UBS Shareholder Engagement Presentation Deck

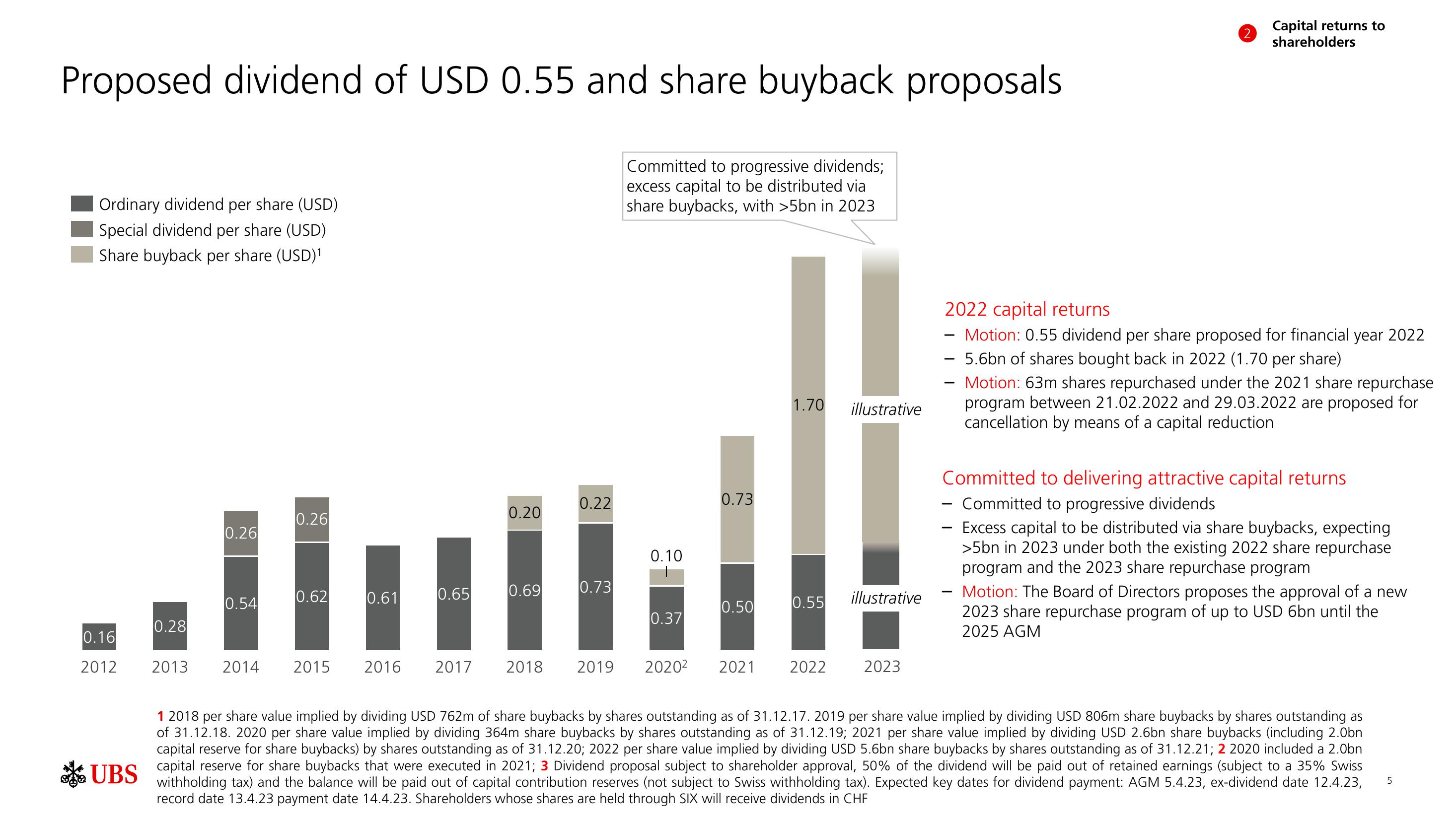

Proposed dividend of USD 0.55 and share buyback proposals

Committed to progressive dividends;

excess capital to be distributed via

share buybacks, with >5bn in 2023

Ordinary dividend per share (USD)

Special dividend per share (USD)

Share buyback per share (USD)¹

0.16

2012

UBS

0.28

2013

0.26

0.54

0.26

0.62

2014 2015

0.61

0.65

0.20

0.69

0.22

0.73

0.10

0.37

0.73

0.50

1.70

0.55

2016 2017 2018 2019 2020² 2021 2022

illustrative

illustrative

2023

2

Capital returns to

shareholders

2022 capital returns

Motion: 0.55 dividend per share proposed for financial year 2022

5.6bn of shares bought back in 2022 (1.70 per share)

-

Motion: 63m shares repurchased under the 2021 share repurchase

program between 21.02.2022 and 29.03.2022 are proposed for

cancellation by means of a capital reduction

Committed to delivering attractive capital returns

Committed to progressive dividends

Excess capital to be distributed via share buybacks, expecting

>5bn in 2023 under both the existing 2022 share repurchase

program and the 2023 share repurchase program

Motion: The Board of Directors proposes the approval of a new

2023 share repurchase program of up to USD 6bn until the

2025 AGM

1 2018 per share value implied by dividing USD 762m of share buybacks by shares outstanding as of 31.12.17. 2019 per share value implied by dividing USD 806m share buybacks by shares outstanding as

of 31.12.18. 2020 per share value implied by dividing 364m share buybacks by shares outstanding as of 31.12.19; 2021 per share value implied by dividing USD 2.6bn share buybacks (including 2.0bn

capital reserve for share buybacks) by shares outstanding as of 31.12.20; 2022 per share value implied by dividing USD 5.6bn share buybacks by shares outstanding as of 31.12.21; 2 2020 included a 2.0bn

capital reserve for share buybacks that were executed in 2021; 3 Dividend proposal subject to shareholder approval, 50% of the dividend will be paid out of retained earnings (subject to a 35% Swiss

withholding tax) and the balance will be paid out of capital contribution reserves (not subject to Swiss withholding tax). Expected key dates for dividend payment: AGM 5.4.23, ex-dividend date 12.4.23,

record date 13.4.23 payment date 14.4.23. Shareholders whose shares are held through SIX will receive dividends in CHF

5View entire presentation