Kinnevik Results Presentation Deck

Intro

•

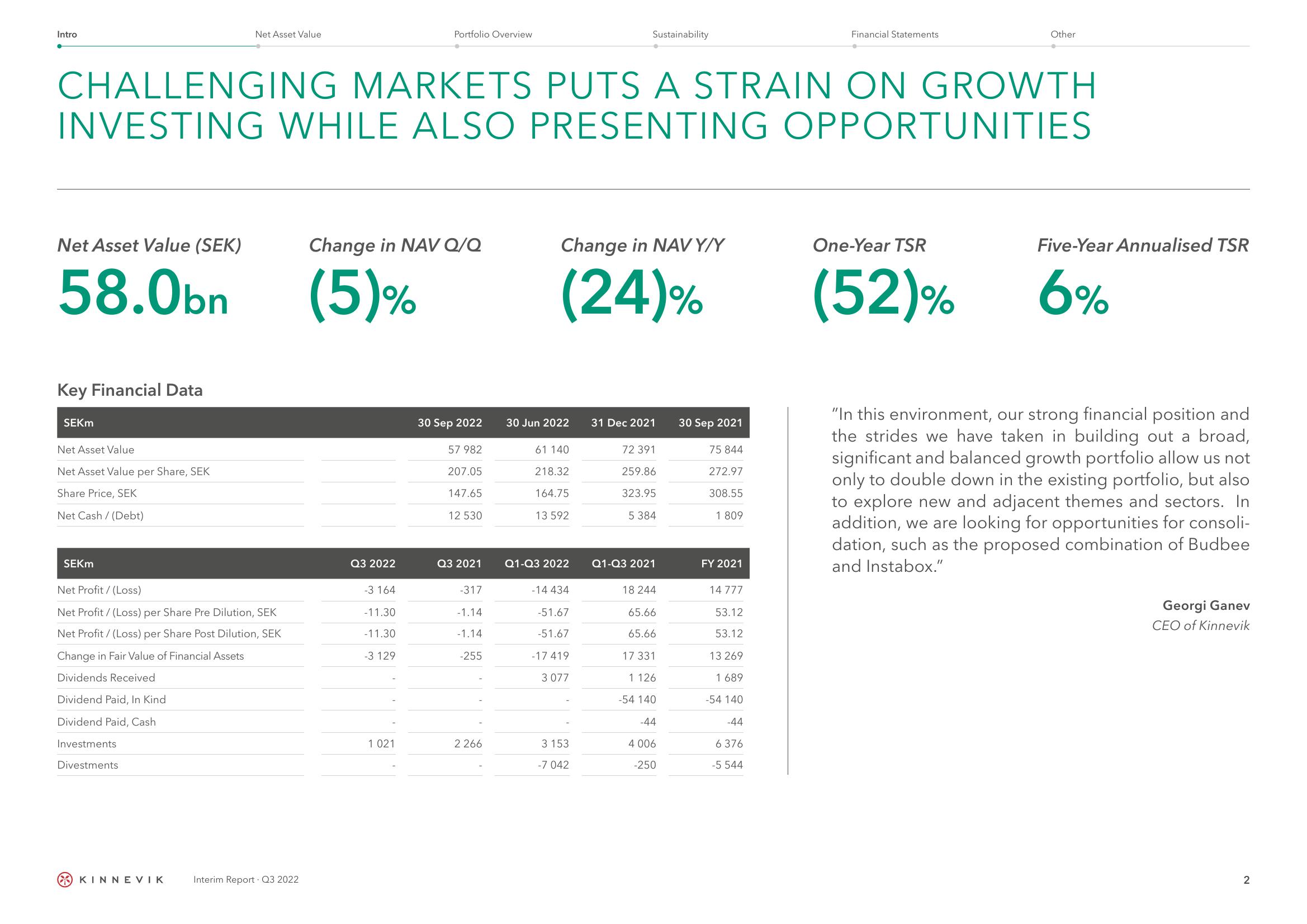

Net Asset Value (SEK)

58.0bn

Key Financial Data

SEKM

Net Asset Value

Net Asset Value per Share, SEK

Share Price, SEK

Net Cash/ (Debt)

CHALLENGING MARKETS PUTS A STRAIN ON GROWTH

INVESTING WHILE ALSO PRESENTING OPPORTUNITIES

SEKM

Net Asset Value

Net Profit/(Loss)

Net Profit / (Loss) per Share Pre Dilution, SEK

Net Profit / (Loss) per Share Post Dilution, SEK

Change in Fair Value of Financial Assets

Dividends Received

Dividend Paid, In Kind

Dividend Paid, Cash

Investments

Divestments

KINNEVIK

Interim Report Q3 2022

Change in NAV Q/Q

(5)%

Q3 2022

-3 164

-11.30

-11.30

Portfolio Overview

-3 129

1 021

30 Sep 2022

57 982

207.05

147.65

12 530

Q3 2021

-317

-1.14

-1.14

-255

2 266

Change in NAVY/Y

(24)%

30 Jun 2022 31 Dec 2021

61 140

218.32

164.75

13 592

Q1-Q3 2022

Sustainability

-14 434

-51.67

-51.67

-17 419

3 077

3 153

-7 042

72 391

259.86

323.95

5 384

Q1-Q3 2021

18 244

65.66

65.66

17 331

1 126

-54 140

-44

4 006

-250

30 Sep 2021

75 844

272.97

308.55

1 809

FY 2021

14 777

53.12

53.12

13 269

1 689

-54 140

Financial Statements

-44

6 376

-5 544

Other

One-Year TSR

(52)%

Five-Year Annualised TSR

6%

"In this environment, our strong financial position and

the strides we have taken in building out a broad,

significant and balanced growth portfolio allow us not

only to double down in the existing portfolio, but also

to explore new and adjacent themes and sectors. In

addition, we are looking for opportunities for consoli-

dation, such as the proposed combination of Budbee

and Instabox."

Georgi Ganev

CEO of Kinnevik

2View entire presentation