Greystar Equity Partners XI (May-23)

CONCLUSION

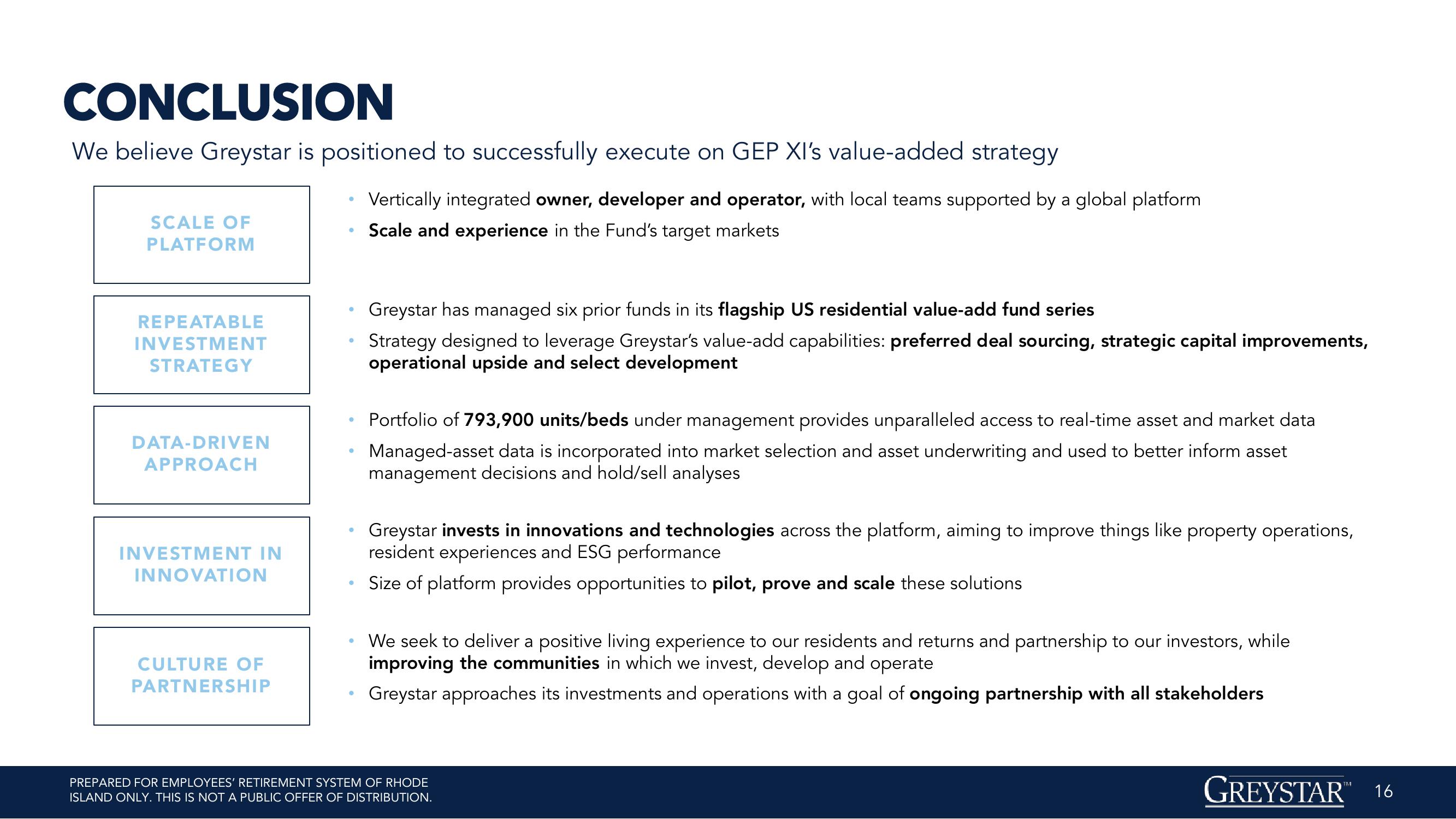

We believe Greystar is positioned to successfully execute on GEP XI's value-added strategy

SCALE OF

PLATFORM

REPEATABLE

INVESTMENT

STRATEGY

DATA-DRIVEN

APPROACH

INVESTMENT IN

INNOVATION

CULTURE OF

PARTNERSHIP

●

●

●

Ⓡ

Vertically integrated owner, developer and operator, with local teams supported by a global platform

Scale and experience in the Fund's target markets

Greystar has managed six prior funds in its flagship US residential value-add fund series

Strategy designed to leverage Greystar's value-add capabilities: preferred deal sourcing, strategic capital improvements,

operational upside and select development

Portfolio of 793,900 units/beds under management provides unparalleled access to real-time asset and market data

Managed-asset data is incorporated into market selection and asset underwriting and used to better inform asset

management decisions and hold/sell analyses

Greystar invests in innovations and technologies across the platform, aiming to improve things like property operations,

resident experiences and ESG performance

Size of platform provides opportunities to pilot, prove and scale these solutions

We seek to deliver a positive living experience to our residents and returns and partnership to our investors, while

improving the communities in which we invest, develop and operate

Greystar approaches its investments and operations with a goal of ongoing partnership with all stakeholders

PREPARED FOR EMPLOYEES' RETIREMENT SYSTEM OF RHODE

ISLAND ONLY. THIS IS NOT A PUBLIC OFFER OF DISTRIBUTION.

GREYSTAR™ 16View entire presentation