

S

(1.399.6)

(108.9)

(1.575.4)

406.4

20.5%

5822 S

29.4%

64.4

(113.6)

5.7%

2009

2,561.6 $ 2,829.0 S 3,411.4 $ 3,613.4 $ 3,857.8 S 4,1221 S 4,343.9 $ 4,570.9

29.3%

20.6%

5.9%

10,4%

6.8%

5.4%

5.2%

2002

(1,728.2) (1,900.0)

(202.6)

(220,7)

(64.7)

(87.5)

(1,995.4)

566.2

22.1%

833.5 S

32.5%

147.2

2003

(138.7)

5.3%

(2,208.3)

620.7

21.9%

928.9 S

32.8%

(29.9)

(195.1)

6.9%

2004

(2,366.5)

(2158)

(118.4)

(2,700.7)

710.7

20.8%

1,044.9

30.0%

(61.2)

(254.3)

7.5%

2005

(2,515.3)

(227.1)

(114.2)

(2,856.6)

756.8

20.9%

S 1,098.1 S

30.4%

(63.6)

(238.4)

6.6%

2006

(2,646.5)

(238.6)

(108.7)

864.1

22.4%

2007

(2,993.8) (3.151.3)

970 8

23.6%

(2,800.6)

(251.4)

(99.3)

(43.9)

(230.9)

6.0%

1.2

2008

(242.0)

5.9%

(2,954.9)

(261.6)

(85.7)

(3,302.3)

1.041.6

24.0%

1,211.4 S 1,321.5 S 1,389.0 $ 1,450.0

31.4%

32.0%

32.1%

31.9%

(3,111.8)

(270.1)

(63.8)

(41.3)

(239.7)

5.5%

(3.445.7)

1.125.2

24.6%

5.4

(253.8)

5.6%

19View entire presentation