2nd Quarter 2021 Investor Presentation

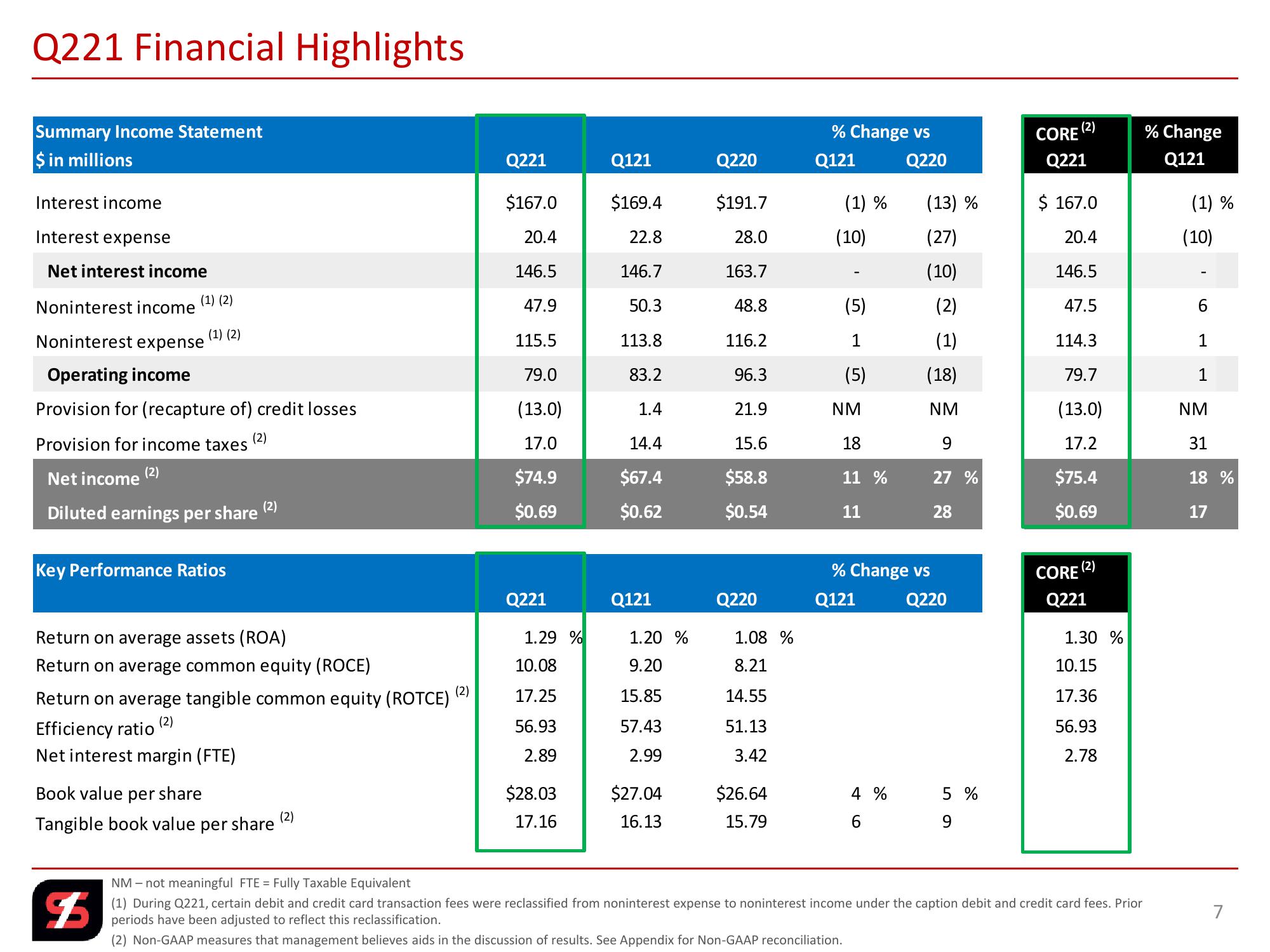

Q221 Financial Highlights

Summary Income Statement

% Change vs

(2)

CORE

% Change

$ in millions

Interest income

Q221

Q121

Q220

Q121

Q220

Q221

Q121

$167.0

$169.4

$191.7

(1) %

(13) %

$ 167.0

(1)%

Interest expense

20.4

22.8

28.0

(10)

(27)

20.4

(10)

Net interest income

146.5

146.7

163.7

(10)

146.5

(1) (2)

Noninterest income

47.9

50.3

48.8

(5)

(2)

47.5

6

Noninterest expense

(1) (2)

115.5

113.8

116.2

1

(1)

114.3

1

Operating income

79.0

83.2

96.3

(5)

(18)

79.7

1

Provision for (recapture of) credit losses

(13.0)

1.4

21.9

NM

NM

(13.0)

NM

Provision for income taxes

(2)

17.0

14.4

15.6

18

9

17.2

31

31

(2)

Net income

$74.9

$67.4

$58.8

11 %

27 %

$75.4

18 %

(2)

Diluted earnings per share

$0.69

$0.62

$0.54

11

28

$0.69

17

Key Performance Ratios

% Change vs

Q221

Q121

Q220

Q121

Q220

CORE (2)

Q221

Return on average assets (ROA)

1.29 %

1.20 %

1.08 %

1.30 %

Return on average common equity (ROCE)

10.08

9.20

8.21

10.15

Efficiency ratio

(2)

Book value per share

Return on average tangible common equity (ROTCE)

Net interest margin (FTE)

Tangible book value per share

(2)

17.25

15.85

14.55

17.36

56.93

57.43

51.13

56.93

2.89

2.99

3.42

2.78

(2)

$28.03

17.16

$27.04

$26.64

16.13

15.79

46

4 %

59

5 %

$

NM - not meaningful FTE = Fully Taxable Equivalent

(1) During Q221, certain debit and credit card transaction fees were reclassified from noninterest expense to noninterest income under the caption debit and credit card fees. Prior

periods have been adjusted to reflect this reclassification.

(2) Non-GAAP measures that management believes aids in the discussion of results. See Appendix for Non-GAAP reconciliation.

7View entire presentation