Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

4,838

1,467

1,721

1,559

91

PERFORMANCE

FY20

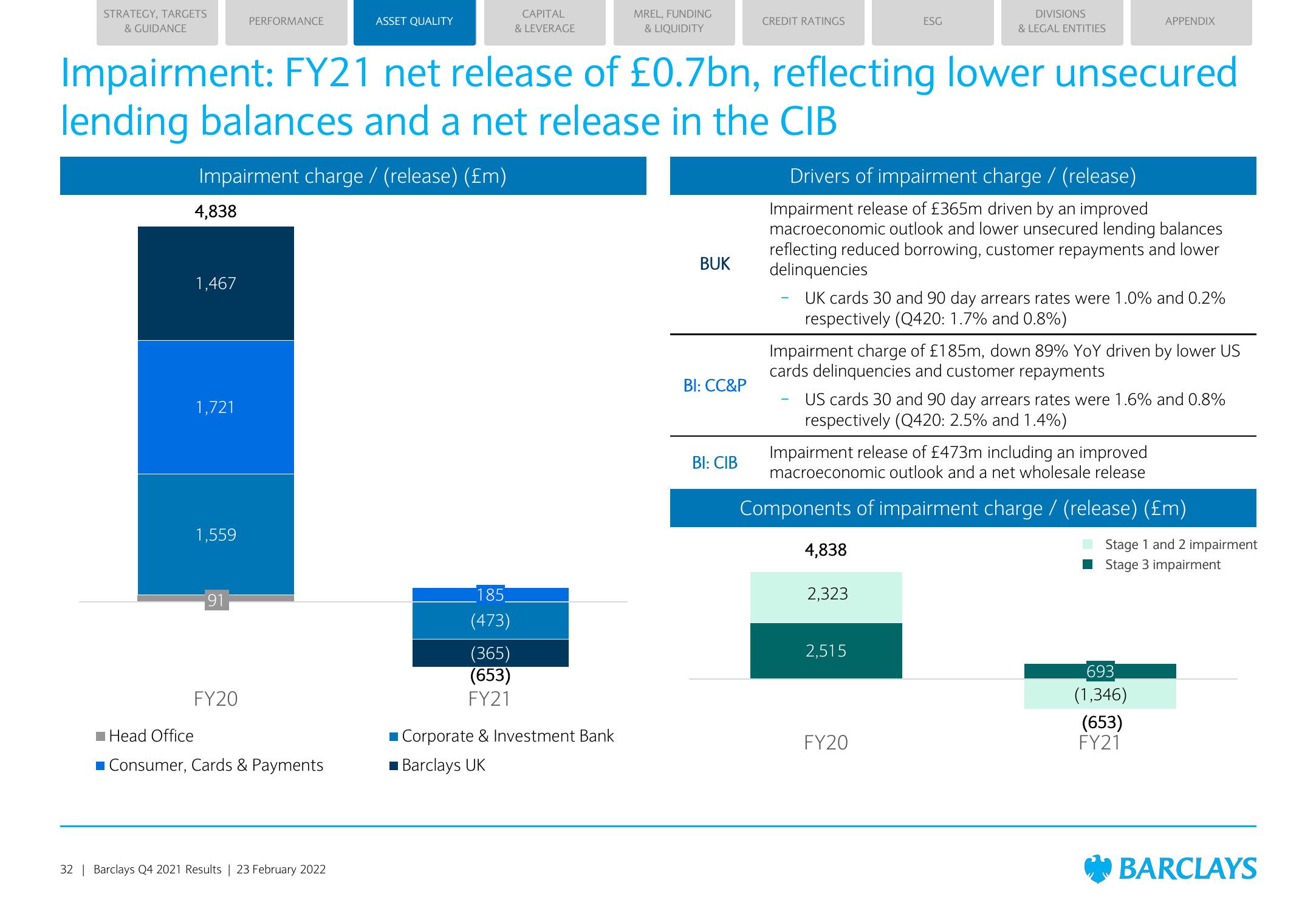

Impairment: FY21 net release of £0.7bn, reflecting lower unsecured

lending balances and a net release in the CIB

Impairment charge / (release) (£m)

Head Office

■ Consumer, Cards & Payments

ASSET QUALITY

32 | Barclays Q4 2021 Results | 23 February 2022

185

(473)

CAPITAL

& LEVERAGE

(365)

(653)

FY21

MREL, FUNDING

& LIQUIDITY

■ Corporate & Investment Bank

■ Barclays UK

BUK

Bl: CC&P

CREDIT RATINGS

BI: CIB

ESG

Drivers of impairment charge / (release)

Impairment release of £365m driven by an improved

macroeconomic outlook and lower unsecured lending balances

reflecting reduced borrowing, customer repayments and lower

delinquencies

DIVISIONS

& LEGAL ENTITIES

UK cards 30 and 90 day arrears rates were 1.0% and 0.2%

respectively (Q420: 1.7% and 0.8%)

Impairment charge of £185m, down 89% YoY driven by lower US

cards delinquencies and customer repayments

4,838

US cards 30 and 90 day arrears rates were 1.6% and 0.8%

respectively (Q420: 2.5% and 1.4%)

2,323

APPENDIX

Impairment release of £473m including an improved

macroeconomic outlook and a net wholesale release

Components of impairment charge / (release) (£m)

2,515

FY20

Stage 1 and 2 impairment

■ Stage 3 impairment

693

(1,346)

(653)

FY21

BARCLAYSView entire presentation