Houlihan Lokey Investor Presentation Deck

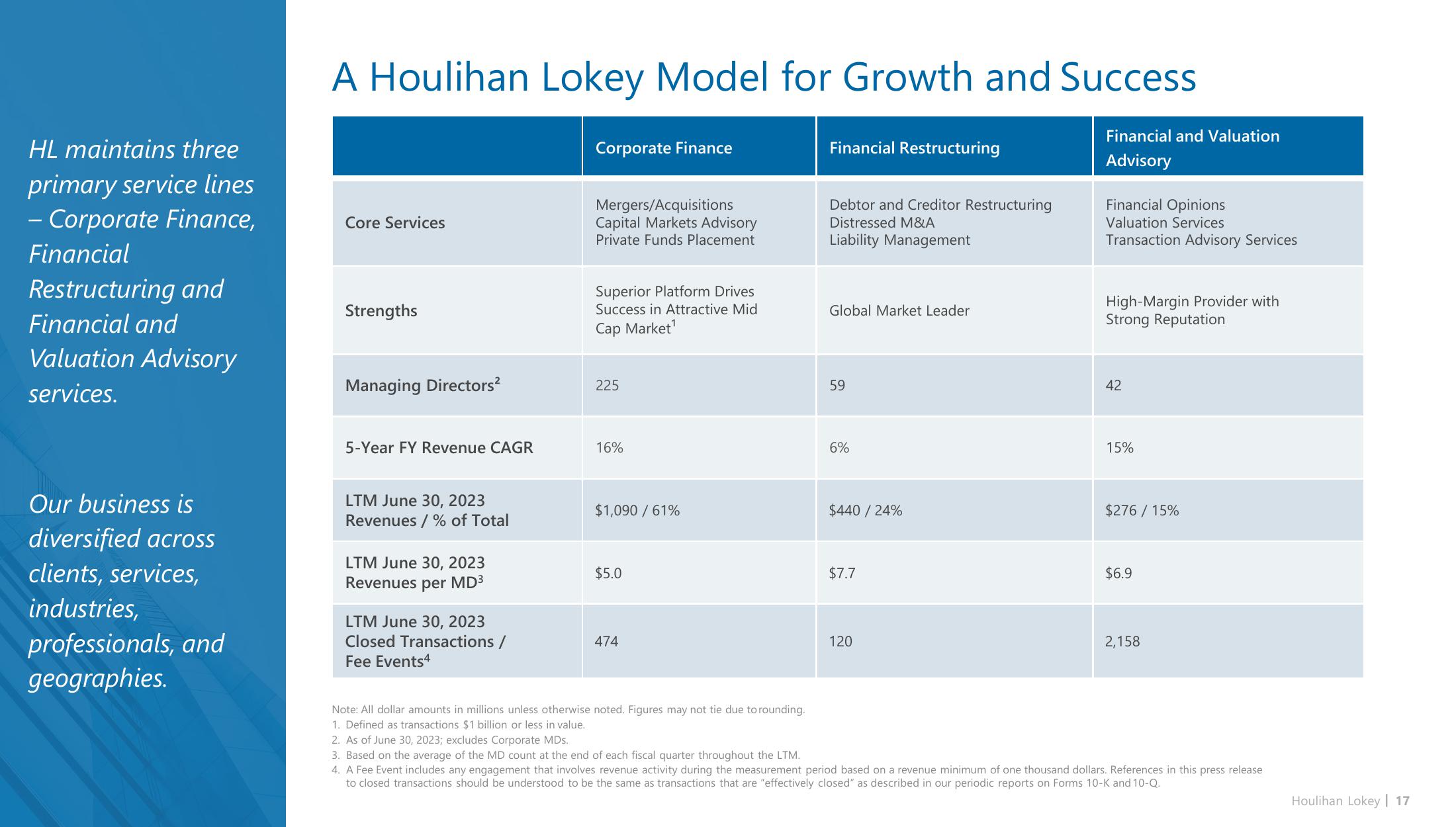

HL maintains three

primary service lines

- Corporate Finance,

Financial

Restructuring and

Financial and

Valuation Advisory

services.

Our business is

diversified across

clients, services,

industries,

professionals, and

geographies.

A Houlihan Lokey Model for Growth and Success

Financial and Valuation

Advisory

Core Services

Strengths

Managing Directors²

5-Year FY Revenue CAGR

LTM June 30, 2023

Revenues/ % of Total

LTM June 30, 2023

Revenues per MD³

LTM June 30, 2023

Closed Transactions /

Fee Events4

Corporate Finance

Mergers/Acquisitions

Capital Markets Advisory

Private Funds Placement

Superior Platform Drives

Success in Attractive Mid

Cap Market¹

225

16%

$1,090 / 61%

$5.0

474

Financial Restructuring

Debtor and Creditor Restructuring

Distressed M&A

Liability Management

Global Market Leader

59

6%

$440 / 24%

$7.7

120

Financial Opinions

Valuation Services

Transaction Advisory Services

High-Margin Provider with

Strong Reputation

42

15%

$276 / 15%

$6.9

2,158

Note: All dollar amounts in millions unless otherwise noted. Figures may not tie due to rounding.

1. Defined as transactions $1 billion or less in value.

2. As of June 30, 2023; excludes Corporate MDs.

3. Based on the average of the MD count at the end of each fiscal quarter throughout the LTM.

4. A Fee Event includes any engagement that involves revenue activity during the measurement period based on a revenue minimum of one thousand dollars. References in this press release

to closed transactions should be understood to be the same as transactions that are "effectively closed" as described in our periodic reports on Forms 10-K and 10-Q.

Houlihan Lokey | 17View entire presentation