Atalaya Risk Management Overview

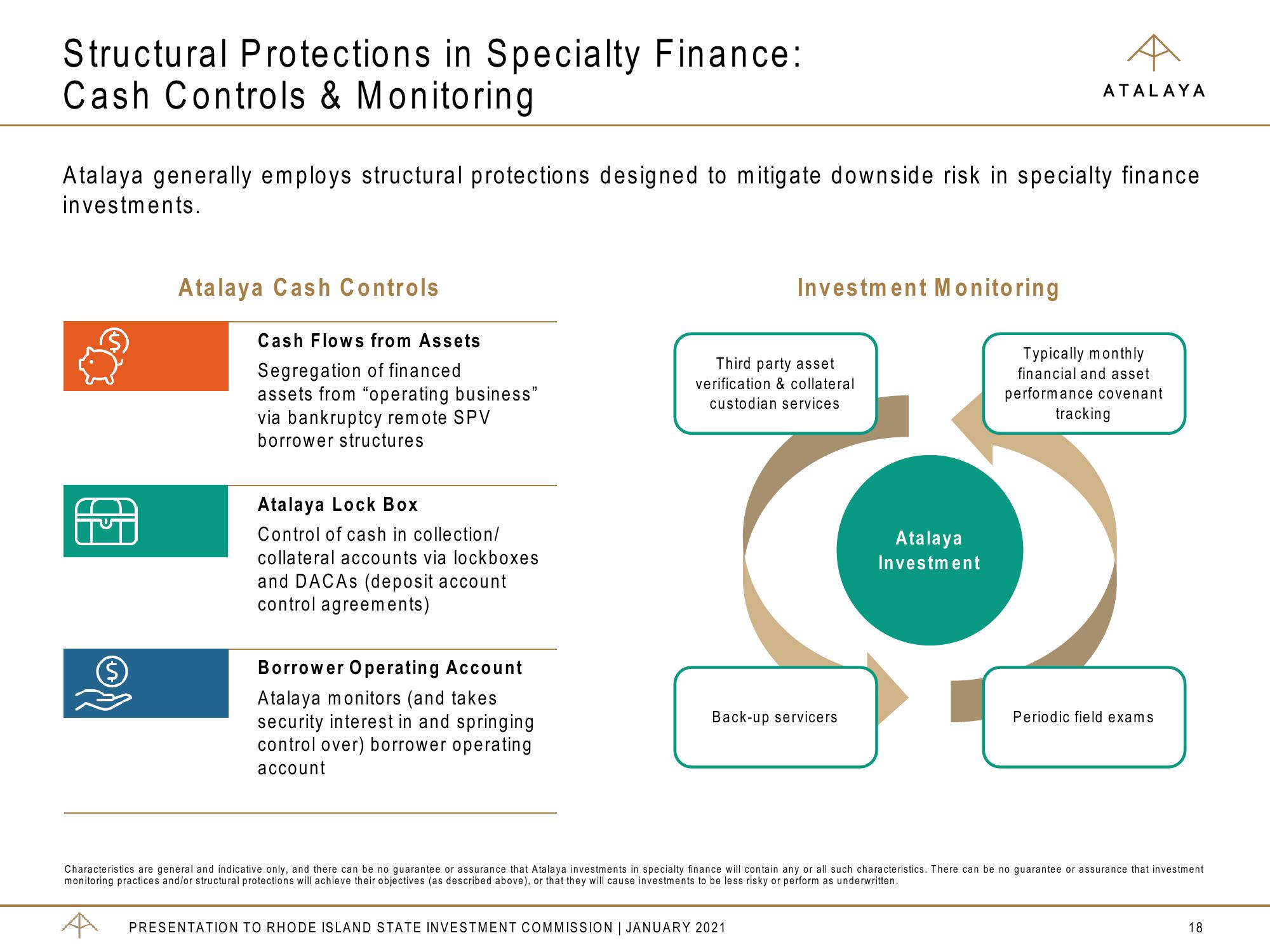

Structural Protections in Specialty Finance:

Cash Controls & Monitoring

Atalaya generally employs structural protections designed to mitigate downside risk in specialty finance

investments.

8

©

Atalaya Cash Controls

Cash Flows from Assets

Segregation of financed

assets from "operating business"

via bankruptcy remote SPV

borrower structures

Atalaya Lock Box

Control of cash in collection/

collateral accounts via lockboxes

and DACAS (deposit account

control agreements)

Borrower Operating Account

Atalaya monitors (and takes

security interest in and springing

control over) borrower operating

account

Investment Monitoring

Third party asset

verification & collateral

custodian services

Back-up servicers

PRESENTATION TO RHODE ISLAND STATE INVESTMENT COMMISSION | JANUARY 2021

ATALAYA

Atalaya

Investment

Typically monthly

financial and asset

performance covenant

tracking

Periodic field exams

Characteristics are general and indicative only, and there can be no guarantee or assurance that Atalaya investments in specialty finance will contain any or all such characteristics. There can be no guarantee or assurance that investment

monitoring practices and/or structural protections will achieve their objectives (as described above), or that they will cause investments to be less risky or perform as underwritten.

18View entire presentation