Kore SPAC Presentation Deck

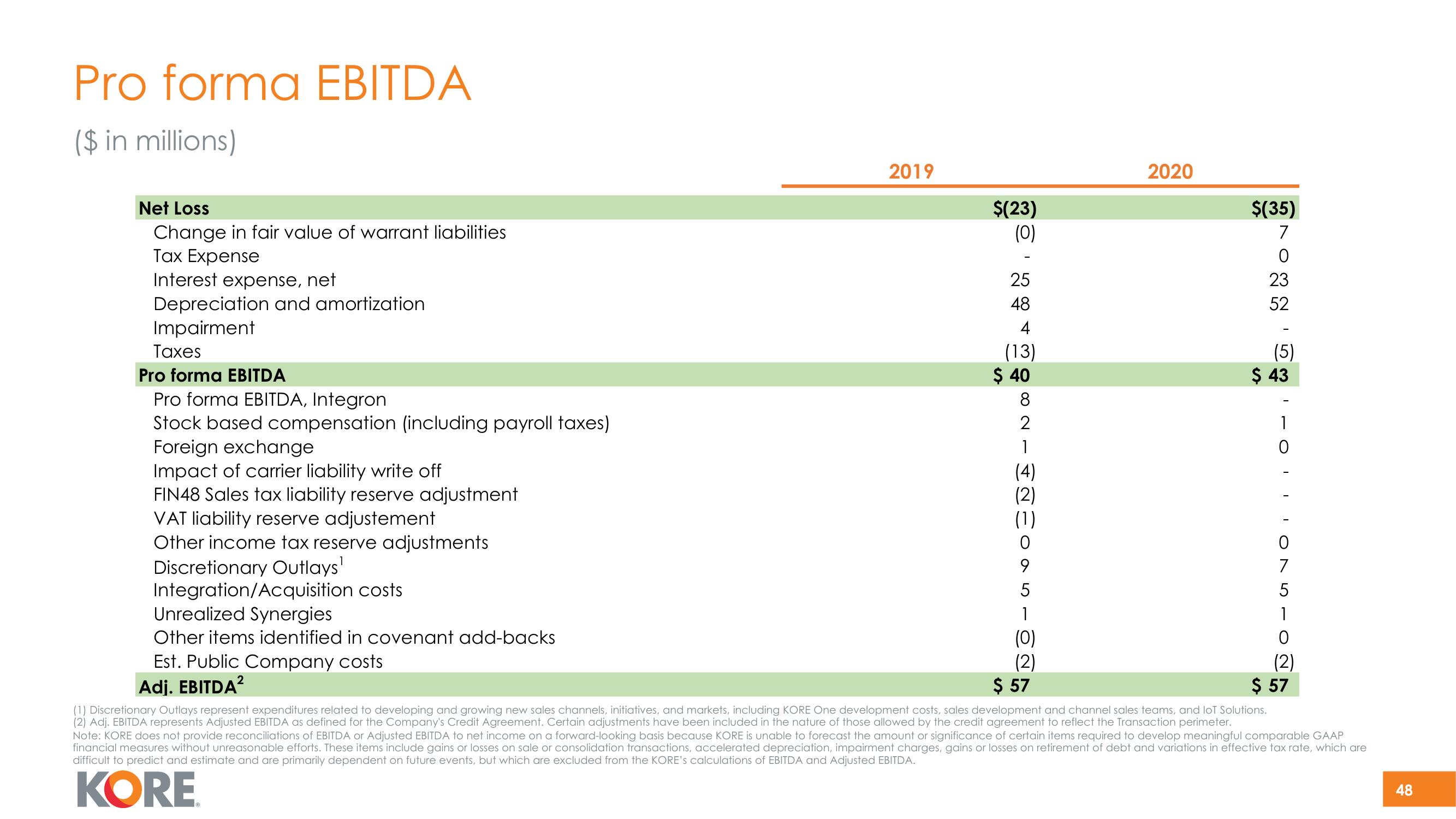

Pro forma EBITDA

($ in millions)

Net Loss

Change in fair value of warrant liabilities

Tax Expense

Interest expense, net

Depreciation and amortization

Impairment

Taxes

Pro forma EBITDA

Pro forma EBITDA, Integron

Stock based compensation (including payroll taxes)

Foreign exchange

Impact of carrier liability write off

FIN48 Sales tax liability reserve adjustment

VAT liability reserve adjustement

Other income tax reserve adjustments

Discretionary Outlays¹

Integration/Acquisition costs

Unrealized Synergies

Other items identified in covenant add-backs

Est. Public Company costs

Adj. EBITDA²

2019

$(23)

(0)

25

48

4

(13)

$ 40

8

2

1

(4)

(2)

(1)

0

9

5

1

(0)

(2)

$ 57

2020

$(35)

7

0

23

52

(5)

$ 43

-O ON

1

7

5

1

O

(2)

$ 57

(1) Discretionary Outlays represent expenditures related to developing and growing new sales channels, initiatives, and markets, including KORE One development costs, sales development and channel sales teams, and loT Solutions.

(2) Adj. EBITDA represents Adjusted EBITDA as defined for the Company's Credit Agreement. Certain adjustments have been included in the nature of those allowed by the credit agreement to reflect the Transaction perimeter.

Note: KORE does not provide reconciliations of EBITDA or Adjusted EBITDA to net income on a forward-looking basis because KORE is unable to forecast the amount or significance of certain items required to develop meaningful comparable GAAP

financial measures without unreasonable efforts. These items include gains or losses on sale or consolidation transactions, accelerated depreciation, impairment charges, gains or losses on retirement of debt and variations in effective tax rate, which are

difficult to predict and estimate and are primarily dependent on future events, but which are excluded from the KORE's calculations of EBITDA and Adjusted EBITDA.

KORE

48View entire presentation