Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

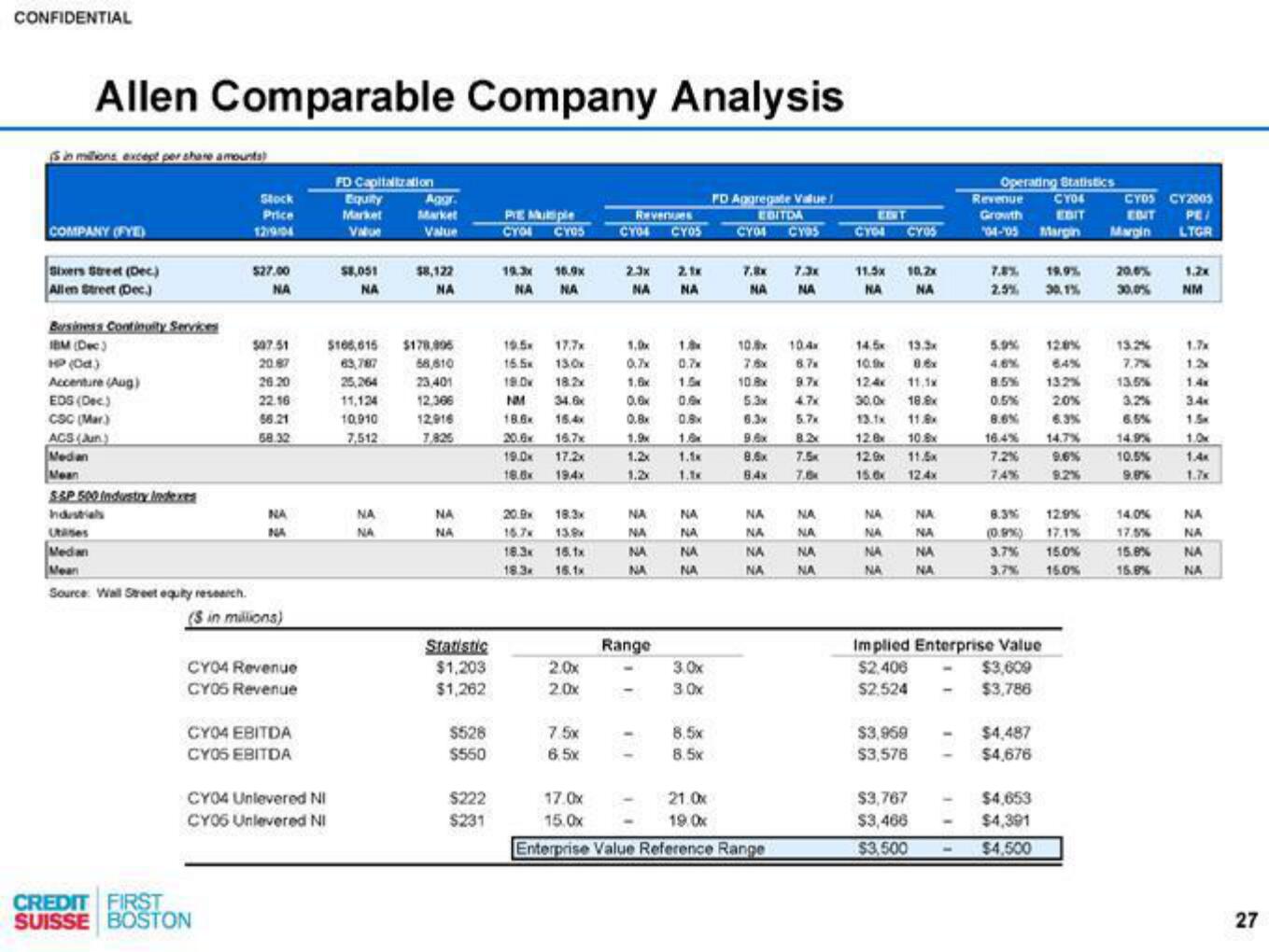

Allen Comparable Company Analysis

Sin milions except per share amounts)

COMPANY (FYE)

Sixers Street (Dec.)

Allen Street (Dec.)

Bersiness Continuity Services

IBM (Dec)

HP (Od)

Accenture (Aug)

EOS (Dec.)

CSC (Mar)

ACS (Jun

Median

Mean

S&P 500 Industry Indexes

Industrials

Utises

Median

Mean

Source: Wall Street equity research.

Stock

Price

$27.00

NA

507.51

20.87

26.20

22.16

66.21

58.32

NA

($ in millions)

CREDIT FIRST

SUISSE BOSTON

CY04 Revenue

CY05 Revenue

CY04 EBITDA

CY05 EBITDA

CY04 Unlevered NI

CY05 Unlevered NI

FD Capitalization

Equity

Market

Value

$8,051

NA

$166,615

63,787

25,264

11,124

10,910

7,512

NA

NA

Aggr.

Market

Value

$8,122

NA

$178.905

68,610

23,401

12.306

12,916

7,825

NA

NA

Statistic

$1,203

$1,262

$528

$550

$222

$231

PE Multiple

CYOL CYOS

19.3x 16.9x

NA NA

19.5x 17.7x

15.5x 13.0x

19.0v 18.2x

NM

18.6.

20.6

34.6x

15.4x

16.7x

19.0x 17.2x

18.8x 19.4x

20.9

18.3x

16.7

13.8x

18.3K 16.1x

18.3

16.1x

2.0x

2.0x

7.5x

6.5x

Revenues

CYOS

CY04

2.3x

NA

1.8

1.0x

0.7x

0,7x

1,6x 1.5

0.6x 0.6

0.8x

0.8x

1.0

2.1x

NA

1.9

1.2x 1.1x

1.2x

1.1K

NA

NA

NA

NA

Range

11

NA

NA

NA

NA

3.0x

3.0x

8.5x

8.5x

FD Aggregate Value

EBITDA

CYO CYDS

NA

10.8x10.4x

7.8x 8.7

10.8x

5.3x

9.7x

4.7x

5.7x

6.3x

9.6x 8.2x

8.6x

7.5

8.4x

NA

NA

7.3x

NA

NA

NA

17.0x

21.0x

15.0x

19.0x

Enterprise Value Reference Range

NA

NA

NA

NA

EINT

CYOU CYOS

113 10,2x

NA NA

14.5x 19.3x

10.9 8.6x

12.4x 11,1x

30.0x 18.8x

11.8x

12.8x 10.8x

12.9x 115.

15.0x 12.4x

NA

NA

NA

NA

$3,959

$3,576

NA

NA

NA

NA

$3,767

$3,466

$3,500

Operating Statistics

Revenue CYOS

Growth EBIT

04-05 Margin

-

7.8% 19.9%

2.5% 30.1%

Implied Enterprise Value

$2,406

$2,524

5.9% 12.0%

4.6%

8.5%

0.5%

8.6%

13.2%

2.0%

6.3%

16.4% 14.7%

7.2%

7.4%

9.6%

8.3%

(0.9%)

3.7%

3.7%

$3,609

$3,786

$4,487

$4,676

$4,653

$4,391

$4,500

12.9%

17.1%

15.0%

15.0%

CYDS CY2005

EDIT PE/

Margin LTGR

20.0%

13.2%

7.7%

13.5%

3,2%

6.5%

14.9%

10.5%

9.0%

14.0%

17.5%

15.8%

15.8%

1.2x

NM

1.7x

1.2

1.4x

3.4K

1.5K

1.4K

NA

NA

NA

NA

27View entire presentation