Evercore Investment Banking Pitch Book

Preliminary Financial Analysis

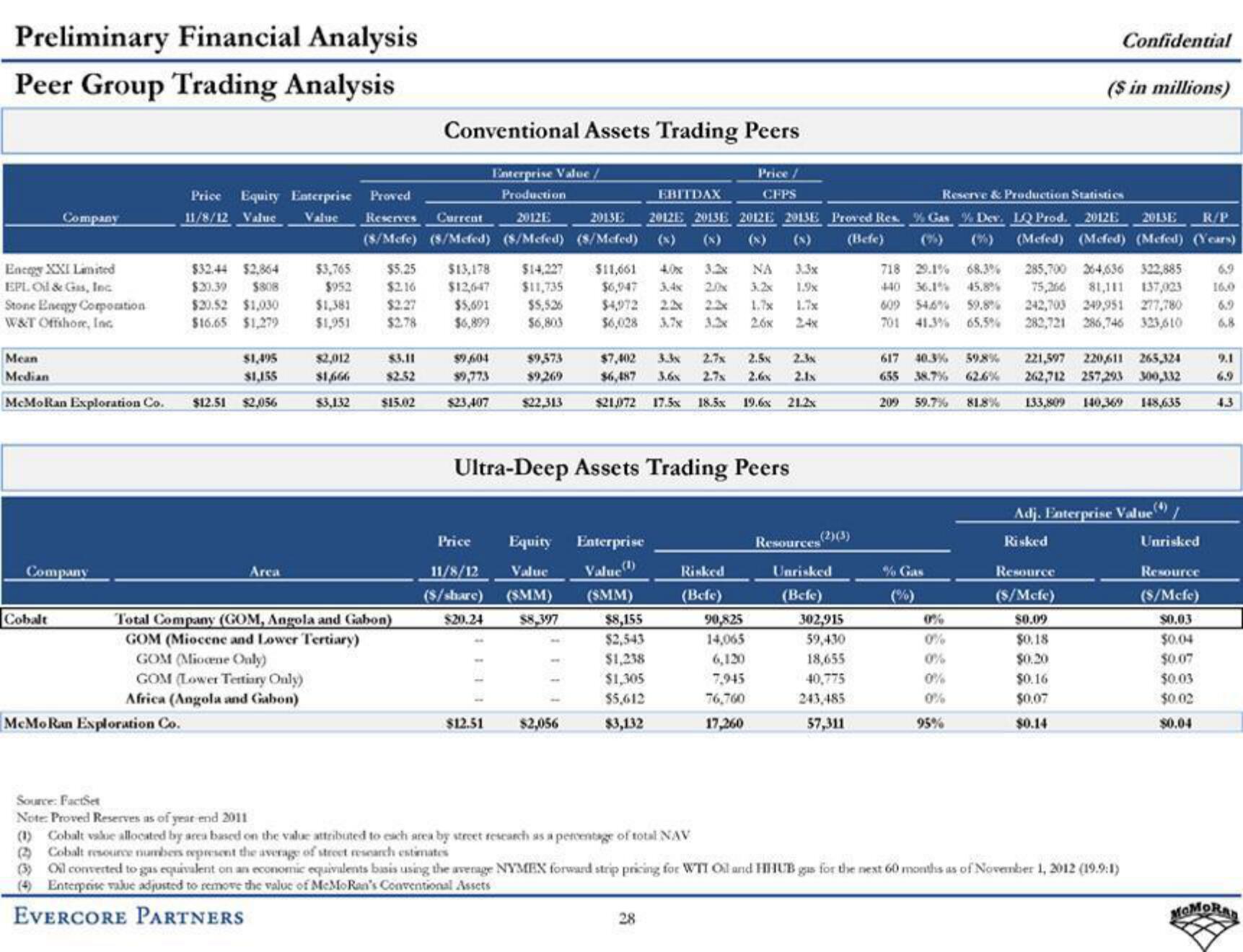

Peer Group Trading Analysis

Company

Encegy XXI Limited

EPL Oil & Gas, Inc.

Stone Energy Corporation

W&T Offshore, Inc.

Mean

Median

McMoRan Exploration Co.

Company

Cobalt

McMo Ran Exploration Co.

$32.44 $2,864

$20.39 $808

$20.52 $1,030

$16.65 $1,279

Price Equity Enterprise Proved

11/8/12 Value Value Reserves Current

$1,495

$1,155

$12.51 $2,056

Area

$3,765

$952

$1,381

$1,951

Enterprise Value

Production

2012E

2013E

(8/Mefe) (8/Mefed) (S/Mefed) (S/Mefed)

Conventional Assets Trading Peers

Price /

CFPS

$5.25 $13,178 $14,227

$2.16 $12,647 $11,735

$2.27

$5,526

$5,691

$2.78

$6,899

$6,803

$2,012

$3.11

31,666 $2.52

$3,132 $15.02

Total Company (GOM, Angola and Gabon)

GOM (Miocene and Lower Tertiary)

GOM (Miocene Only)

GOM (Lower Tertiary Only)

Africa (Angola and Gabon)

$9,604

$9,773

$23,407

Price

$9,573

$9,269

$22,313

$12.51

11/8/12 Value

($/share)

(SMM)

$20.24

Ultra-Deep Assets Trading Peers

Equity Enterprise

Value (1)

(SMM)

$8,397

$2,056

$11,661

NA

$6,947 3.4x 20x 3.2x 1.9x

$4,972

22x 1.7x

$6,028 3.7x

2.6x

EBITDAX

2.7x 2.50x

$7,402

$6,487 3.6x 2.7% 2.60% 2.1x

$21072 175x185x 19.6x 21.2x

$8,155

$2,543

$1,238

$1,305

$5,612

$3,132

(Befe)

Reserve & Production Statistics

2012E 2013E 2012E 2013E Proved Res. % Gas % Dev. LQ Prod.

2012E 2013E R/P

(x)

(%) (Mefed) (Mefed) (Mefed) (Years)

718 29.1% 68.3% 285,700 264,636 322,885 6.9

440 36.1% 45.8% 75,266 81,111 137,023 16.0

609 54.6% 59.8% 242,703 249,951 277,780 6.9

701 41.3% 65,5% 282,721 286,746 323,610 6.8

28

Risked

(Befe)

90,825

14,065

6,120

24x

7,945

76,760

17,260

(2) (3)

Resources

Unrisked

(Befe)

302,915

59,430

18,655

40,775

243,485

57,311

617 40.3% 59,8%

655

38,7%

209 59.7%

% Gas

0%

0%

0%

0%

95%

81.8%

Confidential

($ in millions)

221,597 220,611 265,324

262,712 257,293 300,332

133,809 140,369 148,635

Resource

(S/Mcfe)

$0.09

$0.18

$0.20

$0.16

$0.07

$0.14

Adj. Enterprise Value()

Risked

Source: FactSet

Note: Proved Reserves as of year end 2011

(1) Cobalt value allocated by area based on the value attributed to each area by street research as a percentage of total NAV

(2) Cobalt resource numbers represent the average of street research estimates

(3) Oil converted to gas equivalent on an economic equivalents basis using the average NYMEX forward strip pricing for WTI Oil and HHUB gas for the next 60 months as of November 1, 2012 (19.9:1)

(4) Enterprise value adjusted to remove the value of MeMo Ran's Conventional Assets

EVERCORE PARTNERS

Unrisked

Resource

($/Mcfe)

$0,03

$0.04

$0.07

$0.03

$0.02

$0.04

9.1

6.9

MOMORADView entire presentation