Hagerty Investor Presentation Deck

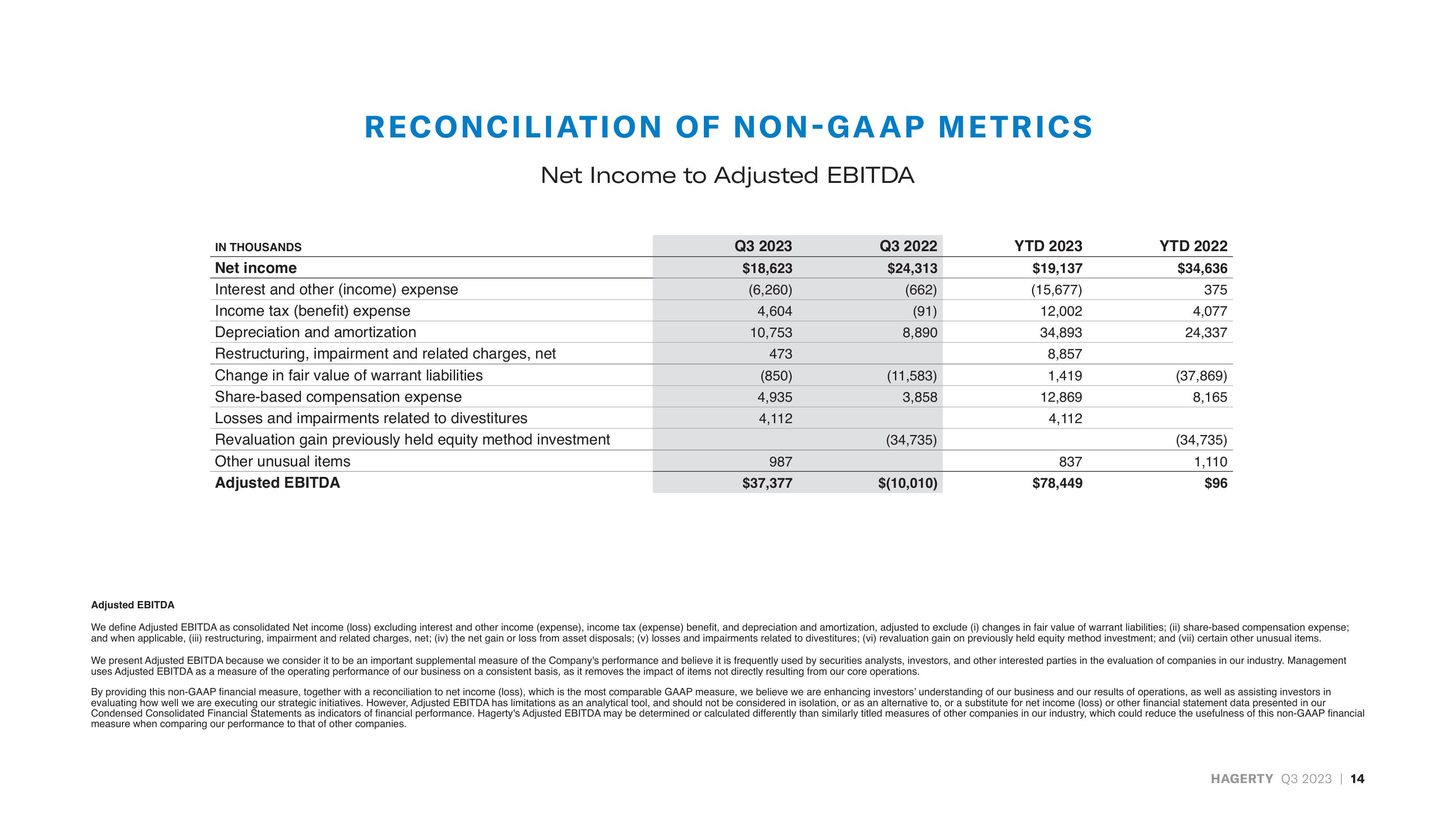

RECONCILIATION OF NON-GAAP METRICS

Net Income to Adjusted EBITDA

IN THOUSANDS

Net income

Interest and other (income) expense

Income tax (benefit) expense

Depreciation and amortization

Restructuring, impairment and related charges, net

Change in fair value of warrant liabilities

Share-based compensation expense

Losses and impairments related to divestitures

Revaluation gain previously held equity method investment

Other unusual items

Adjusted EBITDA

Q3 2023

$18,623

(6,260)

4,604

10,753

473

(850)

4,935

4,112

987

$37,377

Q3 2022

$24,313

(662)

(91)

8,890

(11,583)

3,858

(34,735)

$(10,010)

YTD 2023

$19,137

(15,677)

12,002

34,893

8,857

1,419

12,869

4,112

837

$78,449

YTD 2022

$34,636

375

4,077

24,337

(37,869)

8,165

(34,735)

1,110

$96

Adjusted EBITDA

We define Adjusted EBITDA as consolidated Net income (loss) excluding interest and other income (expense), income tax (expense) benefit, and depreciation and amortization, adjusted to exclude (i) changes in fair value of warrant liabilities; (ii) share-based compensation expense;

and when applicable, (iii) restructuring, impairment and related charges, net; (iv) the net gain or loss from asset disposals; (v) losses and impairments related to divestitures; (vi) revaluation gain on previously held equity method investment; and (vii) certain other unusual items.

We present Adjusted EBITDA because we consider it to be an important supplemental measure of the Company's performance and believe it is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in our industry. Management

uses Adjusted EBITDA as a measure of the operating performance of our business on a consistent basis, as it removes the impact of items not directly resulting from our core operations.

By providing this non-GAAP financial measure, together with a reconciliation to net income (loss), which is the most comparable GAAP measure, we believe we are enhancing investors' understanding of our business and our results of operations, as well as assisting investors in

evaluating how well we are executing our strategic initiatives. However, Adjusted EBITDA has limitations as an analytical tool, and should not be considered in isolation, or as an alternative to, or a substitute for net income (loss) or other financial statement data presented in our

Condensed Consolidated Financial Statements as indicators of financial performance. Hagerty's Adjusted EBITDA may be determined or calculated differently than similarly titled measures of other companies in our industry, which could reduce the usefulness of this non-GAAP financial

measure when comparing our performance to that of other companies.

HAGERTY Q3 2023 | 14View entire presentation