Ares US Real Estate Opportunity Fund III

Ritz-Carlton, Kapalua (Realized)

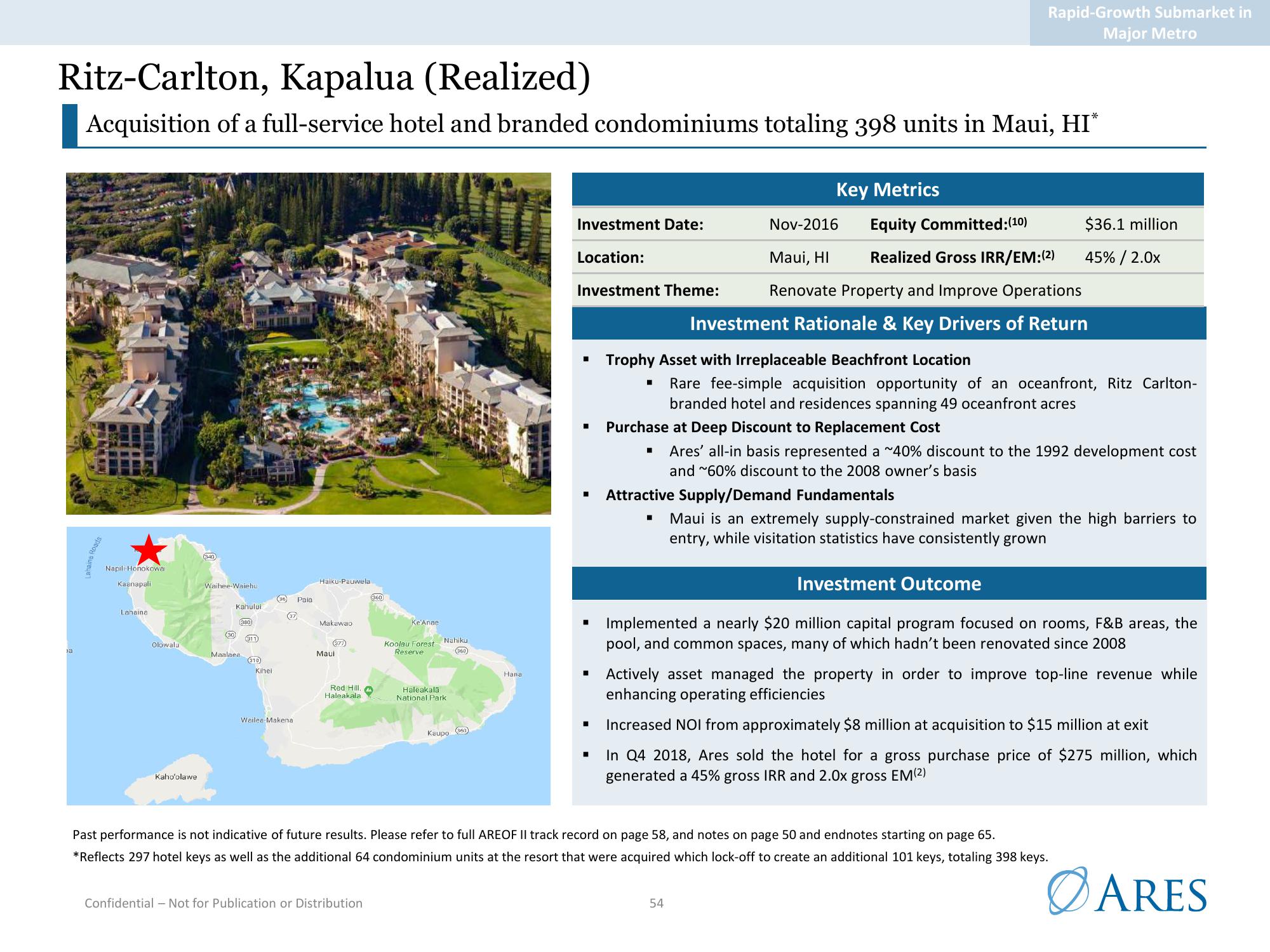

Acquisition of a full-service hotel and branded condominiums totaling 398 units in Maui, HI*

a

Lahaina Roads

Napili Honokowai

Kaanapali

Lahaina

Olowalu

Kaho'olawe

(340

Waihee-Waiehu)

Kahului

(30)

380)

Maalaea

311

(310)

Kihel

(36)

37

Wailea Makenal

Paia

Haiku-Pauwela

Makawao

Maul

Red Hill

Haleakala

(360

Confidential - Not for Publication or Distribution

Ke Anae

Koolau Forest Nahiku

Reserve

360

Haleakalā

National Park.

Kaupo (160)

Hana

REFIK

Investment Date:

Location:

Investment Theme:

■

■

■

■

■

■

Trophy Asset with Irreplaceable Beachfront Location

■

Key Metrics

Equity Committed: (10)

Maui, HI Realized Gross IRR/EM:(2)

Renovate Property and Improve Operations

Investment Rationale & Key Drivers of Return

Nov-2016

Purchase at Deep Discount to Replacement Cost

■

Rapid-Growth Submarket in

Major Metro

Attractive Supply/Demand Fundamentals

Rare fee-simple acquisition opportunity of an oceanfront, Ritz Carlton-

branded hotel and residences spanning 49 oceanfront acres

54

$36.1 million

45% / 2.0x

Ares' all-in basis represented a ~40% discount to the 1992 development cost

and ~60% discount to the 2008 owner's basis

Maui is an extremely supply-constrained market given the high barriers to

entry, while visitation statistics have consistently grown

Investment Outcome

Implemented a nearly $20 million capital program focused on rooms, F&B areas, the

pool, and common spaces, many of which hadn't been renovated since 2008

Past performance is not indicative of future results. Please refer to full AREOF II track record on page 58, and notes on page 50 and endnotes starting on page 65.

*Reflects 297 hotel keys as well as the additional 64 condominium units at the resort that were acquired which lock-off to create an additional 101 keys, totaling 398 keys.

Actively asset managed the property in order to improve top-line revenue while

enhancing operating efficiencies

Increased NOI from approximately $8 million at acquisition to $15 million at exit

In Q4 2018, Ares sold the hotel for a gross purchase price of $275 million, which

generated a 45% gross IRR and 2.0x gross EM (2)

ARESView entire presentation