Oatly Results Presentation Deck

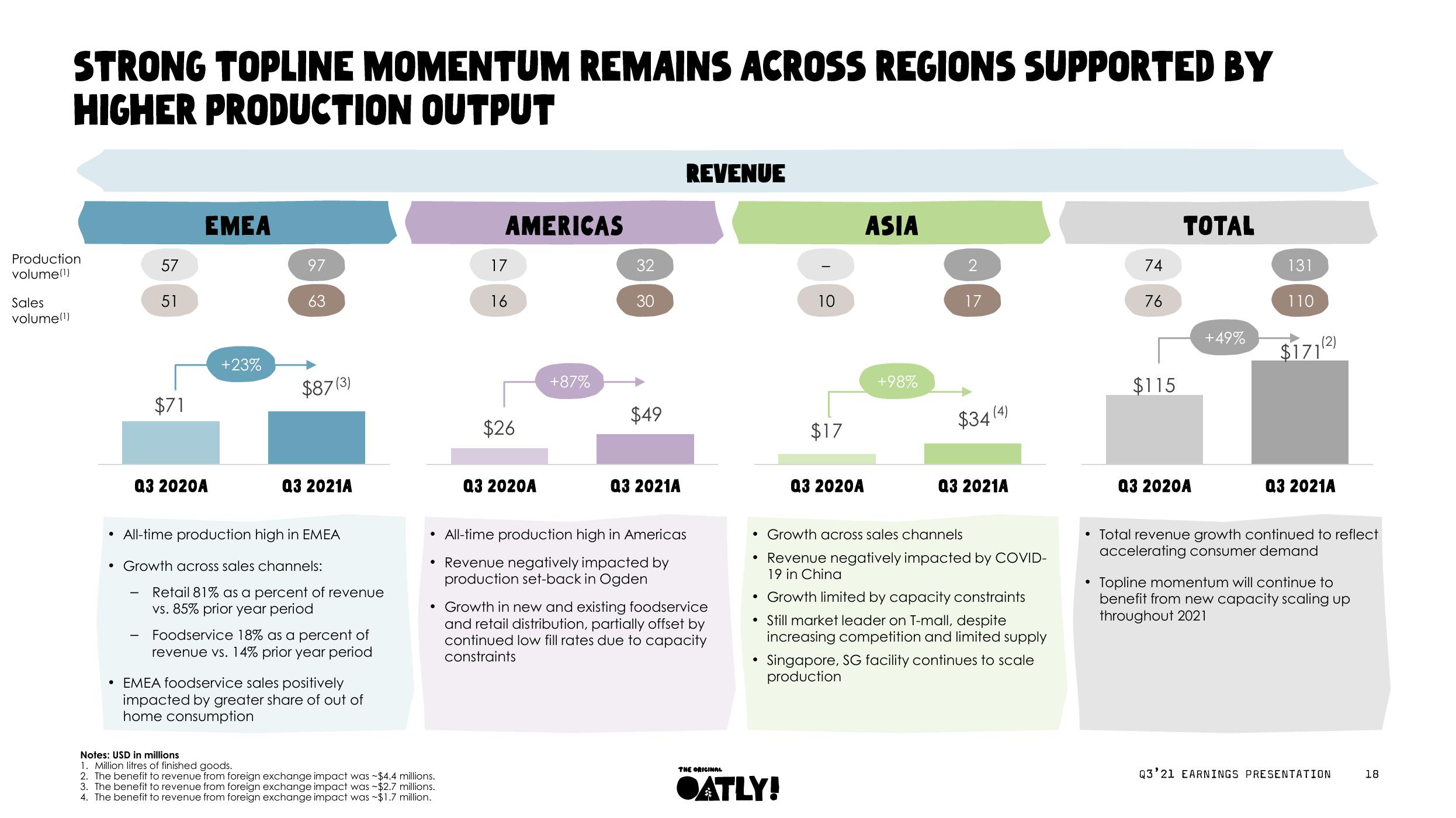

STRONG TOPLINE MOMENTUM REMAINS ACROSS REGIONS SUPPORTED BY

HIGHER PRODUCTION OUTPUT

Production

volume(¹)

Sales

volume(¹)

57

51

$71

-

EMEA

Q3 2020A

+23%

97

63

$87(3)

Q3 2021A

• All-time production high in EMEA

• Growth across sales channels:

Retail 81% as a percent of revenue

vs. 85% prior year period

Foodservice 18% as a percent of

revenue vs. 14% prior year period

EMEA foodservice sales positively

impacted by greater share of out of

home consumption

AMERICAS

17

16

Notes: USD in millions

1. Million litres of finished goods.

2. The benefit to revenue from foreign exchange impact was -$4.4 millions.

3. The benefit to revenue from foreign exchange impact was ~$2.7 millions.

4. The benefit to revenue from foreign exchange impact was -$1.7 million.

$26

Q3 2020A

+87%

32

30

$49

Q3 2021A

REVENUE

• All-time production high in Americas

• Revenue negatively impacted by

production set-back in Ogden

• Growth in new and existing foodservice

and retail distribution, partially offset by

continued low fill rates due to capacity

constraints

THE ORIGINAL

10

●

$17

●ATLY!

ASIA

Q3 2020A

+98%

2

17

$34 (4)

• Growth across sales channels

• Revenue negatively impacted by COVID-

19 in China

Q3 2021A

• Growth limited by capacity constraints

• Still market leader on T-mall, despite

increasing competition and limited supply

Singapore, SG facility continues to scale

production

74

76

●

$115

TOTAL

Q3 2020A

+49%

131

110

$171

Q3 2021A

• Total revenue growth continued to reflect

accelerating consumer demand

Topline momentum will continue to

benefit from new capacity scaling up

throughout 2021

Q3'21 EARNINGS PRESENTATION

18View entire presentation