Syniverse SPAC Presentation Deck

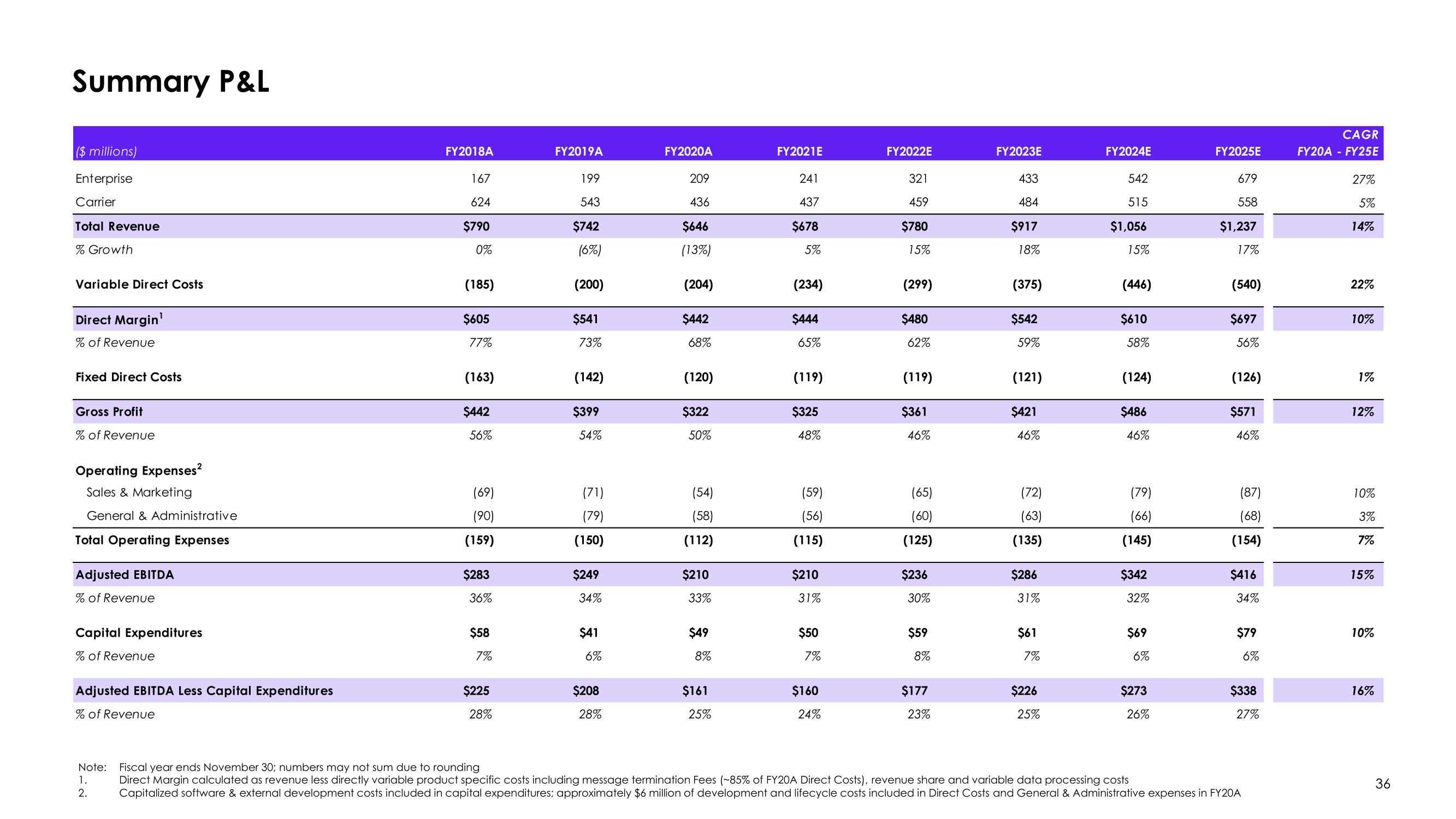

Summary P&L

($ millions)

Enterprise

Carrier

Total Revenue

% Growth

Variable Direct Costs

Direct Margin¹

% of Revenue

Fixed Direct Costs

Gross Profit

% of Revenue

Operating Expenses²

Sales & Marketing

General & Administrative

Total Operating Expenses

Adjusted EBITDA

% of Revenue

Capital Expenditures

% of Revenue

Adjusted EBITDA Less Capital Expenditures

% of Revenue

FY2018A

1.

2.

167

624

$790

0%

(185)

$605

77%

(163)

$442

56%

(69)

(90)

(159)

$283

36%

$58

7%

$225

28%

FY2019A

199

543

$742

(6%)

(200)

$541

73%

(142)

$399

54%

(71)

(79)

(150)

$249

34%

$41

6%

$208

28%

FY2020A

209

436

$646

(13%)

(204)

$442

68%

(120)

$322

50%

(54)

(58)

(112)

$210

33%

$49

8%

$161

25%

FY2021E

241

437

$678

5%

(234)

$444

65%

(119)

$325

48%

(59)

(56)

(115)

$210

31%

$50

7%

$160

24%

FY2022E

321

459

$780

15%

(299)

$480

62%

(119)

$361

46%

(65)

(60)

(125)

$236

30%

$59

8%

$177

23%

FY2023E

433

484

$917

18%

(375)

$542

59%

(121)

$421

46%

(72)

(63)

(135)

$286

31%

$61

7%

$226

25%

FY2024E

542

515

$1,056

15%

(446)

$610

58%

(124)

$486

46%

(79)

(66)

(145)

$342

32%

$69

6%

$273

26%

FY2025E

679

558

$1,237

17%

(540)

$697

56%

(126)

$571

46%

(87)

(68)

(154)

$416

34%

$79

6%

$338

27%

Note: Fiscal year ends November 30; numbers may not sum due to rounding

Direct Margin calculated as revenue less directly variable product specific costs including message termination Fees (~85% of FY20A Direct Costs), revenue share and variable data processing costs

Capitalized software & external development costs included in capital expenditures; approximately $6 million of development and lifecycle costs included in Direct Costs and General & Administrative expenses in FY20A

CAGR

FY20A - FY25E

27%

5%

14%

22%

10%

1%

12%

10%

3%

7%

15%

10%

16%

36View entire presentation