Ford Investor Conference

Transaction Credit Enhancement

|

|

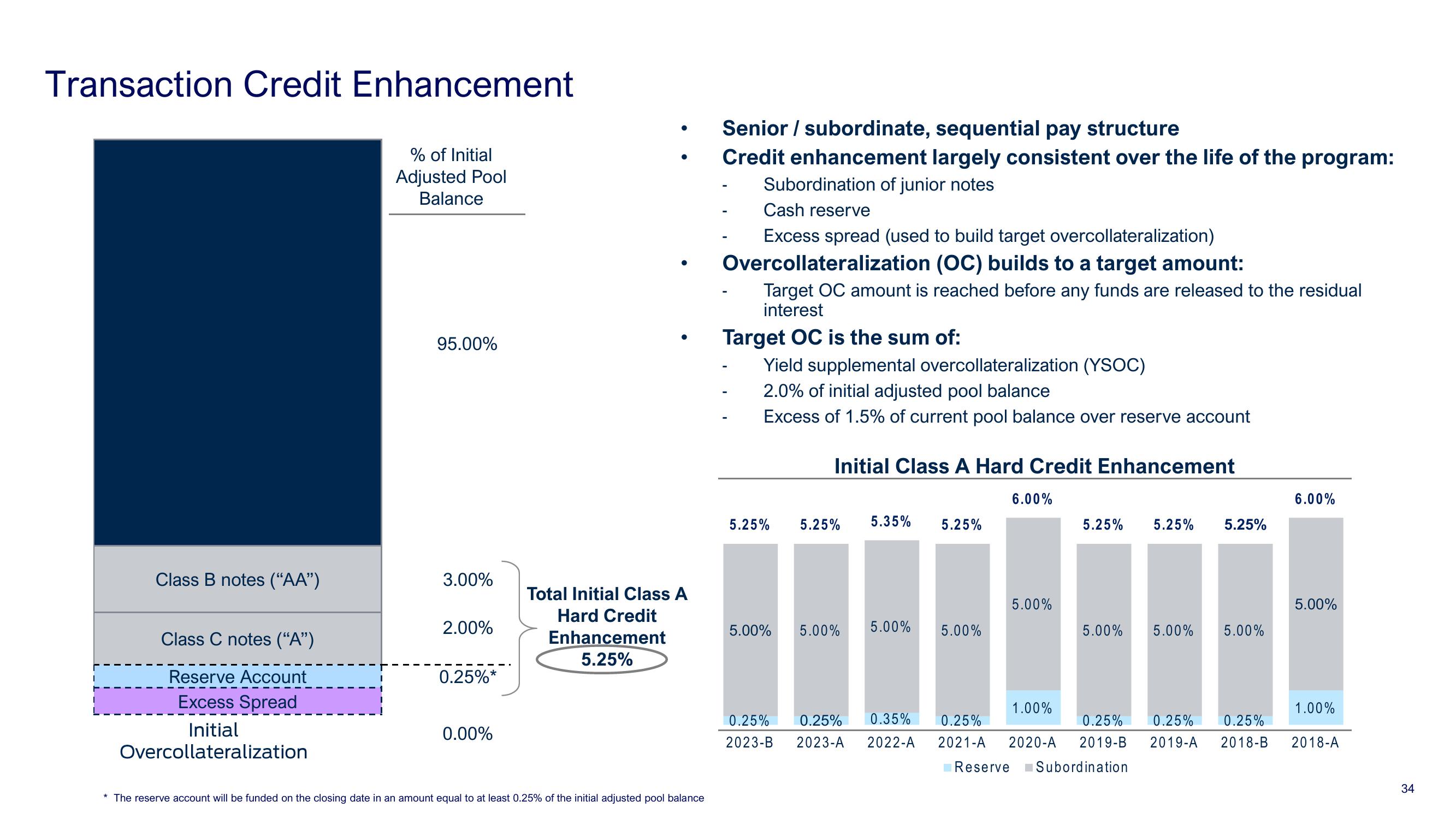

Class B notes ("AA”)

Class C notes (“A”)

Reserve Account

Excess Spread

Initial

Overcollateralization

% of Initial

Adjusted Pool

Balance

95.00%

3.00%

2.00%

0.25%*

0.00%

●

Total Initial Class A

Hard Credit

Enhancement

5.25%

* The reserve account will be funded on the closing date in an amount equal to at least 0.25% of the initial adjusted pool balance

Senior / subordinate, sequential pay structure

Credit enhancement largely consistent over the life of the program:

Subordination of junior notes

Cash reserve

Excess spread (used to build target overcollateralization)

Overcollateralization (OC) builds to a target amount:

Target OC amount is reached before any funds are released to the residual

interest

Target OC is the sum of:

Yield supplemental overcollateralization (YSOC)

2.0% of initial adjusted pool balance

Excess of 1.5% of current pool balance over reserve account

Initial Class A Hard Credit Enhancement

5.25% 5.25% 5.35% 5.25%

5.00% 5.00%

5.00% 5.00%

6.00%

5.00%

1.00%

5.25% 5.25% 5.25%

5.00% 5.00% 5.00%

6.00%

5.00%

1.00%

0.25% 0.25% 0.35% 0.25%

0.25% 0.25% 0.25%

2023-B 2023-A 2022-A 2021-A 2020-A 2019-B 2019-A 2018-B 2018-A

Reserve Subordination

34View entire presentation