Altus Power Investor Presentation Deck

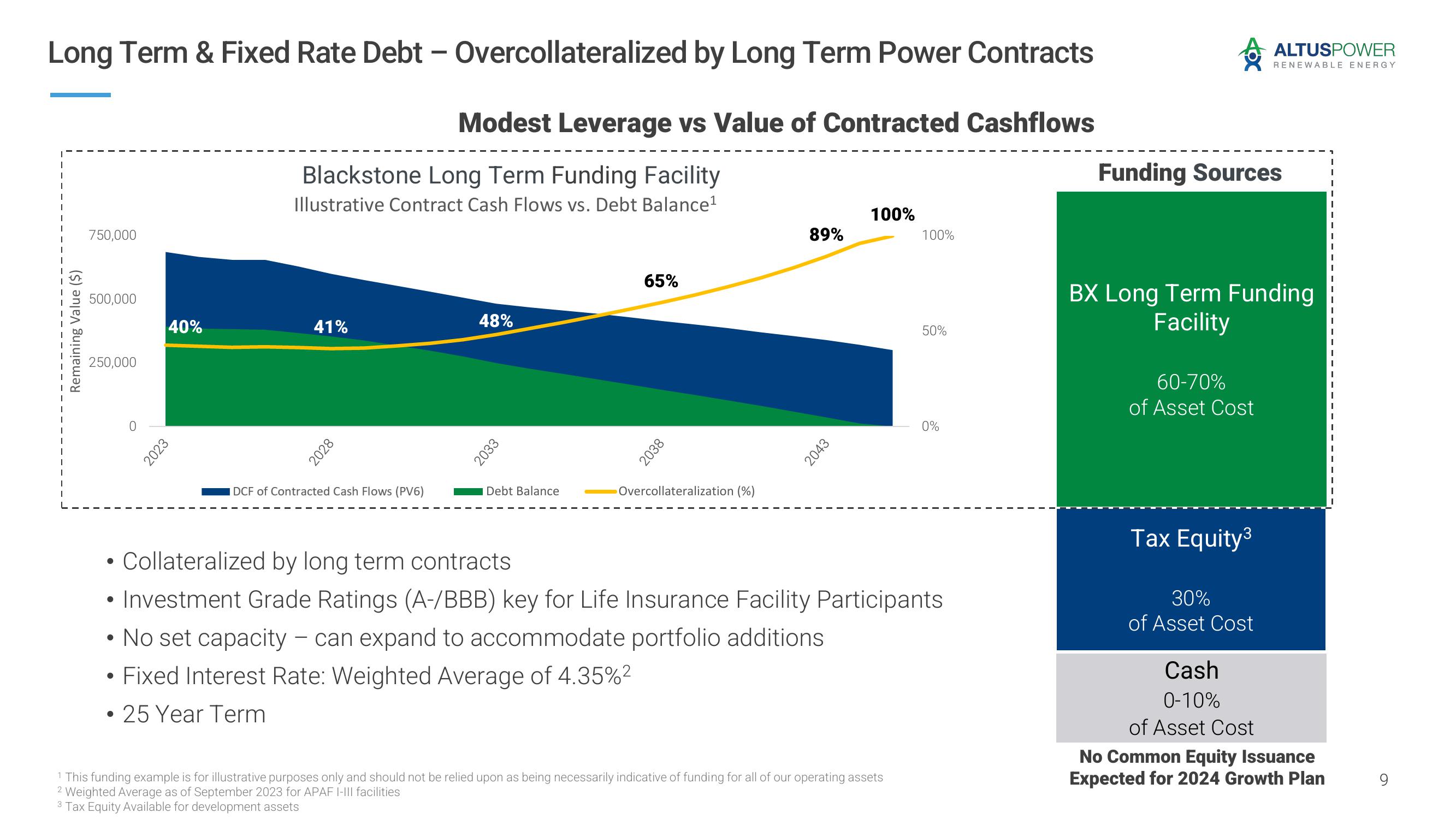

Long Term & Fixed Rate Debt - Overcollateralized by Long Term Power Contracts

Modest Leverage vs Value of Contracted Cashflows

I

I

I

I

I

I

I

I

I

Remaining Value ($)

750,000

500,000

250,000

0

40%

2023

Blackstone Long Term Funding Facility

Illustrative Contract Cash Flows vs. Debt Balance¹

41%

2028

DCF of Contracted Cash Flows (PV6)

48%

2033

Debt Balance

65%

2038

Overcollateralization (%)

89%

2043

100%

100%

1 This funding example is for illustrative purposes only and should not be relied upon as being necessarily indicative of funding for all of our operating assets

2 Weighted Average as of September 2023 for APAF I-III facilities

3 Tax Equity Available for development assets

50%

0%

• Collateralized by long term contracts

• Investment Grade Ratings (A-/BBB) key for Life Insurance Facility Participants

• No set capacity - can expand to accommodate portfolio additions

• Fixed Interest Rate: Weighted Average of 4.35%²

• 25 Year Term

Funding Sources

60-70%

of Asset Cost

ALTUSPOWER

BX Long Term Funding

Facility

Tax Equity³

RENEWABLE ENERGY

30%

of Asset Cost

Cash

0-10%

of Asset Cost

No Common Equity Issuance

Expected for 2024 Growth PlanView entire presentation