Ashtead Group Results Presentation Deck

HIGHLIGHTS

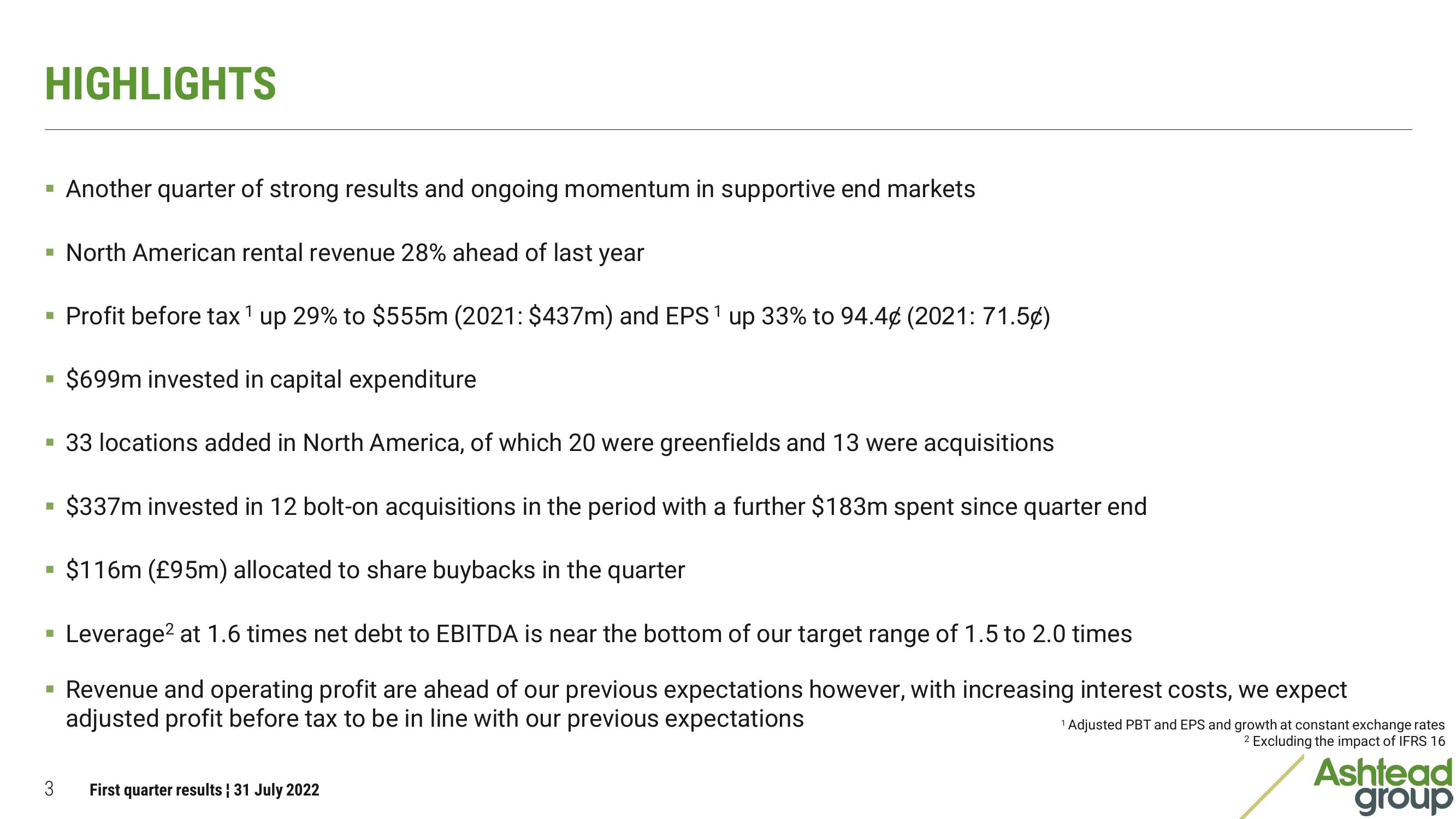

Another quarter of strong results and ongoing momentum in supportive end markets

North American rental revenue 28% ahead of last year

▪ Profit before tax ¹ up 29% to $555m (2021: $437m) and EPS¹ up 33% to 94.4¢ (2021: 71.50)

$699m invested in capital expenditure

▪ 33 locations added in North America, of which 20 were greenfields and 13 were acquisitions

$337m invested in 12 bolt-on acquisitions in the period with a further $183m spent since quarter end

$116m (£95m) allocated to share buybacks in the quarter

Leverage² at 1.6 times net debt to EBITDA is near the bottom of our target range of 1.5 to 2.0 times

▪ Revenue and operating profit are ahead of our previous expectations however, with increasing interest costs, we expect

adjusted profit before tax to be in line with our previous expectations

■

■

■

3

First quarter results ¦ 31 July 2022

¹ Adjusted PBT and EPS and growth at constant exchange rates

2 Excluding the impact of IFRS 16

Ashtead

groupView entire presentation