AstraZeneca Results Presentation Deck

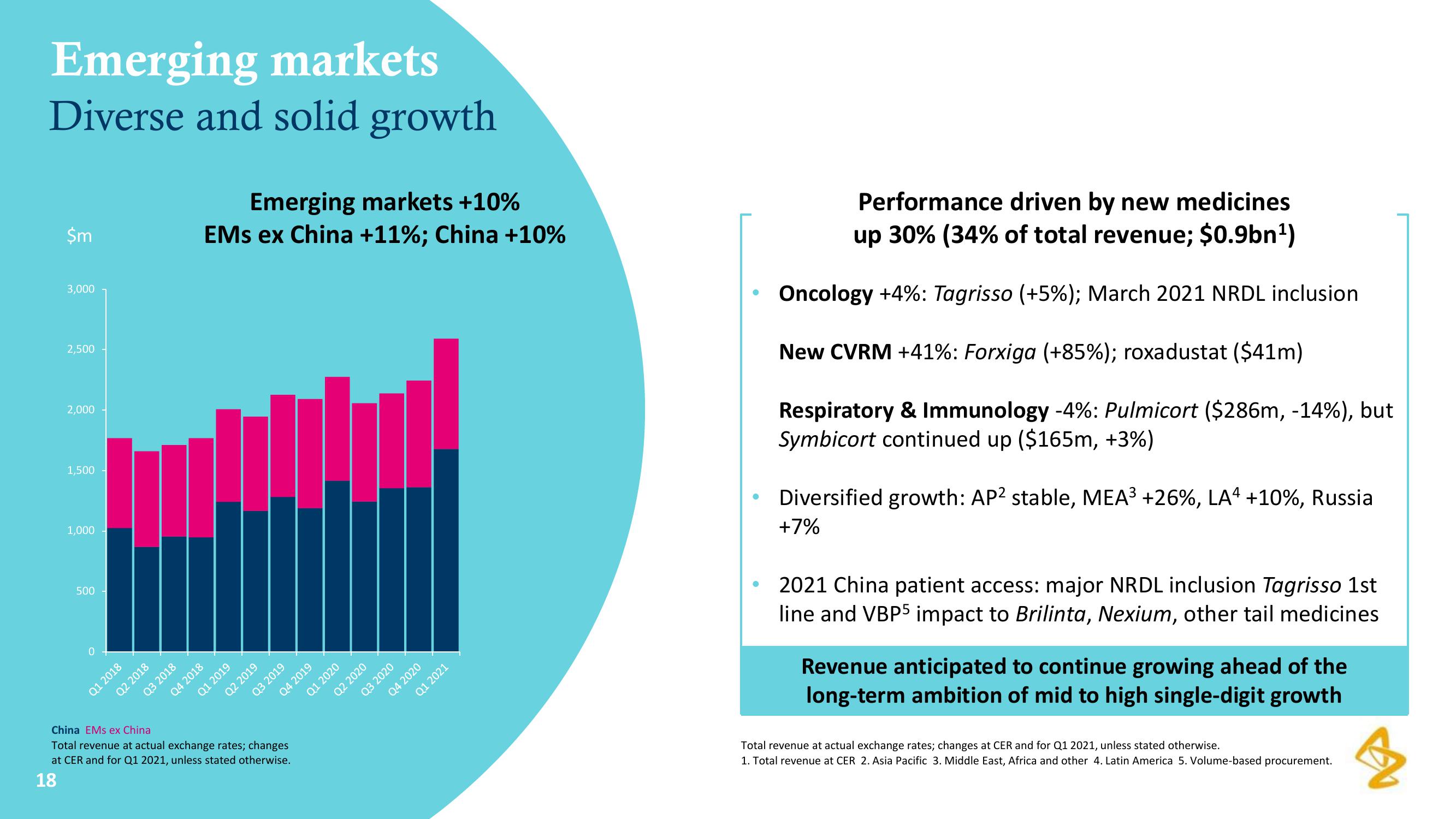

Emerging markets

Diverse and solid growth

$m

3,000

2,500

2,000

1,500

1,000

500

Q1 2018

Q2 2018

Q3 2018

Emerging markets +10%

EMs ex China +11%; China +10%

Q4 2018

Q1 2019

Q2 2019

Q3 2019

China EMs ex China

Total revenue at actual exchange rates; changes

at CER and for Q1 2021, unless stated otherwise.

18

Q4 2019

Q1 2020

Q2 2020

Q3 2020

Q4 2020

Q1 2021

Performance driven by new medicines

up 30% (34% of total revenue; $0.9bn¹)

Oncology +4%: Tagrisso (+5%) ; March 2021 NRDL inclusion.

New CVRM +41% : Forxiga (+85%); roxadustat ($41m)

Respiratory & Immunology -4%: Pulmicort ($286m, -14%), but

Symbicort continued up ($165m, +3%)

Diversified growth: AP2 stable, MEA³ +26%, LA4 +10%, Russia

+7%

2021 China patient access: major NRDL inclusion Tagrisso 1st

line and VBP5 impact to Brilinta, Nexium, other tail medicines

Revenue anticipated to continue growing ahead of the

long-term ambition of mid to high single-digit growth

Total revenue at actual exchange rates; changes at CER and for Q1 2021, unless stated otherwise.

1. Total revenue at CER 2. Asia Pacific 3. Middle East, Africa and other 4. Latin America 5. Volume-based procurement.

3View entire presentation