Security Matters SPAC Presentation Deck

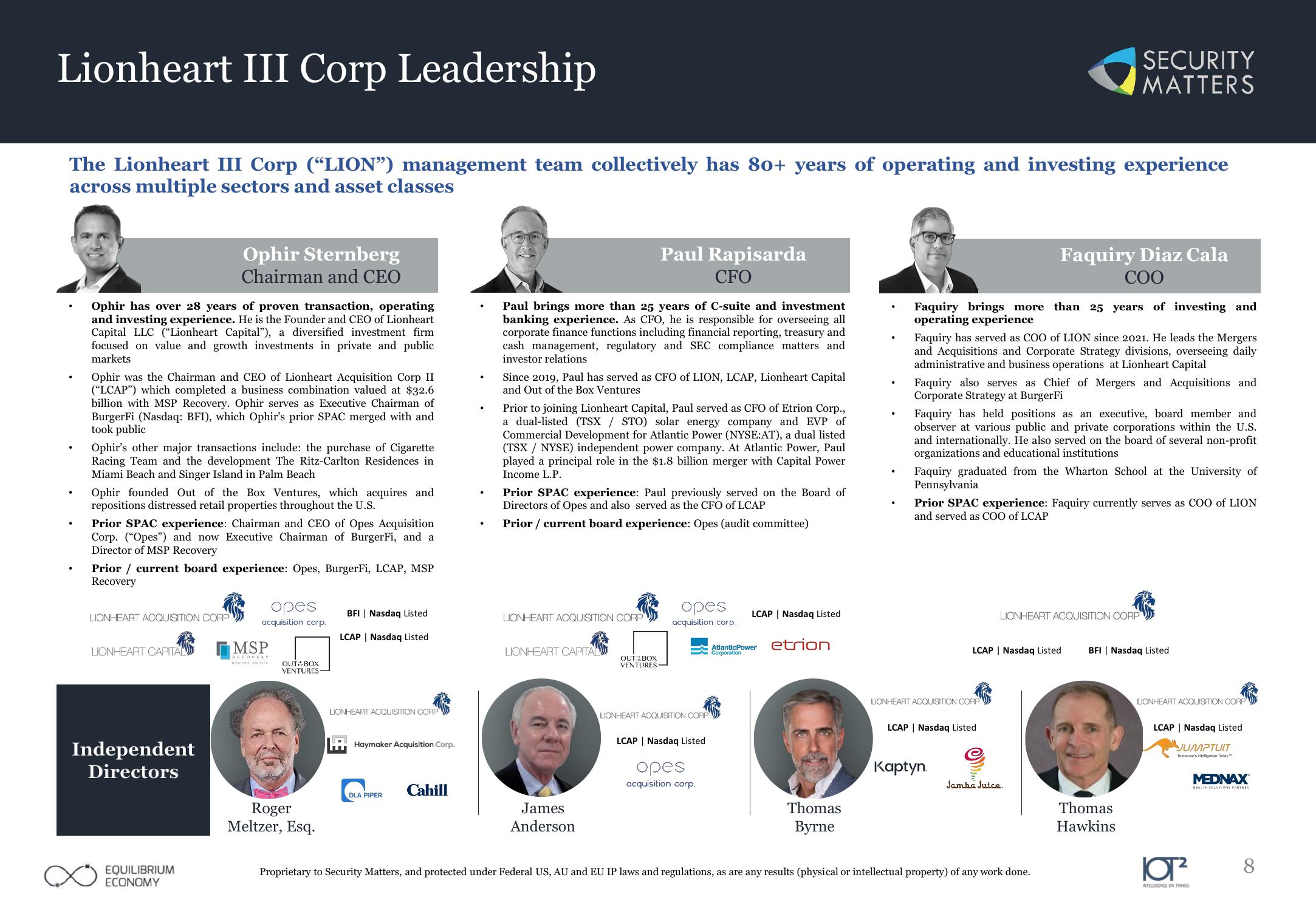

Lionheart III Corp Leadership

The Lionheart III Corp ("LION") management team collectively has 80+ years of operating and investing experience

across multiple sectors and asset classes

.

.

Ophir has over 28 years of proven transaction, operating

and investing experience. He is the Founder and CEO of Lionheart

Capital LLC ("Lionheart Capital"), a diversified investment firm

focused on value and growth investments in private and public

markets

Ophir was the Chairman and CEO of Lionheart Acquisition Corp II

("LCAP") which completed a business combination valued at $32.6

billion with MSP Recovery. Ophir serves as Executive Chairman of

BurgerFi (Nasdaq: BFI), which Ophir's prior SPAC merged with and

took public

Ophir's other major transactions include: the purchase of Cigarette

Racing Team and the development The Ritz-Carlton Residences in

Miami Beach and Singer Island in Palm Beach

Ophir Sternberg

Chairman and CEO

Ophir founded Out of the Box Ventures, which acquires and

repositions distressed retail properties throughout the U.S.

Prior SPAC experience: Chairman and CEO of Opes Acquisition

Corp. ("Opes") and now Executive Chairman of BurgerFi, and a

Director of MSP Recovery

Prior current board experience: Opes, BurgerFi, LCAP, MSP

Recovery

LIONHEART ACQUISITION CORP

LIONHEART CAPITAL

Independent

Directors

EQUILIBRIUM

ECONOMY

opes

acquisition corp.

MSP

RECOVERY

Bitcoyes ACOR

OUT BOX

VENTURES

Roger

Meltzer, Esq.

BFI | Nasdaq Listed

LCAP | Nasdaq Listed

LIONHEART ACQUISITION CORP

Haymaker Acquisition Corp.

DLA PIPER

Cahill

Paul Rapisarda

CFO

Paul brings more than 25 years of C-suite and investment

banking experience. As CFO, he is responsible for overseeing all

corporate finance functions including financial reporting, treasury and

cash management, regulatory and SEC compliance matters and

investor relations

Since 2019, Paul has served as CFO of LION, LCAP, Lionheart Capital

and Out of the Box Ventures

Prior to joining Lionheart Capital, Paul served as CFO of Etrion Corp.,

a dual-listed (TSX / STO) solar energy company and EVP of

Commercial Development for Atlantic Power (NYSE:AT), a dual listed

(TSX / NYSE) independent power company. At Atlantic Power, Paul

played a principal role in the $1.8 billion merger with Capital Power

Income L.P.

Prior SPAC experience: Paul previously served on the Board of

Directors of Opes and also served as the CFO of LCAP

Prior / current board experience: Opes (audit committee)

LIONHEART ACQUISITION CORP

LIONHEART CAPITAL

James

Anderson

OUT BOX

VENTURES

opes

acquisition corp.

LIONHEART ACQUISITION CORP

LCAP | Nasdaq Listed

opes

acquisition corp.

LCAP | Nasdaq Listed

Atlantic Power

Corporation

etrion

Thomas

Byrne

Faquiry brings more than 25 years of investing and

operating experience

Faquiry has served as COO of LION since 2021. He leads the Mergers

and Acquisitions and Corporate Strategy divisions, overseeing daily

administrative and business operations at Lionheart Capital

Faquiry also serves as Chief of Mergers and Acquisitions and

Corporate Strategy at BurgerFi

Faquiry has held positions as an executive, board member and

observer at various public and private corporations within the U.S.

and internationally. He also served on the board of several non-profit

organizations and educational institutions

Faquiry graduated from the Wharton School at the University of

Pennsylvania

Faquiry Diaz Cala

COO

Prior SPAC experience: Faquiry currently serves as COO of LION

and served as COO of LCAP

LIONHEART ACQUISITION CORP

LCAP | Nasdaq Listed

Kaptyn.

SECURITY

MATTERS

LCAP | Nasdaq Listed

LIONHEART ACQUISITION CORP

Jamba Juice.

Proprietary to Security Matters, and protected under Federal US, AU and EU IP laws and regulations, as are any results (physical or intellectual property) of any work done.

BFI Nasdaq Listed

Thomas

Hawkins

LIONHEART ACQUISITION CORP

LCAP | Nasdaq Listed

JUMPTUIT

Tomomcu's Intelligence Today

or²

INTELLIGENCE ON THINGS

MEDNAX

HEALTH SOLUTIONS PARTNER

8View entire presentation