Hyperfine SPAC Presentation Deck

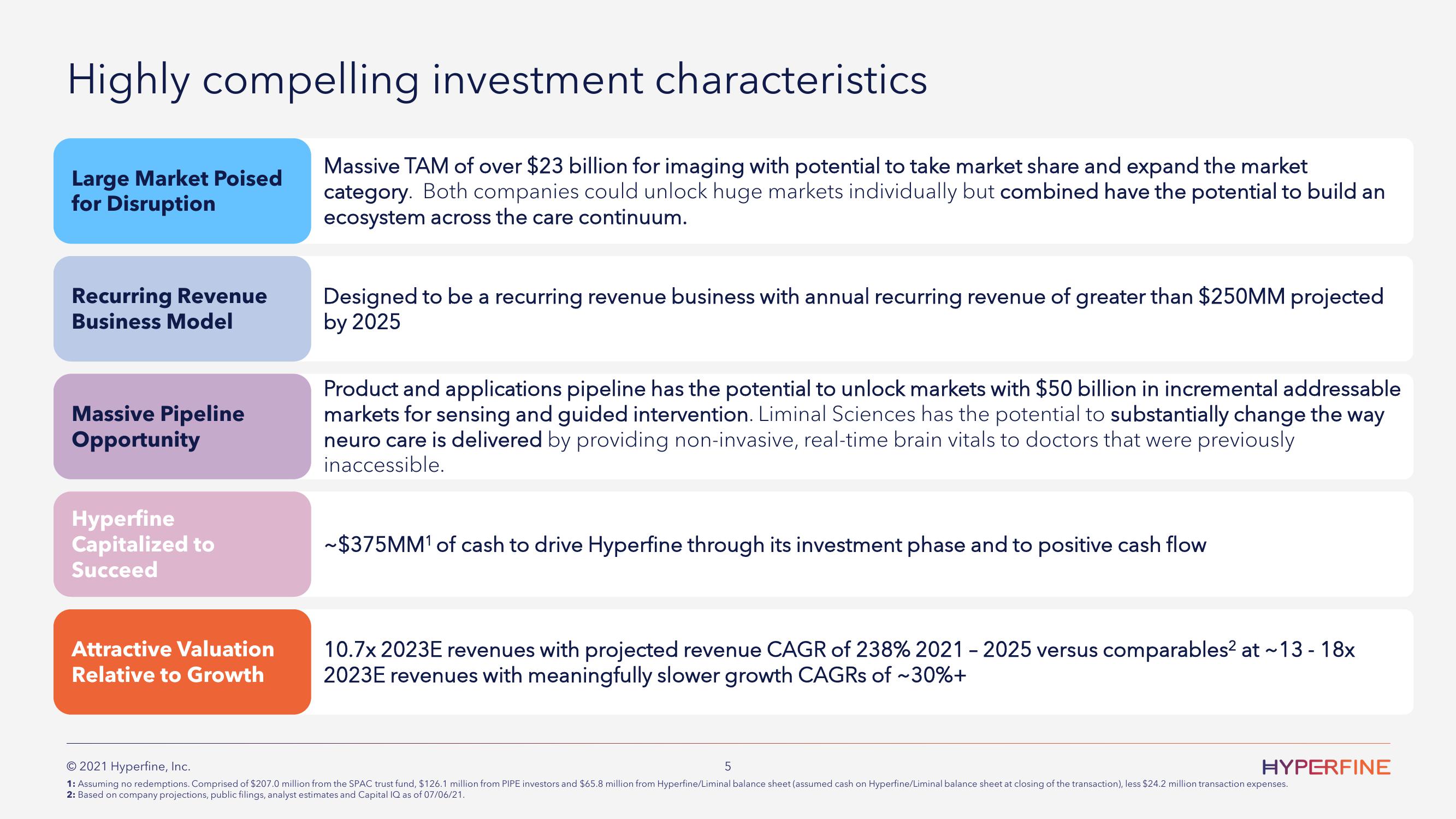

Highly compelling investment characteristics.

Large Market Poised

for Disruption

Recurring Revenue

Business Model

Massive Pipeline

Opportunity

Hyperfine

Capitalized to

Succeed

Attractive Valuation

Relative to Growth

Massive TAM of over $23 billion for imaging with potential to take market share and expand the market

category. Both companies could unlock huge markets individually but combined have the potential to build an

ecosystem across the care continuum.

Designed to be a recurring revenue business with annual recurring revenue of greater than $250MM projected

by 2025

Product and applications pipeline has the potential to unlock markets with $50 billion in incremental addressable

markets for sensing and guided intervention. Liminal Sciences has the potential to substantially change the way

neuro care is delivered by providing non-invasive, real-time brain vitals to doctors that were previously

inaccessible.

~$375MM¹ of cash to drive Hyperfine through its investment phase and to positive cash flow

10.7x 2023E revenues with projected revenue CAGR of 238% 2021 - 2025 versus comparables² at ~13 - 18x

2023E revenues with meaningfully slower growth CAGRs of ~30%+

© 2021 Hyperfine, Inc.

1: Assuming no redemptions. Comprised of $207.0 million from the SPAC trust fund, $126.1 million from PIPE investors and $65.8 million from Hyperfine/Liminal balance sheet (assumed cash on Hyperfine/Liminal balance sheet at closing of the transaction), less $24.2 million transaction expenses.

2: Based on company projections, public filings, analyst estimates and Capital IQ as of 07/06/21.

5

HYPERFINEView entire presentation