Matterport Results Presentation Deck

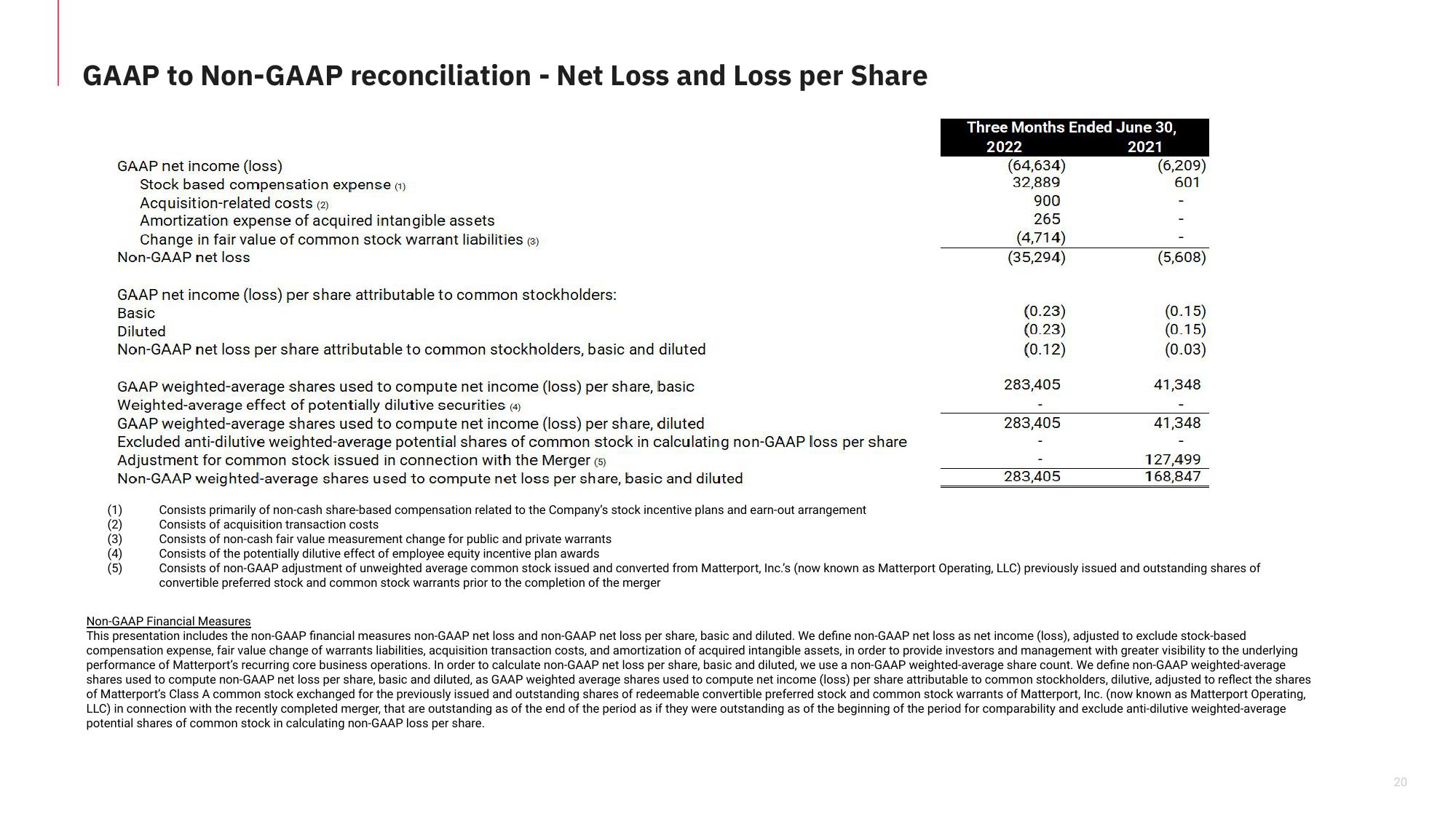

GAAP to Non-GAAP reconciliation - Net Loss and Loss per Share

GAAP net income (loss)

Stock based compensation expense (1)

Acquisition-related costs (2)

Amortization expense of acquired intangible assets

Change in fair value of common stock warrant liabilities (3)

Non-GAAP net loss

GAAP net income (loss) per share attributable to common stockholders:

Basic

Diluted

Non-GAAP net loss per share attributable to common stockholders, basic and diluted

GAAP weighted-average shares used to compute net income (loss) per share, basic

Weighted-average effect of potentially dilutive securities (4)

GAAP weighted-average shares used to compute net income (loss) per share, diluted

Excluded anti-dilutive weighted-average potential shares of common stock in calculating non-GAAP loss per share

Adjustment for common stock issued in connection with the Merger (5)

Non-GAAP weighted-average shares used to compute net loss per share, basic and diluted

(2)

(4)

(5)

Consists primarily of non-cash share-based compensation related to the Company's stock incentive plans and earn-out arrangement

Consists of acquisition transaction costs

Three Months Ended June 30,

2022

2021

(64,634)

32,889

900

265

(4,714)

(35,294)

(0.23)

(0.23)

(0.12)

283,405

283,405

283,405

(6,209)

601

(5,608)

(0.15)

(0.15)

(0.03)

41,348

41,348

127,499

168,847

Consists of non-cash fair value measurement change for public and private warrants

Consists of the potentially dilutive effect of employee equity incentive plan awards

Consists of non-GAAP adjustment of unweighted average common stock issued and converted from Matterport, Inc.'s (now known as Matterport Operating, LLC) previously issued and outstanding shares of

convertible preferred stock and common stock warrants prior to the completion of the merger

Non-GAAP Financial Measures

ted to exclude stock-based

This presentation includes the non-GAAP financial measures non-GAAP net loss and non-GAAP net loss per share, basic and diluted. We define non-GAAP net loss as net income (loss),

compensation expense, fair value change of warrants liabilities, acquisition transaction costs, and amortization of acquired intangible assets, in order to provide investors and management with greater visibility to the underlying

performance of Matterport's recurring core business operations. In order to calculate non-GAAP net loss per share, basic and diluted, we use a non-GAAP weighted-average share count. We define non-GAAP weighted-average

shares used to compute non-GAAP net loss per share, basic and diluted, as GAAP weighted average shares used to compute net income (loss) per share attributable to common stockholders, dilutive, adjusted to reflect the shares

of Matterport's Class A common stock exchanged for the previously issued and outstanding shares of redeemable convertible preferred stock and common stock warrants of Matterport, Inc. (now known as Matterport Operating,

LLC) in connection with the recently completed merger, that are outstanding as of the end of the period as if they were outstanding as of the beginning of the period for comparability and exclude anti-dilutive weighted-average

potential shares of common stock in calculating non-GAAP loss per share.

20View entire presentation