Comcast Results Presentation Deck

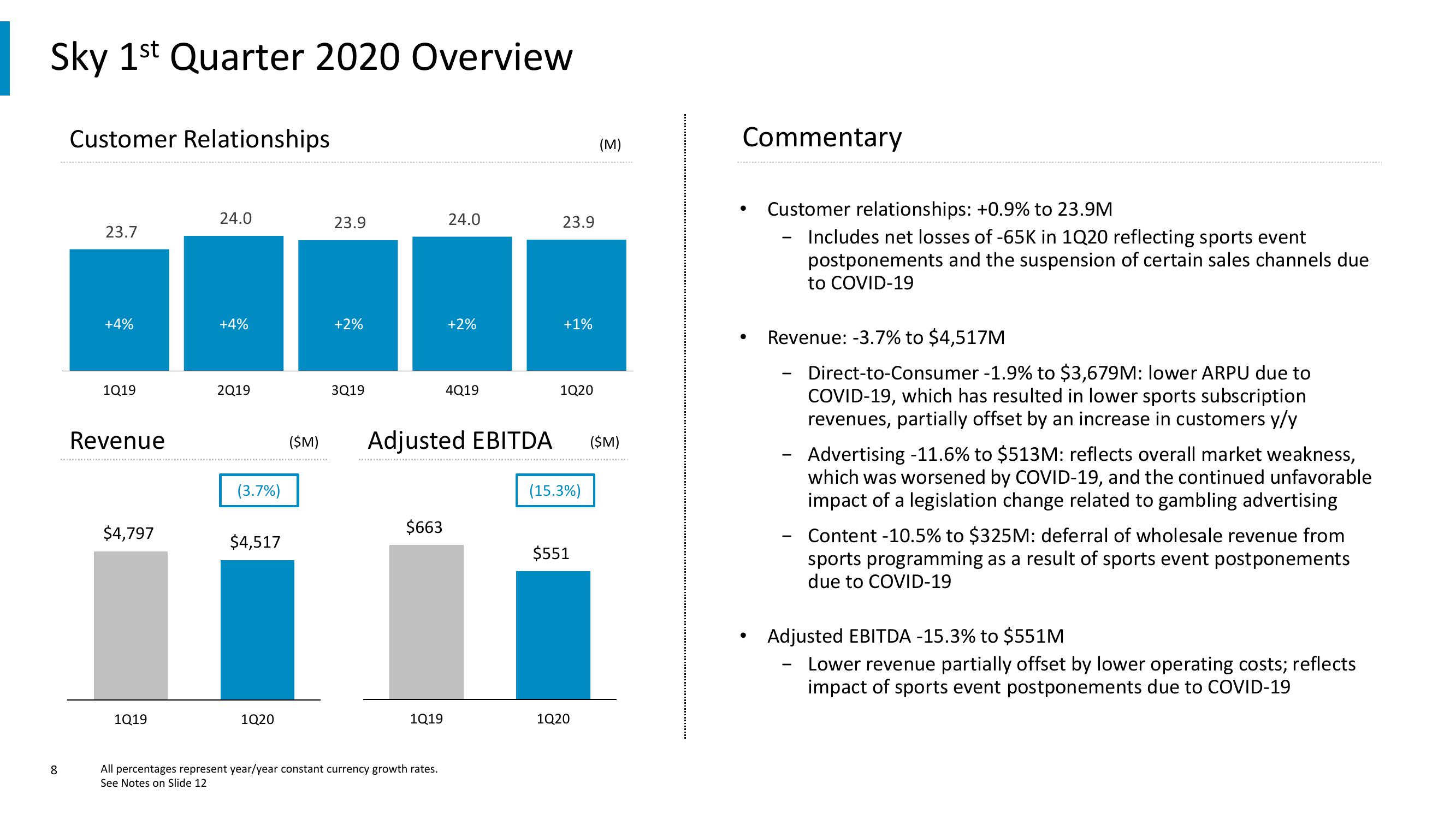

Sky 1st Quarter 2020 Overview

8

Customer Relationships

23.7

+4%

1Q19

Revenue

$4,797

1Q19

24.0

+4%

2Q19

(3.7%)

$4,517

1Q20

23.9

+2%

3Q19

$663

1Q19

24.0

All percentages represent year/year constant currency growth rates.

See Notes on Slide 12

+2%

4Q19

23.9

+1%

($M) Adjusted EBITDA ($M)

1Q20

(15.3%)

$551

(M)

1Q20

Commentary

●

Customer relationships: +0.9% to 23.9M

Includes net losses of -65K in 1Q20 reflecting sports event

postponements and the suspension of certain sales channels due

to COVID-19

-

Revenue: -3.7% to $4,517M

Direct-to-Consumer -1.9% to $3,679M: lower ARPU due to

COVID-19, which has resulted in lower sports subscription

revenues, partially offset by an increase in customers y/y

-

Advertising -11.6% to $513M: reflects overall market weakness,

which was worsened by COVID-19, and the continued unfavorable

impact of a legislation change related to gambling advertising

Content -10.5% to $325M: deferral of wholesale revenue from

sports programming as a result of sports event postponements

due to COVID-19

Adjusted EBITDA -15.3% to $551M

Lower revenue partially offset by lower operating costs; reflects

impact of sports event postponements due to COVID-19View entire presentation