Affirm Results Presentation Deck

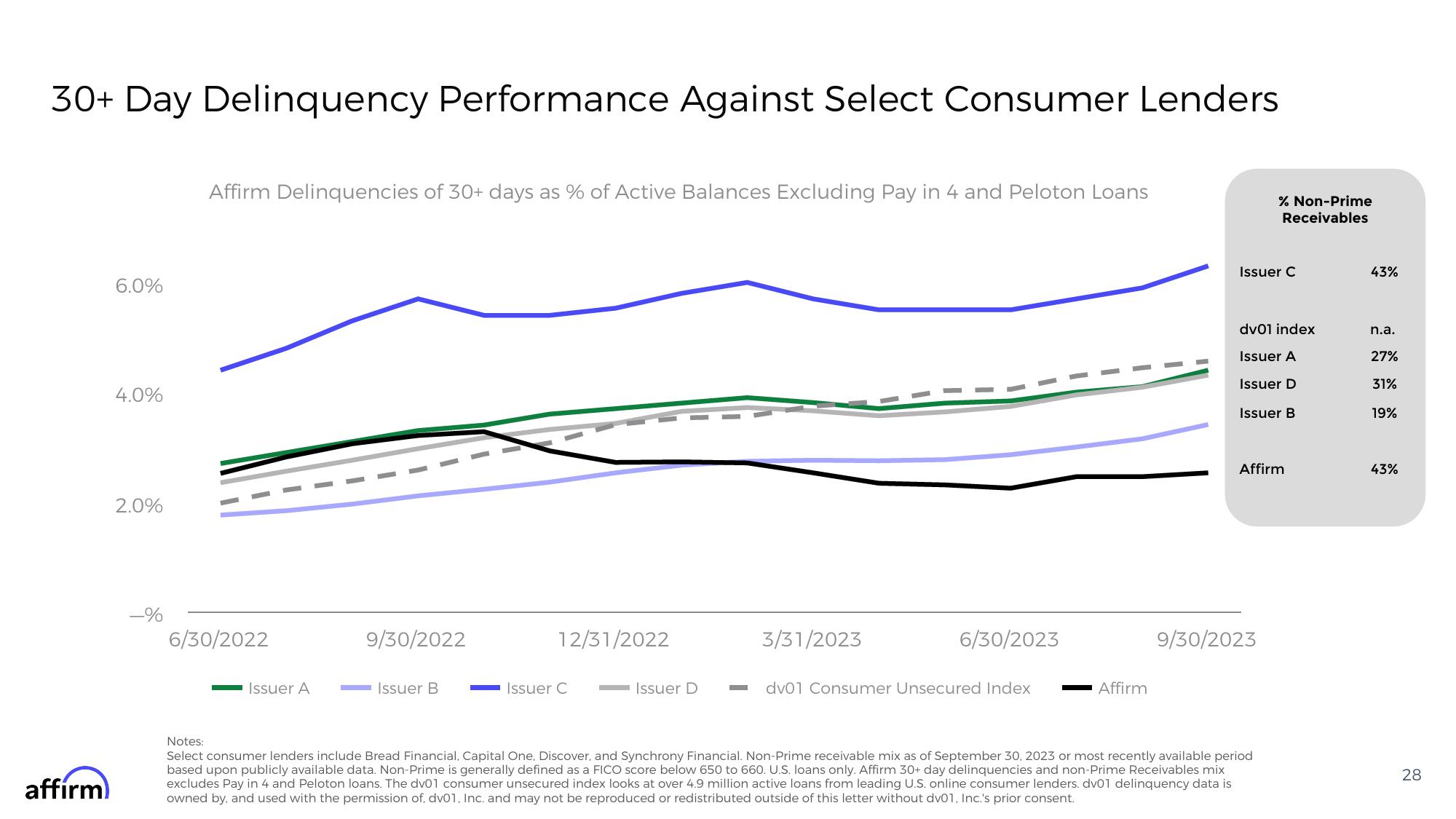

30+ Day Delinquency Performance Against Select Consumer Lenders

affirm

6.0%

4.0%

2.0%

-%

Affirm Delinquencies of 30+ days as % of Active Balances Excluding Pay in 4 and Peloton Loans

6/30/2022

Issuer A

9/30/2022

Issuer B

12/31/2022

Issuer C

Issuer D

3/31/2023

6/30/2023

dv01 Consumer Unsecured Index

Affirm

Issuer C

% Non-Prime

Receivables

dv01 index

Issuer A

Issuer D

Issuer B

Affirm

9/30/2023

Notes:

Select consumer lenders include Bread Financial, Capital One, Discover, and Synchrony Financial. Non-Prime receivable mix as of September 30, 2023 or most recently available period

based upon publicly available data. Non-Prime is generally defined as a FICO score below 650 to 660. U.S. loans only. Affirm 30+ day delinquencies and non-Prime Receivables mix

excludes Pay in 4 and Peloton loans. The dv01 consumer unsecured index looks at over 4.9 million active loans from leading U.S. online consumer lenders. dv01 delinquency data is

owned by, and used with the permission of, dv01, Inc. and may not be reproduced or redistributed outside of this letter without dv01, Inc.'s prior consent.

43%

n.a.

27%

31%

19%

43%

28View entire presentation