GreenLight SPAC Presentation Deck

Summary of approach

●

GreenLight indicative valuation

●

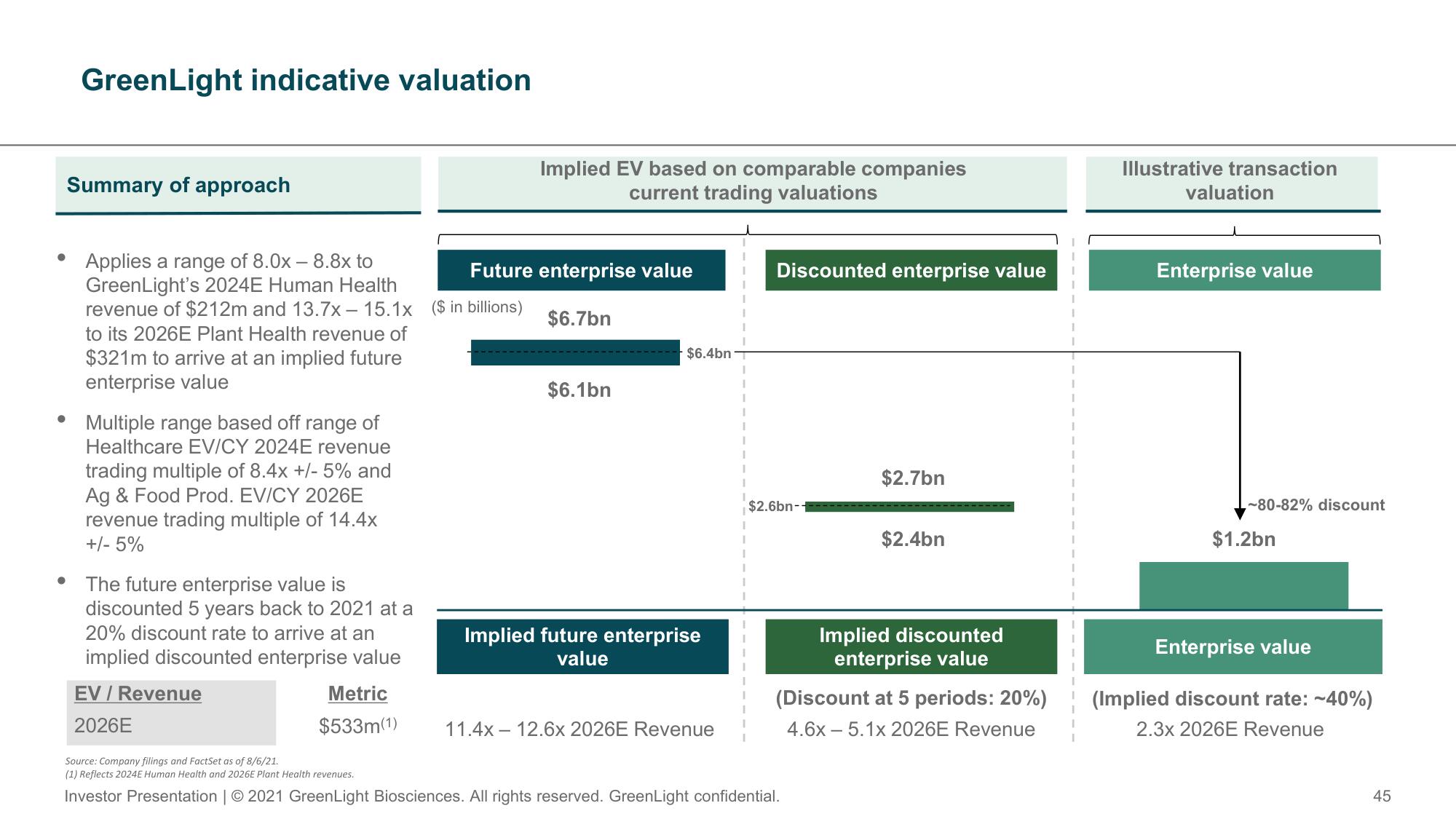

Applies a range of 8.0x - 8.8x to

GreenLight's 2024E Human Health

revenue of $212m and 13.7x- 15.1x ($ in billions)

to its 2026E Plant Health revenue of

$321m to arrive at an implied future

enterprise value

Multiple range based off range of

Healthcare EV/CY 2024E revenue

trading multiple of 8.4x +/- 5% and

Ag & Food Prod. EV/CY 2026E

revenue trading multiple of 14.4x

+/- 5%

The future enterprise value is

discounted 5 years back to 2021 at a

20% discount rate to arrive at an

implied discounted enterprise value

EV/ Revenue

2026E

Metric

$533m(1)

Implied EV based on comparable companies

current trading valuations

Future enterprise value

$6.7bn

$6.1bn

$6.4bn T

Implied future enterprise

value

11.4x 12.6x 2026E Revenue

1

1

I

1

Discounted enterprise value

$2.6bn--

$2.7bn

Source: Company filings and FactSet as of 8/6/21.

(1) Reflects 2024E Human Health and 2026E Plant Health revenues.

Investor Presentation | © 2021 GreenLight Biosciences. All rights reserved. GreenLight confidential.

$2.4bn

Implied discounted

enterprise value

(Discount at 5 periods: 20%)

4.6x - 5.1x 2026E Revenue

Illustrative transaction

valuation

Enterprise value

L-80-82% discount

$1.2bn

Enterprise value

(Implied discount rate: -40%)

2.3x 2026E Revenue

45View entire presentation