KKR Real Estate Finance Trust Results Presentation Deck

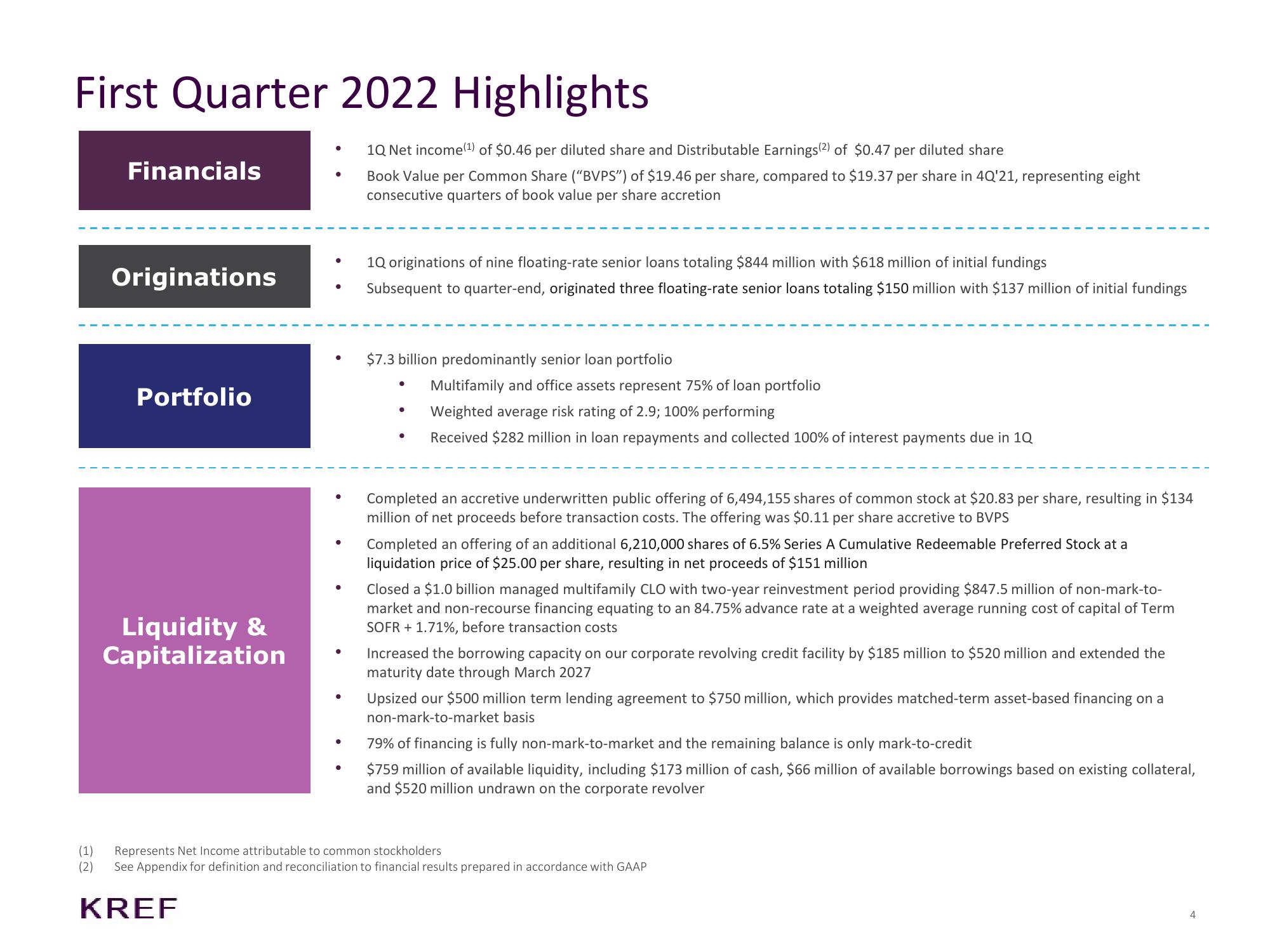

First Quarter 2022 Highlights

(1)

(2)

Financials

Originations

Portfolio

Liquidity &

Capitalization

1Q Net income (1¹) of $0.46 per diluted share and Distributable Earnings (2) of $0.47 per diluted share

Book Value per Common Share ("BVPS") of $19.46 per share, compared to $19.37 per share in 4Q'21, representing eight

consecutive quarters of book value per share accretion

KREF

1Q originations of nine floating-rate senior loans totaling $844 million with $618 million of initial fundings

Subsequent to quarter-end, originated three floating-rate senior loans totaling $150 million with $137 million of initial fundings

$7.3 billion predominantly senior loan portfolio

●

●

●

Multifamily and office assets represent 75% of loan portfolio

Weighted average risk rating of 2.9; 100% performing

Received $282 million in loan repayments and collected 100% of interest payments due in 1Q

Completed an accretive underwritten public offering of 6,494,155 shares of common stock at $20.83 per share, resulting in $134

million of net proceeds before transaction costs. The offering was $0.11 per share accretive to BVPS

Completed an offering of an additional 6,210,000 shares of 6.5% Series A Cumulative Redeemable Preferred Stock at a

liquidation price of $25.00 per share, resulting in net proceeds of $151 million

Closed a $1.0 billion managed multifamily CLO with two-year reinvestment period providing $847.5 million of non-mark-to-

market and non-recourse financing equating to an 84.75% advance rate at a weighted average running cost of capital of Term

SOFR + 1.71%, before transaction costs

Increased the borrowing capacity on our corporate revolving credit facility by $185 million to $520 million and extended the

maturity date through March 2027

Upsized our $500 million term lending agreement to $750 million, which provides matched-term asset-based financing on a

non-mark-to-market basis

79% of financing is fully non-mark-to-market and the remaining balance is only mark-to-credit

$759 million of available liquidity, including $173 million of cash, $66 million of available borrowings based on existing collateral,

and $520 million undrawn on the corporate revolver

Represents Net Income attributable to common stockholders

See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP

4View entire presentation