Pathward Financial Results Presentation Deck

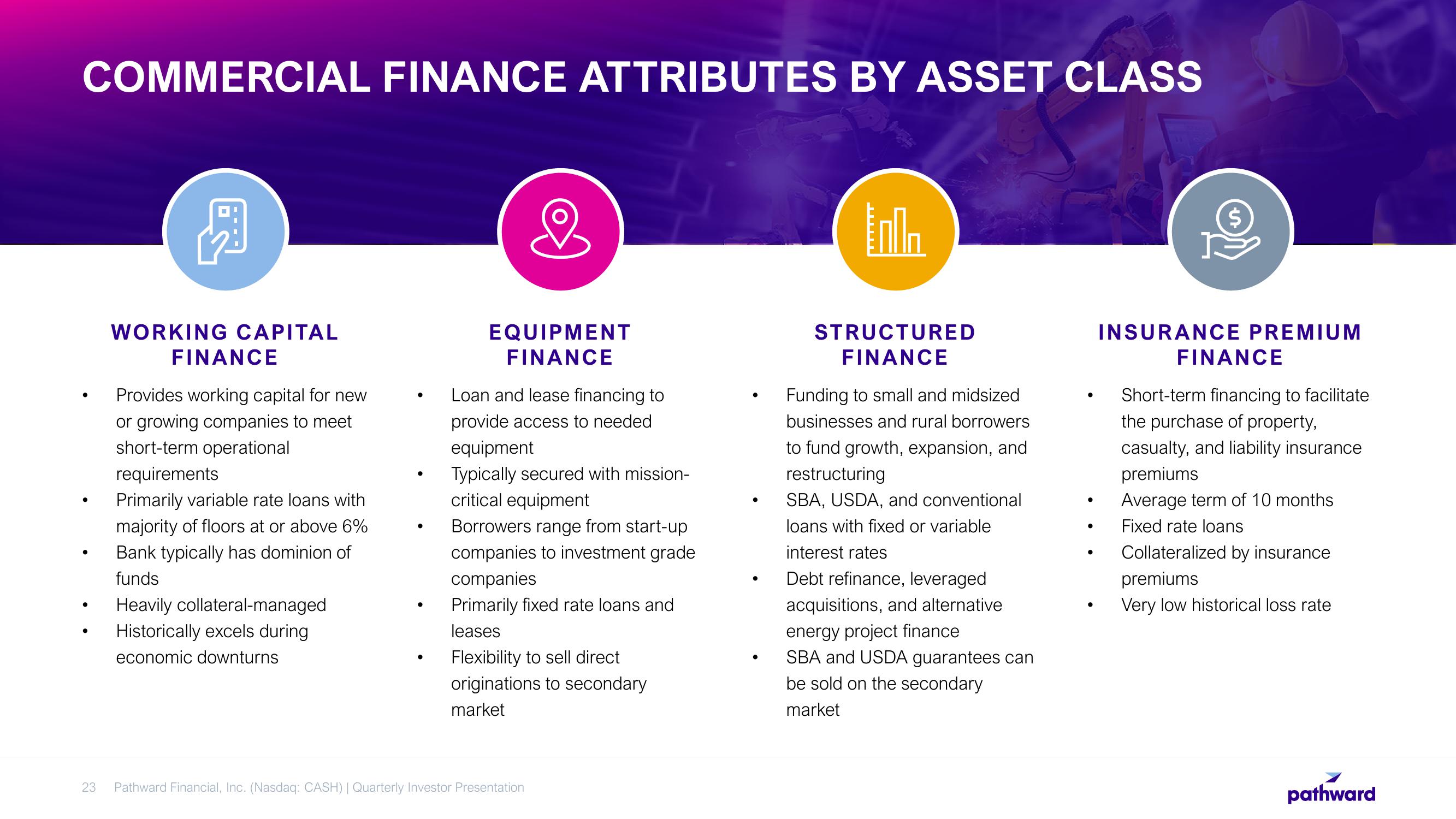

COMMERCIAL FINANCE ATTRIBUTES BY ASSET CLASS

●

4

WORKING CAPITAL

FINANCE

Provides working capital for new

or growing companies to meet

short-term operational

requirements

Primarily variable rate loans with

majority of floors at or above 6%

Bank typically has dominion of

funds

Heavily collateral-managed

Historically excels during

economic downturns

&

EQUIPMENT

FINANCE

Loan and lease financing to

provide access to needed

equipment

Typically secured with mission-

critical equipment

Borrowers range from start-up

companies to investment grade

companies

Primarily fixed rate loans and

leases

Flexibility to sell direct

originations to secondary

market

23 Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

1000

STRUCTURED

FINANCE

Funding to small and midsized

businesses and rural borrowers

to fund growth, expansion, and

restructuring

SBA, USDA, and conventional

loans with fixed or variable

interest rates

Debt refinance, leveraged

acquisitions, and alternative

energy project finance

SBA and USDA guarantees can

be sold on the secondary

market

●

●

$

INSURANCE PREMIUM

FINANCE

Short-term financing to facilitate

the purchase of property,

casualty, and liability insurance

premiums

Average term of 10 months

Fixed rate loans

Collateralized by insurance

premiums

Very low historical loss rate

pathwardView entire presentation