ILPT Q2 2023 Financial Results

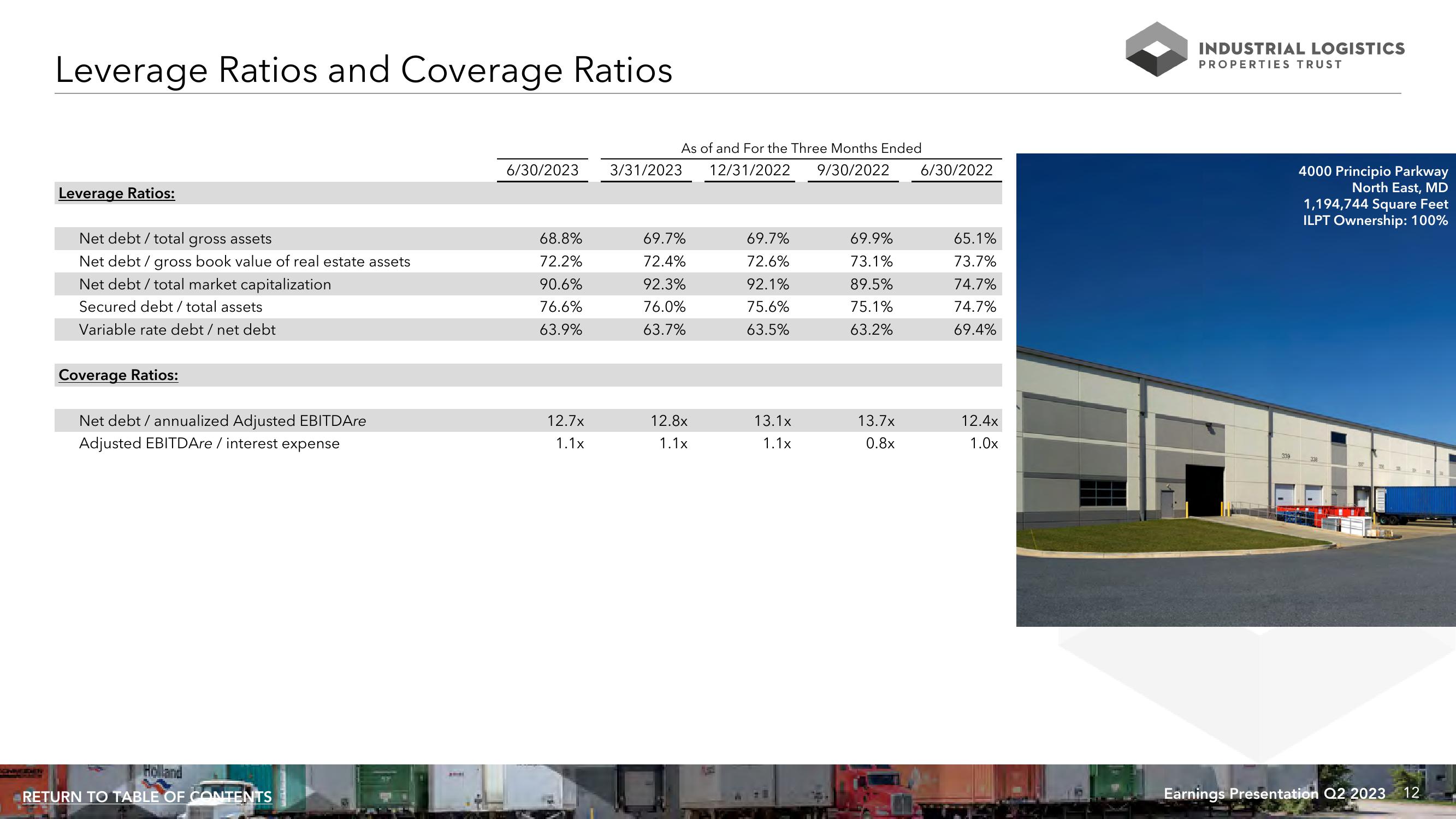

Leverage Ratios and Coverage Ratios

Leverage Ratios:

Net debt / total gross assets

Net debt / gross book value of real estate assets

Net debt / total market capitalization

Secured debt / total assets

Variable rate debt / net debt

Coverage Ratios:

Net debt / annualized Adjusted EBITDAre

Adjusted EBITDAre / interest expense

Holland

RETURN TO TABLE OF CONTENTS

As of and For the Three Months Ended

6/30/2023 3/31/2023 12/31/2022 9/30/2022

68.8%

72.2%

90.6%

76.6%

63.9%

12.7x

1.1x

69.7%

72.4%

92.3%

76.0%

63.7%

12.8x

1.1x

69.7%

72.6%

92.1%

75.6%

63.5%

13.1x

1.1x

69.9%

73.1%

89.5%

75.1%

63.2%

13.7x

0.8x

6/30/2022

65.1%

73.7%

74.7%

74.7%

69.4%

12.4x

1.0x

INDUSTRIAL LOGISTICS

PROPERTIES TRUST

339

4000 Principio Parkway

North East, MD

1,194,744 Square Feet

ILPT Ownership: 100%

Earnings Presentation Q2 2023 12View entire presentation