Valneva IPO Presentation Deck

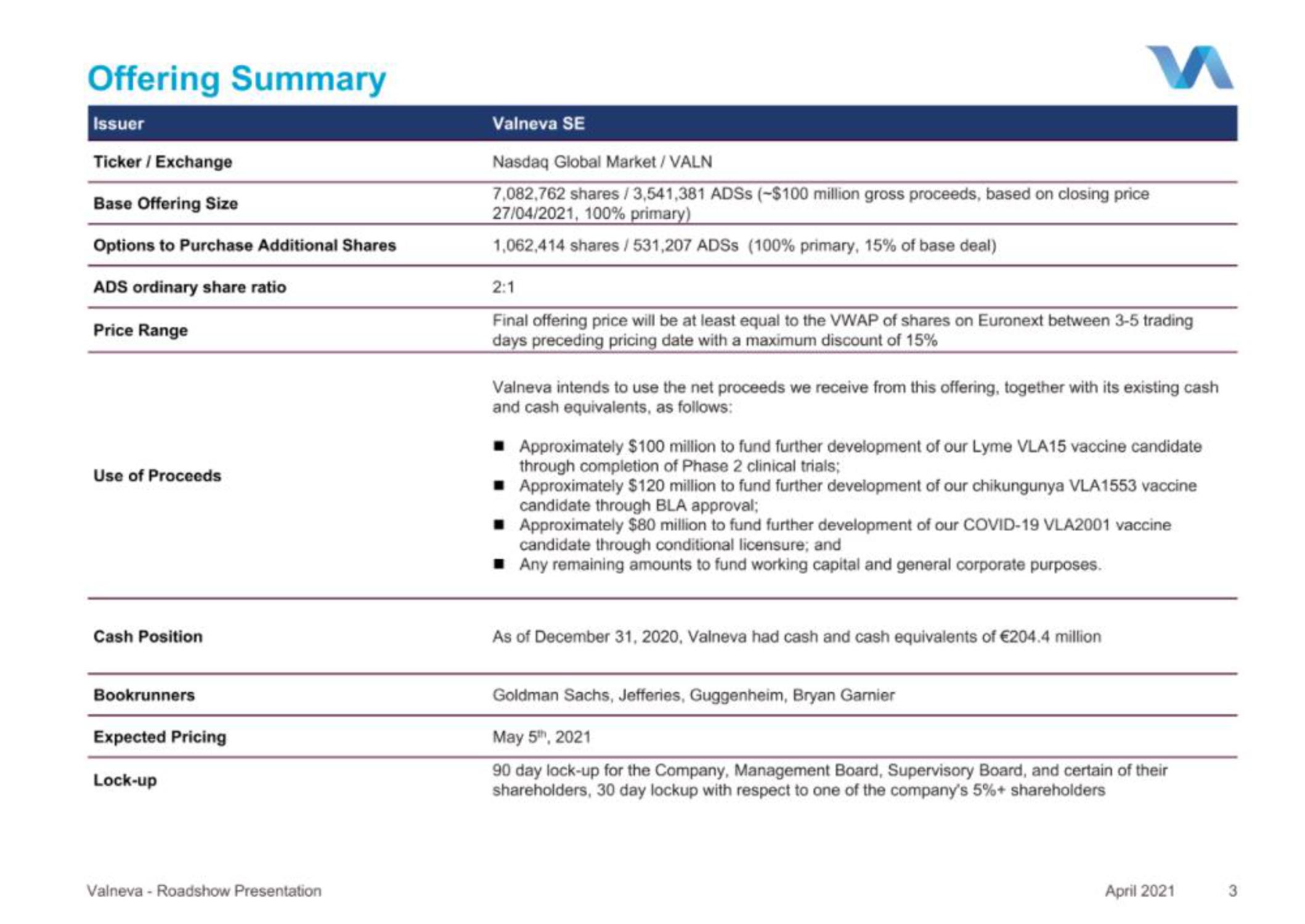

Offering Summary

Issuer

Ticker / Exchange

Base Offering Size

Options to Purchase Additional Shares

ADS ordinary share ratio

Price Range

Use of Proceeds

Cash Position

Bookrunners

Expected Pricing

Lock-up

Valneva - Roadshow Presentation

Valneva SE

Nasdaq Global Market / VALN

7,082,762 shares/3,541,381 ADSS (-$100 million gross proceeds, based on closing price

27/04/2021, 100% primary)

1,062,414 shares/531,207 ADSS (100% primary, 15% of base deal)

2:1

Final offering price will be at least equal to the VWAP of shares on Euronext between 3-5 trading

days preceding pricing date with a maximum discount of 15%

Valneva intends to use the net proceeds we receive from this offering, together with its existing cash

and cash equivalents, as follows:

■ Approximately $100 million to fund further development of our Lyme VLA15 vaccine candidate

through completion of Phase 2 clinical trials;

■ Approximately $120 million to fund further development of our chikungunya VLA1553 vaccine

candidate through BLA approval;

Approximately $80 million to fund further development of our COVID-19 VLA2001 vaccine

candidate through conditional licensure; and

■ Any remaining amounts to fund working capital and general corporate purposes.

As of December 31, 2020, Valneva had cash and cash equivalents of €204.4 million

Goldman Sachs, Jefferies, Guggenheim, Bryan Garnier

May 5th, 2021

90 day lock-up for the Company, Management Board, Supervisory Board, and certain of their

shareholders, 30 day lockup with respect to one of the company's 5% + shareholders

April 2021View entire presentation