Nikola SPAC Presentation Deck

PROPOSED TRANSACTION

OVERVIEW

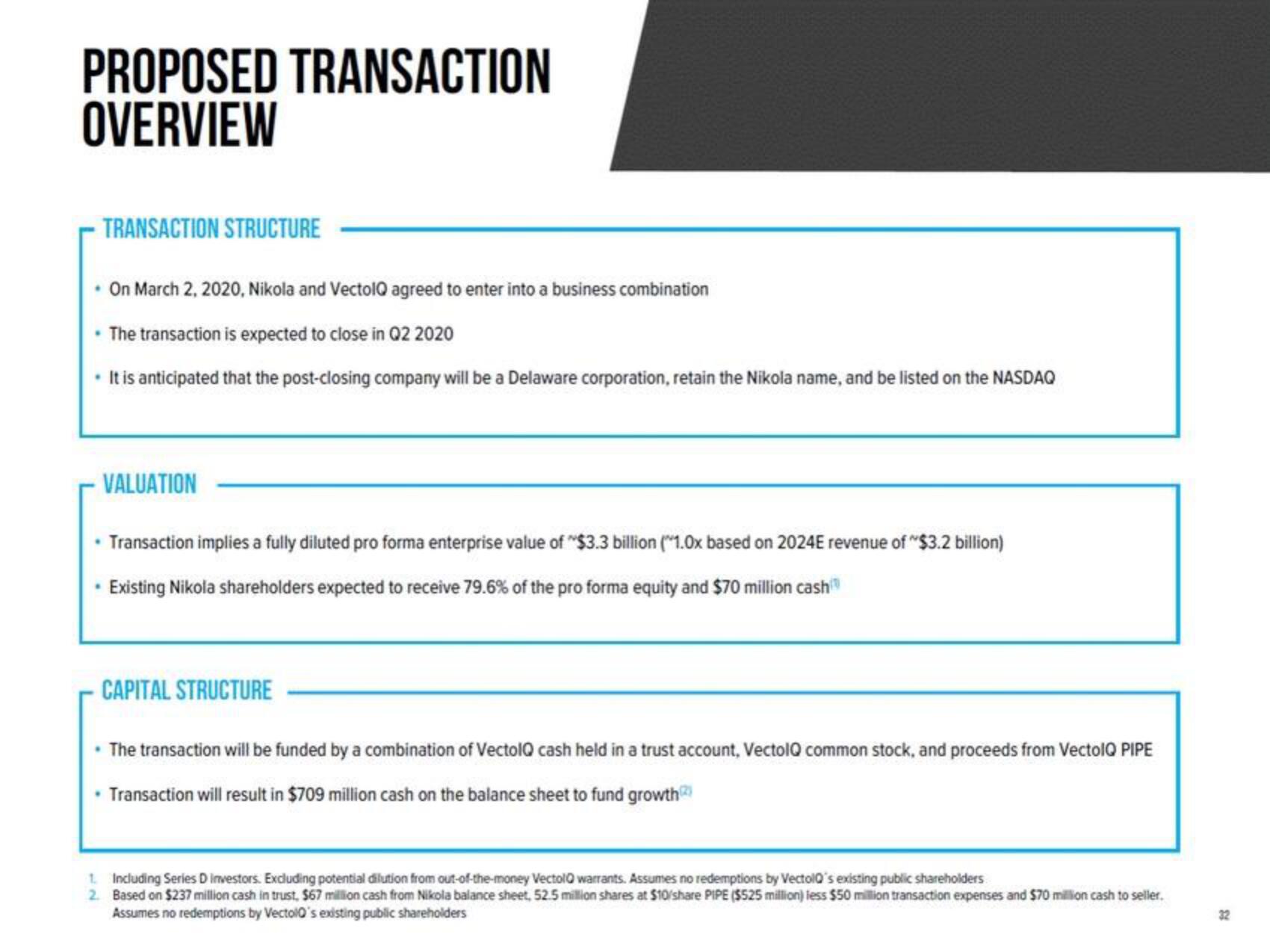

TRANSACTION STRUCTURE

• On March 2, 2020, Nikola and VectolQ agreed to enter into a business combination

• The transaction is expected to close in Q2 2020

. It is anticipated that the post-closing company will be a Delaware corporation, retain the Nikola name, and be listed on the NASDAQ

VALUATION

• Transaction implies a fully diluted pro forma enterprise value of "$3.3 billion (1.0x based on 2024E revenue of "$3.2 billion)

• Existing Nikola shareholders expected to receive 79.6% of the pro forma equity and $70 million cash

CAPITAL STRUCTURE

• The transaction will be funded by a combination of VectolQ cash held in a trust account, VectolQ common stock, and proceeds from VectolQ PIPE

Transaction will result in $709 million cash on the balance sheet to fund growth)

.

1. Including Series D investors. Excluding potential dilution from out-of-the-money VectolQ warrants. Assumes no redemptions by VectolQ's existing public shareholders

2.

Based on $237 million cash in trust, $67 million cash from Nikola balance sheet, 52.5 million shares at $10/share PIPE ($525 million) less $50 million transaction expenses and $70 million cash to seller.

Assumes no redemptions by Vectolo's existing public shareholders

32View entire presentation