Building a Leading P&C Insurer

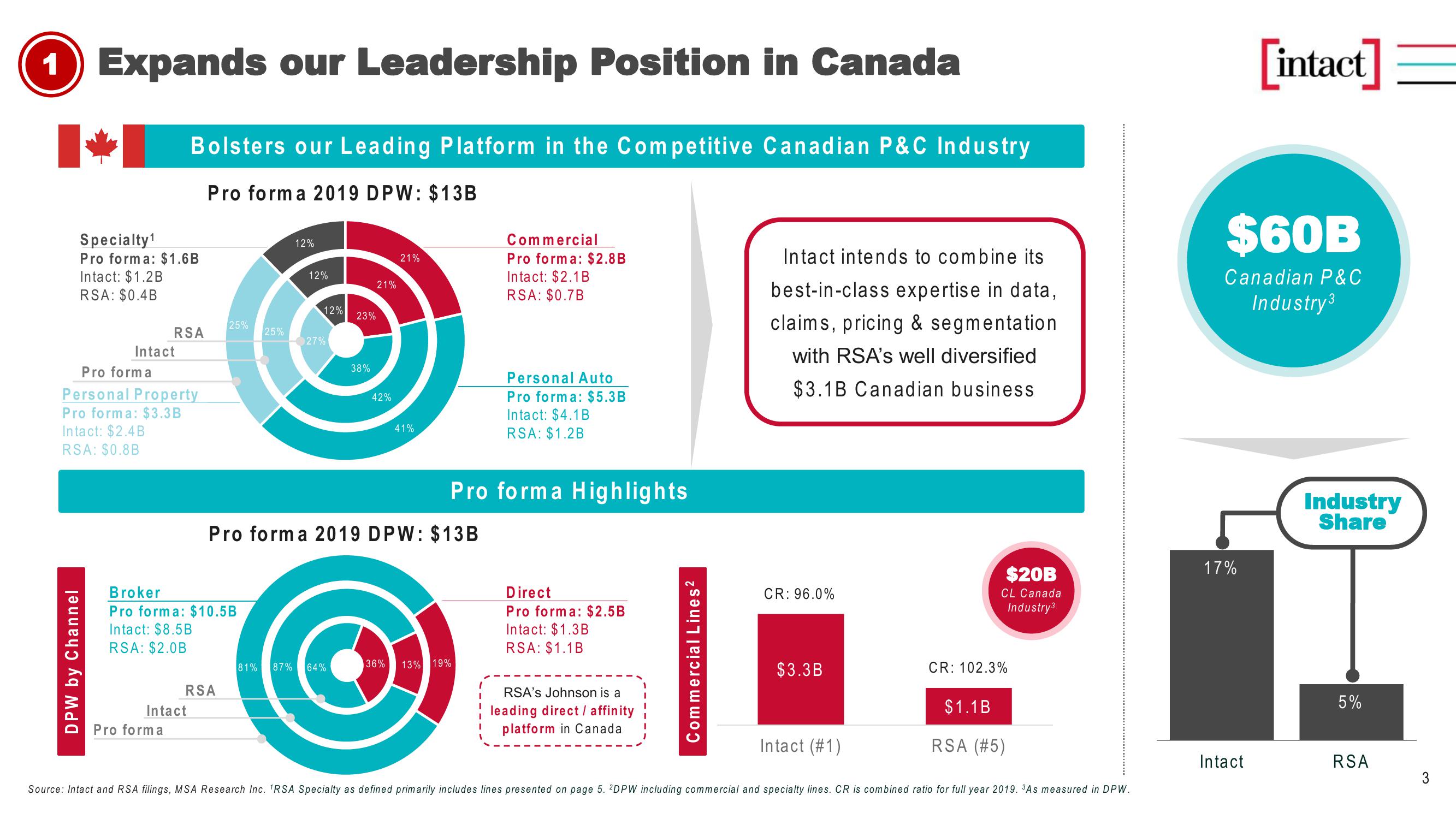

1) Expands our Leadership Position in Canada

Specialty¹

Pro forma: $1.6B

Intact: $1.2B

RSA: $0.4B

DPW by Channel

Intact

Bolsters our Leading Platform in the Competitive Canadian P&C Industry

Pro form a 2019 DPW: $13B

RSA

Pro forma

Personal Property

Pro forma: $3.3B

Intact: $2.4B

RSA: $0.8B

Pro forma

Intact

Broker

Pro forma: $10.5B

Intact: $8.5B

RSA: $2.0B

25%

RSA

25%

12%

12%

12%

-27%

23%

38%

21%

42%

21%

41%

Pro forma 2019 DPW: $13B

81% 87% 64% 36 % 13% 19%

Commercial

Pro forma: $2.8B

Intact: $2.1B

RSA: $0.7B

Personal Auto

Pro forma: $5.3B

Intact: $4.1B

RSA: $1.2B

Pro forma Highlights

Direct

Pro forma: $2.5B

Intact: $1.3B

RSA: $1.1B

RSA's Johnson is a

leading direct / affinity

platform in Canada

Commercial Lines²

Intact intends to combine its

best-in-class expertise in data,

claims, pricing & segmentation

with RSA's well diversified

$3.1B Canadian business

CR: 96.0%

$3.3B

Intact (#1)

$20B

CL Canada

Industry³

CR: 102.3%

$1.1B

RSA (#5)

Source: Intact and RSA filings, MSA Research Inc. RSA Specialty as defined primarily includes lines presented on page 5. 2DPW including commercial and specialty lines. CR is combined ratio for full year 2019. As measured in DPW.

$60B

Canadian P&C

Industry³

17%

[intact]

Intact

Industry

Share

5%

RSA

3View entire presentation