Sonder Investor Presentation Deck

Non-GAAP Reconciliations

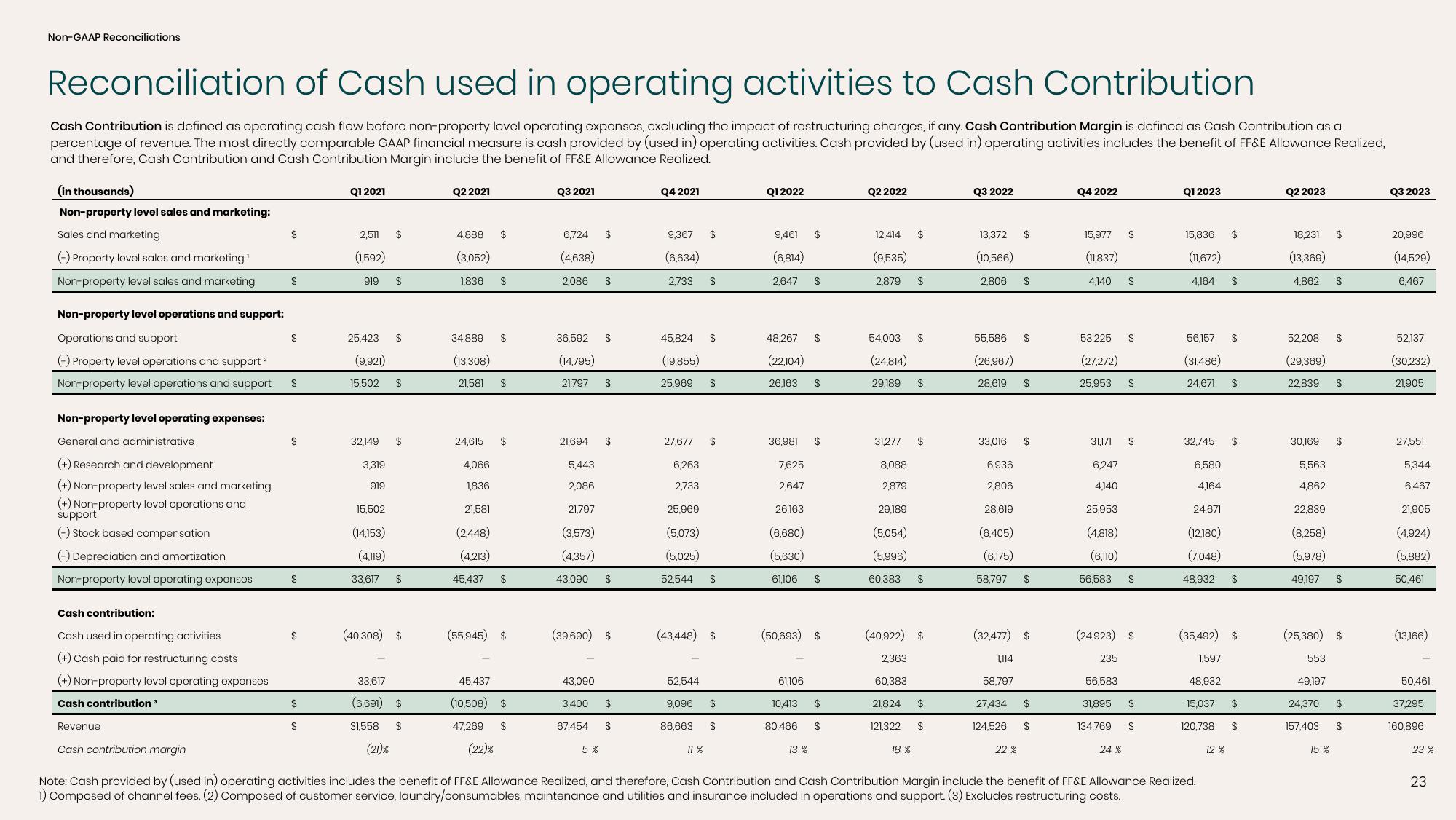

Reconciliation of Cash used in operating activities to Cash Contribution

Cash Contribution is defined as operating cash flow before non-property level operating expenses, excluding the impact of restructuring charges, if any. Cash Contribution Margin is defined as Cash Contribution as a

percentage of revenue. The most directly comparable GAAP financial measure is cash provided by (used in) operating activities. Cash provided by (used in) operating activities includes the benefit of FF&E Allowance Realized,

and therefore, Cash Contribution and Cash Contribution Margin include the benefit of FF&E Allowance Realized.

(in thousands)

Non-property level sales and marketing:

Sales and marketing

(-) Property level sales and marketing¹

Non-property level sales and marketing

Non-property level operations and support:

Operations and support

(-) Property level operations and support ²

Non-property level operations and support

Non-property level operating expenses:

General and administrative

(+) Research and development

(+) Non-property level sales and marketing

(+) Non-property level operations and

support

(-) Stock based compensation

(-) Depreciation and amortization

Non-property level operating expenses

Cash contribution:

Cash used in operating activities

(+) Cash paid for restructuring costs

(+) Non-property level operating expenses

Cash contribution ³

Revenue

$

S

S

S

S

S

S

$

S

Q1 2021

2,511

(1,592)

919

32,149

3,319

919

$

25,423

(9,921)

15,502 $

$

$

33,617

(6,691)

31,558

(21)%

$

15,502

(14,153)

(4,119)

33,617 $

(40,308) $

$

$

Q2 2021

4,888

(3,052)

1,836

24,615

4,066

1,836

34,889

(13,308)

21,581 $

21,581

(2.448)

(4,213)

$

45,437

$

$

$

$

(55,945) $

45,437

(10,508) $

47,269

(22)%

$

Q3 2021

6,724

(4,638)

2,086

36,592

(14,795)

21,797

21,694

5,443

2,086

21,797

(3,573)

(4,357)

43,090

43,090

$

3,400

$

$

5%

$

(39,690) $

$

$

$

67,454 $

Q4 2021

9,367

(6,634)

2,733

27,677

6,263

2,733

25,969

(5,073)

(5,025)

45,824

(19,855)

25,969 S

52,544

S

52,544

S

S

11%

S

(43,448) S

S

9,096

86,663 S

S

Q1 2022

9,461

(6,814)

2,647

48,267

(22,104)

26,163

36,981

7,625

2,647

61,106

$

10,413

$

$

26,163

(6,680)

(5,630)

61,106 $

$

(50,693) $

13 %

$

$

80,466 $

Q2 2022

12,414

(9,535)

2,879

54,003

(24,814)

29,189

31,277

8,088

2,879

29,189

(5,054)

(5,996)

60,383

$

$

18 %

$

$

$

$

(40,922) $

2,363

60,383

21,824 $

121,322 $

Q3 2022

13,372

(10,566)

2,806

55,586

(26,967)

28,619

33,016

6,936

2,806

1,114

58,797

$

27,434

$

28,619

(6,405)

(6,175)

58,797 $

$

(32,477) $

$

22 %

$

$

124,526 $

Q4 2022

15,977

(11,837)

4,140 S

53,225 S

(27,272)

25,953

31,171

6.247

4140

S

235

25,953

(4,818)

(6,110)

56,583 S

56,583

(24,923) S

S

31,895

S

S

134,769 S

24%

Q1 2023

15,836

(11,672)

4,164

56,157

(31,486)

24,671

32,745

6,580

4,164

Cash contribution margin

Note: Cash provided by (used in) operating activities includes the benefit of FF&E Allowance Realized, and therefore, Cash Contribution and Cash Contribution Margin include the benefit of FF&E Allowance Realized.

1) Composed of channel fees. (2) Composed of customer service, laundry/consumables, maintenance and utilities and insurance included in operations and support. (3) Excludes restructuring costs.

24,671

(12,180)

(7,048)

48,932

48,932

$

$

12%

$

$

(35,492) $

1,597

$

$

15,037 $

120,738 $

Q2 2023

18,231

(13,369)

4,862

52,208

(29,369)

22,839

30,169

5,563

4,862

22,839

(8,258)

(5,978)

49,197

24,370

157,403

$

15 %

$

$

$

(25,380) $

553

49,197

$

$

$

$

Q3 2023

20,996

(14,529)

6,467

52,137

(30,232)

21,905

27,551

5,344

6,467

21,905

(4,924)

(5,882)

50,461

(13,166)

50,461

37,295

160,896

23 %

23View entire presentation