KKR Real Estate Finance Trust Results Presentation Deck

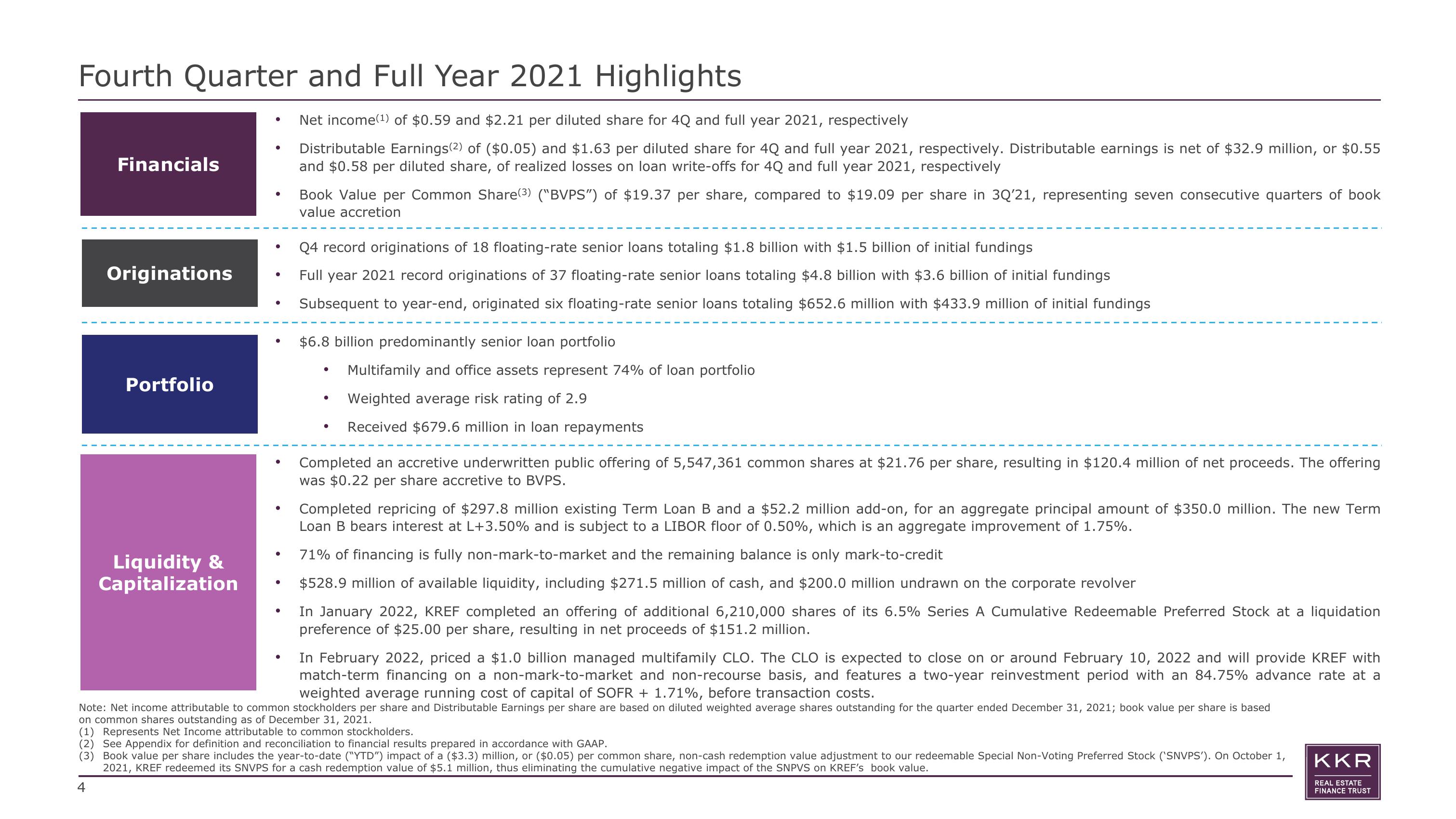

Fourth Quarter and Full Year 2021 Highlights

Financials

Originations

4

Portfolio

Liquidity &

Capitalization

●

●

●

●

●

●

●

●

●

Net income(¹) of $0.59 and $2.21 per diluted share for 4Q and full year 2021, respectively

Distributable Earnings(2) of ($0.05) and $1.63 per diluted share for 4Q and full year 2021, respectively. Distributable earnings is net of $32.9 million, or $0.55

and $0.58 per diluted share, of realized losses on loan write-offs for 4Q and full year 2021, respectively

●

Book Value per Common Share(³) (“BVPS") of $19.37 per share, compared to $19.09 per share in 3Q'21, representing seven consecutive quarters of book

value accretion

Q4 record originations of 18 floating-rate senior loans totaling $1.8 billion with $1.5 billion of initial fundings

Full year 2021 record originations of 37 floating-rate senior loans totaling $4.8 billion with $3.6 billion of initial fundings

Subsequent to year-end, originated six floating-rate senior loans totaling $652.6 million with $433.9 million of initial fundings

$6.8 billion predominantly senior loan portfolio

●

Multifamily and office assets represent 74% of loan portfolio

Weighted average risk rating of 2.9

Received $679.6 million in loan repayments

Completed an accretive underwritten public offering of 5,547,361 common shares at $21.76 per share, resulting in $120.4 million of net proceeds. The offering

was $0.22 per share accretive to BVPS.

In February 2022, priced a $1.0 billion managed multifamily CLO. The CLO is expected to close on or around February 10, 2022 and will provide KREF with

match-term financing on a non-mark-to-market and non-recourse basis, and features a two-year reinvestment period with an 84.75% advance rate at a

weighted average running cost of capital of SOFR + 1.71%, before transaction costs.

Note: Net income attributable to common stockholders per share and Distributable Earnings per share are based on diluted weighted average shares outstanding for the quarter ended December 31, 2021; book value per share is based

on common shares outstanding as of December 31, 2021.

(1) Represents Net Income attributable to common stockholders.

Completed repricing of $297.8 million existing Term Loan B and a $52.2 million add-on, for an aggregate principal amount of $350.0 million. The new Term

Loan B bears interest at L+3.50% and is subject to a LIBOR floor of 0.50%, which is an aggregate improvement of 1.75%.

71% of financing is fully non-mark-to-market and the remaining balance is only mark-to-credit

$528.9 million of available liquidity, including $271.5 million of cash, and $200.0 million undrawn on the corporate revolver

In January 2022, KREF completed an offering of additional 6,210,000 shares of its 6.5% Series A Cumulative Redeemable Preferred Stock at a liquidation

preference of $25.00 per share, resulting in net proceeds of $151.2 million.

(2) See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP.

(3) Book value per share includes the year-to-date ("YTD") impact of a ($3.3) million, or ($0.05) per common share, non-cash redemption value adjustment to our redeemable Special Non-Voting Preferred Stock (SNVPS'). On October 1,

2021, KREF redeemed its SNVPS for a cash redemption value of $5.1 million, thus eliminating the cumulative negative impact of the SNPVS on KREF's book value.

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation