Nano Dimension Mergers and Acquisitions Presentation Deck

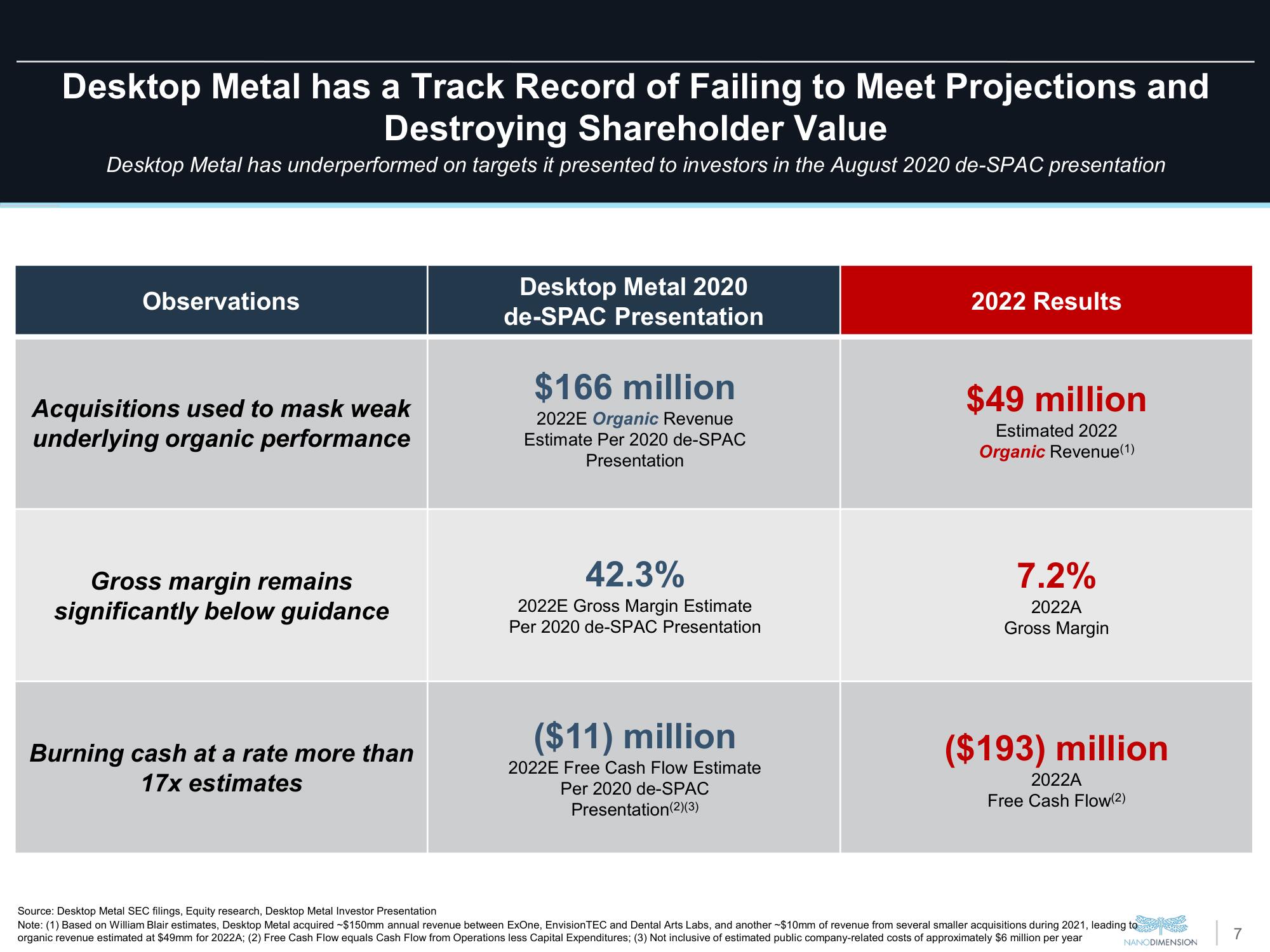

Desktop Metal has a Track Record of Failing to Meet Projections and

Destroying Shareholder Value

Desktop Metal has underperformed on targets it presented to investors in the August 2020 de-SPAC presentation

Observations

Acquisitions used to mask weak

underlying organic performance

Gross margin remains

significantly below guidance

Burning cash at a rate more than

17x estimates

Desktop Metal 2020

de-SPAC Presentation

$166 million

2022E Organic Revenue

Estimate Per 2020 de-SPAC

Presentation

42.3%

2022E Gross Margin Estimate

Per 2020 de-SPAC Presentation

($11) million

2022E Free Cash Flow Estimate

Per 2020 de-SPAC

Presentation (2)(3)

2022 Results

$49 million

Estimated 2022

Organic Revenue(1)

7.2%

2022A

Gross Margin

($193) million

2022A

Free Cash Flow(2)

Source: Desktop Metal SEC filings, Equity research, Desktop Metal Investor Presentation

Note: (1) Based on William Blair estimates, Desktop Metal acquired -$150mm annual revenue between ExOne, EnvisionTEC and Dental Arts Labs, and another -$10mm of revenue from several smaller acquisitions during 2021, leading to

organic revenue estimated at $49mm for 2022A; (2) Free Cash Flow equals Cash Flow from Operations less Capital Expenditures; (3) Not inclusive of estimated public company-related costs of approximately $6 million per year

NANODIMENSION

7View entire presentation