Tudor, Pickering, Holt & Co Investment Banking

Discount Rate

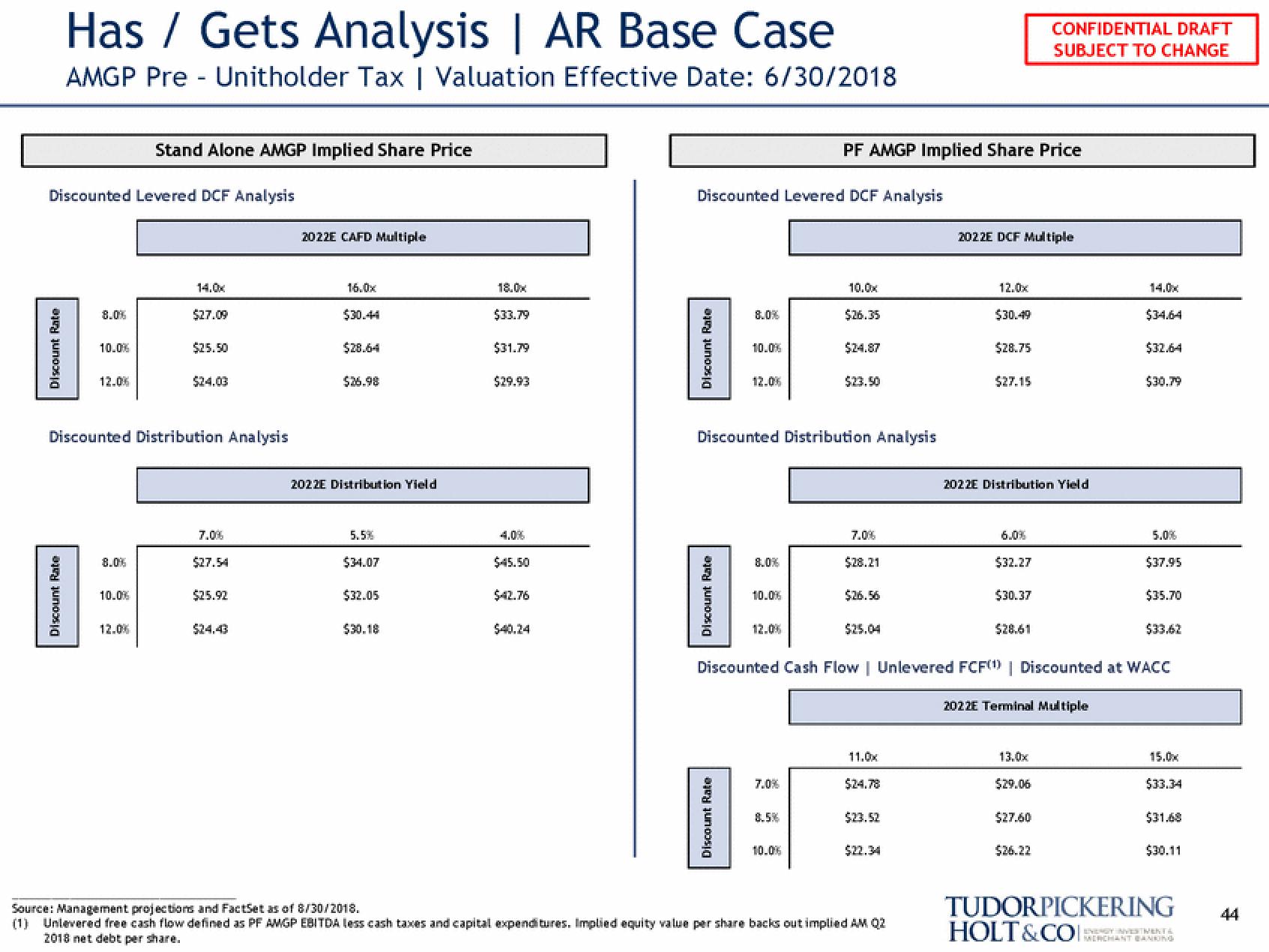

Has / Gets Analysis | AR Base Case

AMGP Pre Unitholder Tax | Valuation Effective Date: 6/30/2018

Discounted Levered DCF Analysis

Discount Rate

8.0%

10.0%

12.0%

8.0%

Stand Alone AMGP Implied Share Price

Discounted Distribution Analysis

10.0%

12.0%

14.0x

$27.09

$25.50

7.0%

$27.54

$25.92

$24.43

2022E CAFD Multiple

16.0x

$30.44

$28.64

$26.98

2022E Distribution Yield

5.5%

$34.07

$32.05

$30.18

18.0x

$33.79

$31.79

$29.93

$45.50

$42.76

$40.24

Discounted Levered DCF Analysis

Discount Rate

Discount Rate

8.0%

10.0%

Discount Rate

12.0%

8.0%

Discounted Distribution Analysis

10.0%

12.0%

7.0%

PF AMGP Implied Share Price

8.5%

10.0x

$26.35

10.0%

$24.87

$23.50

7.00

$28.21

$26.56

11.0x

$24.78

$23.52

$22.34

Source: Management projections and FactSet as of 8/30/2018.

(1) Unlevered free cash flow defined as PF AMGP EBITDA less cash taxes and capital expenditures. Implied equity value per share backs out implied AM Q2

2018 net debt per share.

2022E DCF Multiple

12.0x

$30.49

$28.75

$27.15

2022E Distribution Yield

6.0%

$32.27

$30.37

Discounted Cash Flow | Unlevered FCF(1) | Discounted at WACC

$28.61

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

2022E Terminal Multiple

13.0x

$29.06

$27.60

$26.22

14.0x

$34.64

$32.64

$30.79

5.0%

$37.95

$35.70

$33.62

15.0x

$33.34

$31.68

$30.11

TUDORPICKERING

HOLT&COI:

ENERGY NYESTIVENTA

MERCHANT BANKING

44View entire presentation