Kin SPAC Presentation Deck

750

500

250

0

(250)

(500)

kin.com | 77

167

(335)

2011

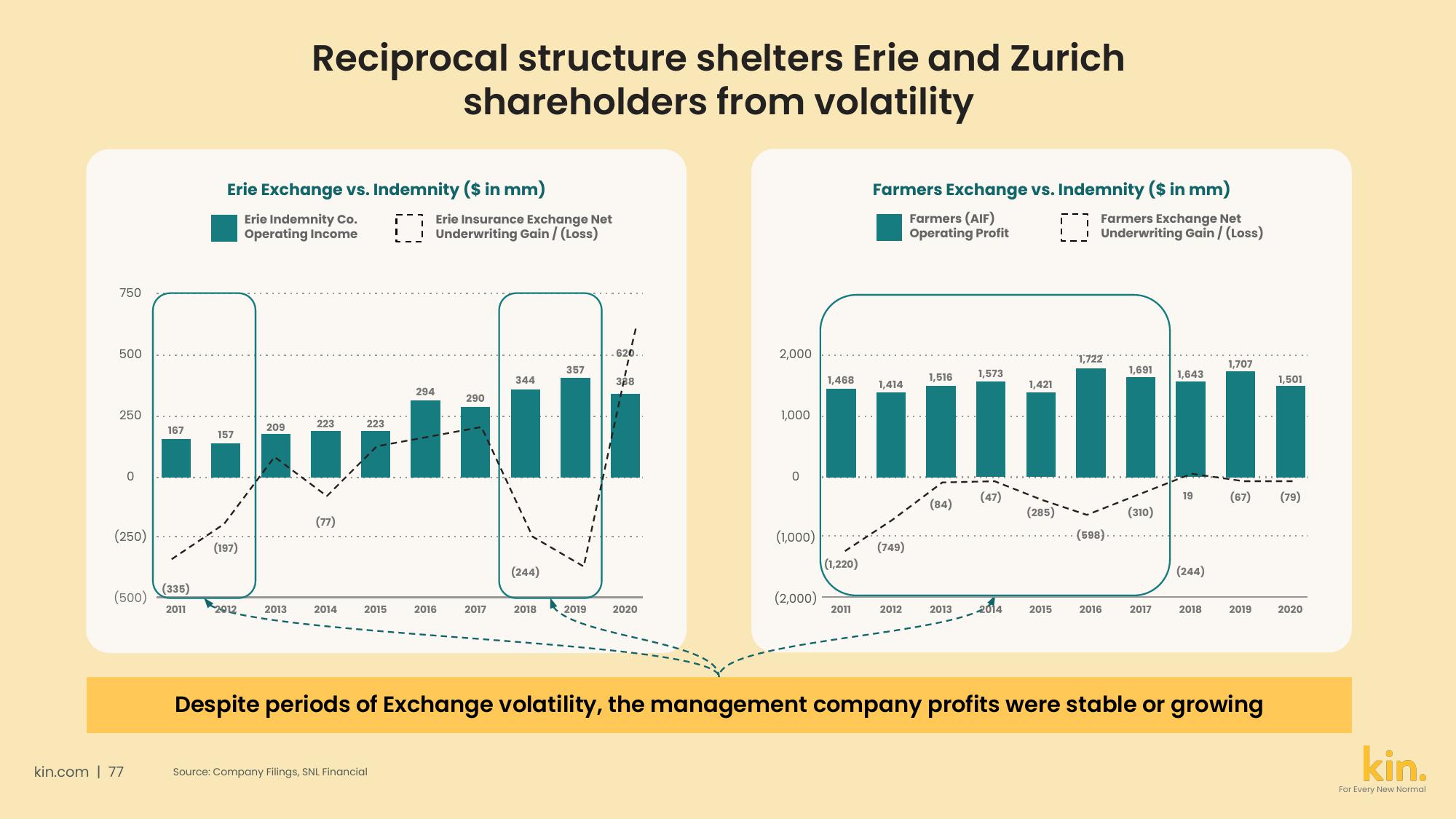

Erie Exchange vs. Indemnity ($ in mm)

Erie Indemnity Co.

Operating Income

157

(197)

209

2012-.

Reciprocal structure shelters Erie and Zurich

shareholders from volatility

2013

223

(77)

2014

223

2015

I

Source: Company Filings, SNL Financial

Erie Insurance Exchange Net

Underwriting Gain / (Loss)

294

2016

290

2017

620

I

388

357

344

ill

J

(244)

2019 2020

2018

2,000

1,000

0

(1,000)

(2,000)

1,468

(1,220)

2011

Farmers Exchange vs. Indemnity ($ in mm)

Farmers (AIF)

Operating Profit

0

1,414

(749)

2012

1,516

(84)

1,573

(47)

1,421

(285)

Farmers Exchange Net

Underwriting Gain / (Loss)

1,691

1,643

illu

2013 2014 2015

1,722

(598)

2016

(310)

2017

19

(244)

1,707

2018

(67) (79)

2019

Despite periods of Exchange volatility, the management company profits were stable or growing

1,501

2020

kin.

For Every New NormalView entire presentation