Vale Investor Day Presentation Deck

76

5

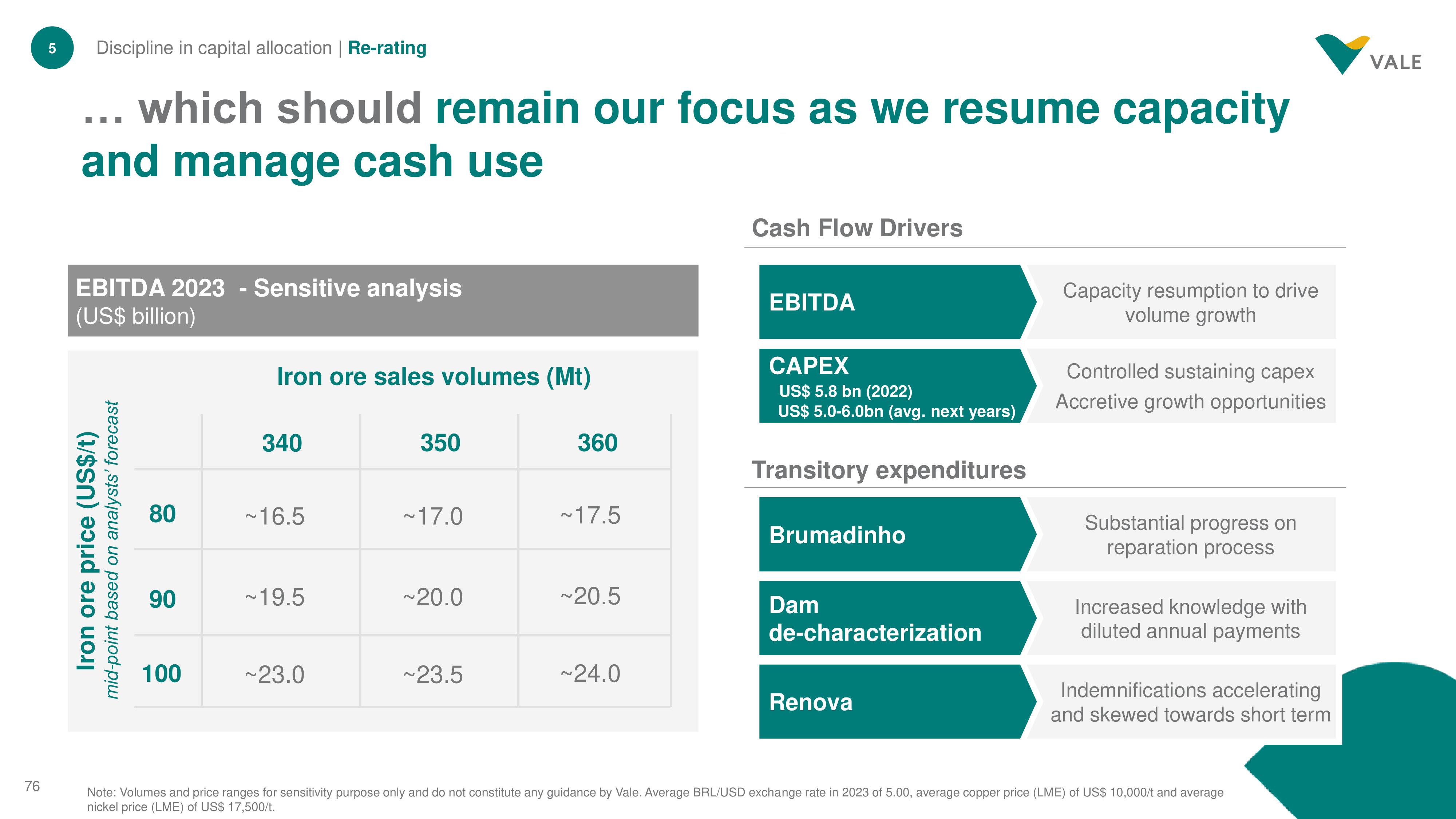

Discipline in capital allocation | Re-rating

... which should remain our focus as we resume capacity

and manage cash use

EBITDA 2023 - Sensitive analysis

(US$ billion)

Iron ore price (US$/t)

mid-point based on analysts' forecast

80

90

100

Iron ore sales volumes (Mt)

340

~16.5

~19.5

~23.0

350

~17.0

~20.0

~23.5

360

~17.5

~20.5

~24.0

Cash Flow Drivers

EBITDA

CAPEX

US$ 5.8 bn (2022)

US$ 5.0-6.0bn (avg. next years)

Transitory expenditures

Brumadinho

Dam

de-characterization

Renova

Capacity resumption to drive

volume growth

Controlled sustaining capex

Accretive growth opportunities

Substantial progress on

reparation process

Increased knowledge with

diluted annual payments

Indemnifications accelerating

and skewed towards short term

Note: Volumes and price ranges for sensitivity purpose only and do not constitute any guidance by Vale. Average BRL/USD exchange rate in 2023 of 5.00, average copper price (LME) of US$ 10,000/t and average

nickel price (LME) of US$ 17,500/t.

VALEView entire presentation