LionTree Investment Banking Pitch Book

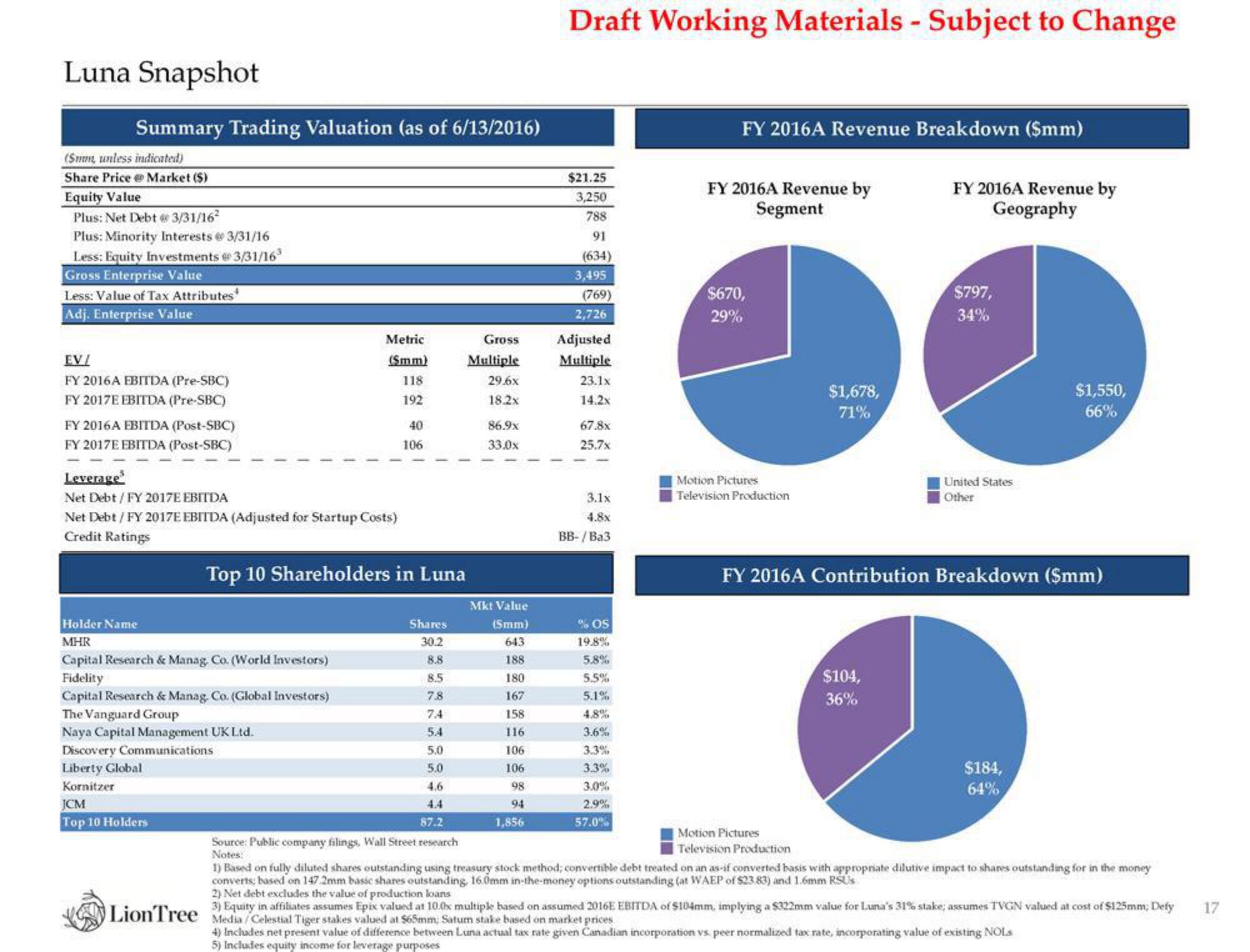

Luna Snapshot

Summary Trading Valuation (as of 6/13/2016)

(Smm, unless indicated)

Share Price Market ($)

Equity Value

Plus: Net Debt @ 3/31/16²

Plus: Minority Interests @ 3/31/16

Less: Equity Investments @ 3/31/16³

Gross Enterprise Value

Less: Value of Tax Attributes

Adj. Enterprise Value

EV/

FY 2016A EBITDA (Pre-SBC)

FY 2017E EBITDA (Pre-SBC)

FY 2016A EBITDA (Post-SBC)

FY 2017E EBITDA (Post-SBC)

Leverage

Net Debt/FY 2017E EBITDA

Net Debt / FY 2017E EBITDA (Adjusted for Startup Costs)

Credit Ratings

Metric

(Smm)

118

192

Holder Name

MHR

Capital Research & Manag, Co. (World Investors)

Fidelity

Capital Research & Manag. Co. (Global Investors)

The Vanguard Group

Naya Capital Management UK Ltd.

Discovery Communications

Liberty Global

Kornitzer

JCM

Top 10 Holders

40

106

Top 10 Shareholders in Luna

Shares

30.2

8.8

8.5

7.8

7.4

5.4

5.0

5.0

4.6

87.2

Source: Public company filings, Wall Street research

Notes:

Gross

Multiple

29.6x

18.2x

86.9x

33.0x

Mkt Value

(Smm)

643

188

180

167

158

116

106

106

98

1,856

Draft Working Materials - Subject to Change

$21.25

3,250

788

91

(634)

3,495

(769)

2,726

Adjusted

Multiple

23.1x

14.2x

67.8x

25.7x

3.1x

4.8x

BB-/Ba3

% OS

19.8%

5.8%

5.5%

5.1%

4.8%

3.6%

3.3%

3.3%

3.0%

2.9%

57.0%

FY 2016A Revenue Breakdown ($mm)

FY 2016A Revenue by

Segment

$670,

29%

Motion Pictures

Television Production

$1,678,

71%

FY 2016A Revenue by

Geography

$104,

36%

$797,

34%

United States

Other

FY 2016A Contribution Breakdown ($mm)

$1,550,

66%

$184,

64%

Motion Pictures

Television Production

1) Based on fully diluted shares outstanding using treasury stock method; convertible debt treated on an as-if converted basis with appropriate dilutive impact to shares outstanding for in the money

converts; based on 147.2mm basic shares outstanding, 16.0mm in-the-money options outstanding (at WAEP of $23.83) and 1.6mm RSUS

2) Net debt excludes the value of production loans

Equity in affiliates assumes Epix valued at 10.0x multiple based on assumed 2016E EBITDA of $104mm, implying a $322mm value for Luna's 31% stake; assumes TVGN valued at cost of $125mm, Defy

LionTree Media Celestial Tiger stakes valued at $65mm; Satum stake based on market prices

3)

4) Includes net present value of difference between Luna actual tax rate given Canadian incorporation vs. peer normalized tax rate, incorporating value of existing NOLS

5) Includes equity income for leverage purposes

17View entire presentation