BenevolentAI Results Presentation Deck

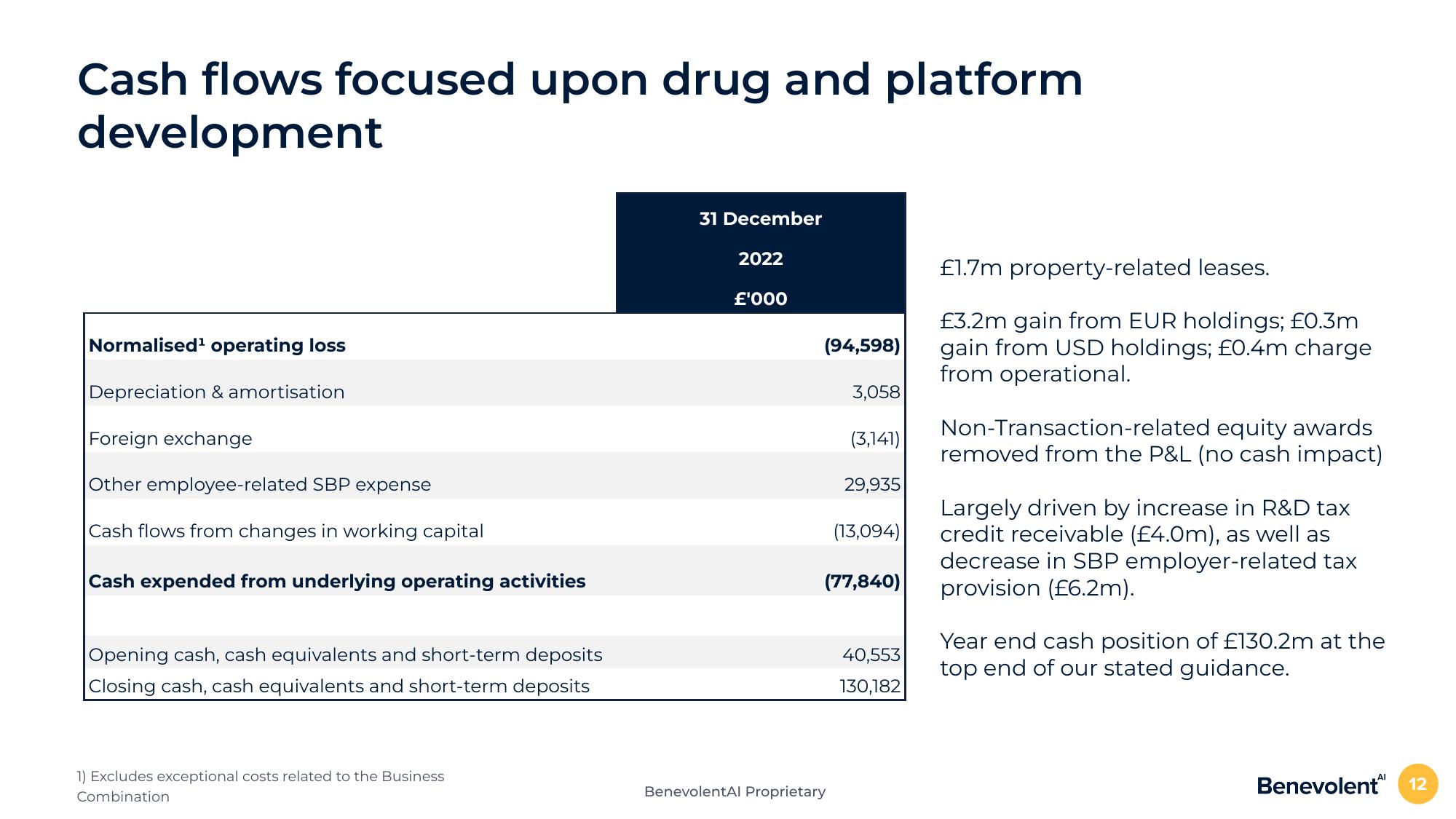

Cash flows focused upon drug and platform

development

Normalised¹ operating loss

Depreciation & amortisation

Foreign exchange

Other employee-related SBP expense

Cash flows from changes in working capital

Cash expended from underlying operating activities

Opening cash, cash equivalents and short-term deposits

Closing cash, cash equivalents and short-term deposits

1) Excludes exceptional costs related to the Business

Combination

31 December

2022

£'000

(94,598)

3,058

BenevolentAl Proprietary

(3,141)

29,935

(13,094)

(77,840)

40,553

130,182

£1.7m property-related leases.

£3.2m gain from EUR holdings; £0.3m

gain from USD holdings; £0.4m charge

from operational.

Non-Transaction-related equity awards

removed from the P&L (no cash impact)

Largely driven by increase in R&D tax

credit receivable (£4.0m), as well as

decrease in SBP employer-related tax

provision (£6.2m).

Year end cash position of £130.2m at the

top end of our stated guidance.

Benevolent 12View entire presentation