Coppersmith Presentation to Alere Inc Stockholders

PAGE 53 |

COPPERSMITH

In his 7/17/13 letter to stockholders, Chairman & CEO Zwanziger diverts from discussing Alere and the serious issues it

faces, to instead focus on three other companies where MMI, a former employer of Mr. Lande, obtained board representation

for individuals other than the Coppersmith Nominees. We believe his letter misrepresented these situations. Here are the

facts:

Past Nominees of a Former Firm: Setting the Facts Straight

Brink's - MMI's involvement resulted in stockholder returns of 129% for Brink's, or outperformance of 43% versus the

S&P400, and 119% for BHS, or outperformance of 73%³4

▪ MMI drove five-years of value-creating transactions: sale of the underperforming BAX division, an over $500mm Dutch-

auction buyback, the tax-free spin-off of BHS and BHS' subsequent sale to Tyco

DHT Holdings -MMI's involvement resulted in replacement of a poor-performing CEO with sophisticated management who

ensured solvency and fleet growth while larger, distinguished peers like General Maritime and OSG went bankrupt

▪ DHT performed well despite the unprecedented downturn in the tanker market that depressed its stock price

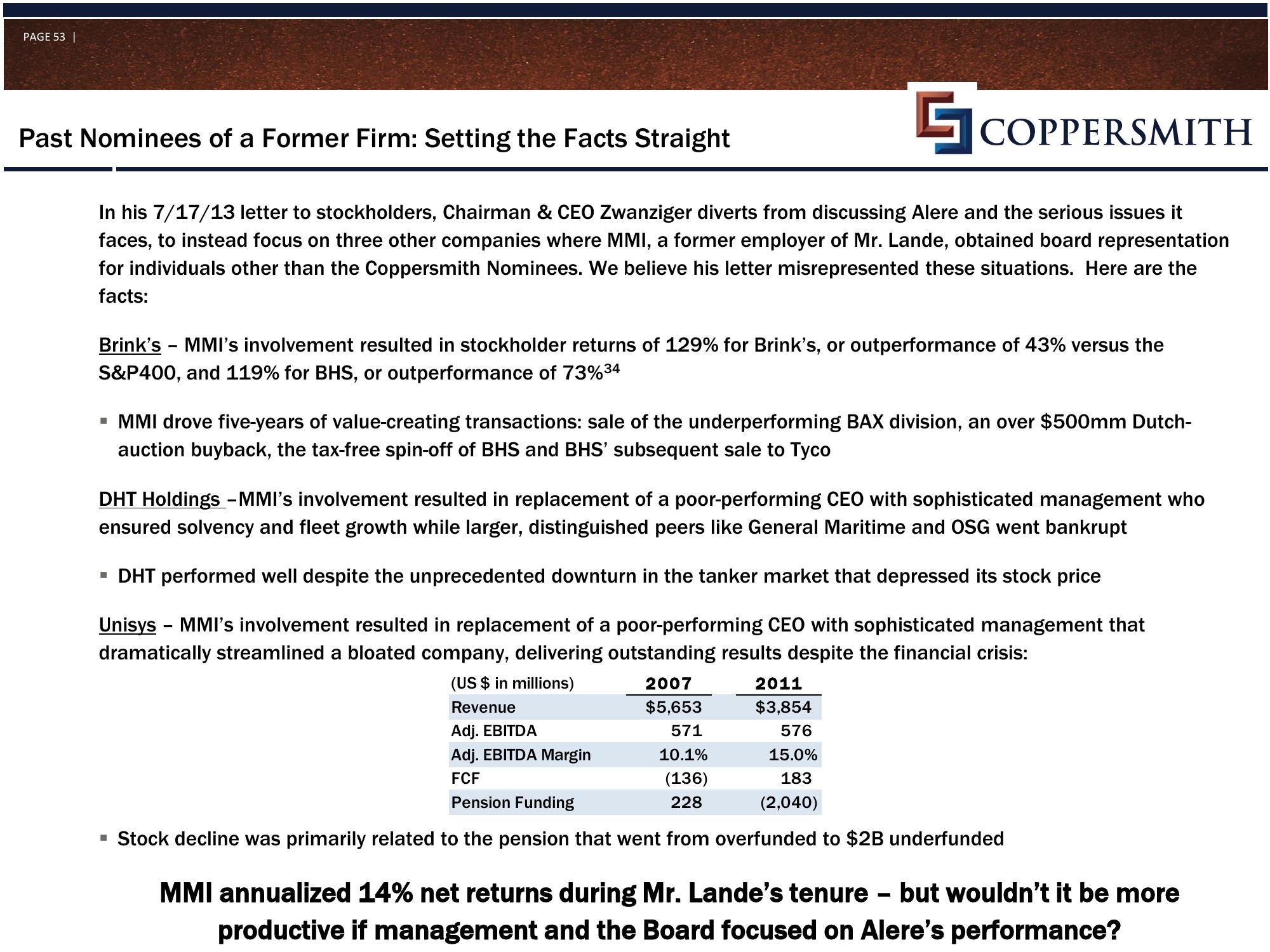

Unisys - MMI's involvement resulted in replacement of a poor-performing CEO with sophisticated management that

dramatically streamlined a bloated company, delivering outstanding results despite the financial crisis:

(US$ in millions)

Revenue

2007

$5,653

571

10.1%

(136)

228

2011

$3,854

Adj. EBITDA

Adj. EBITDA Margin

FCF

Pension Funding

▪ Stock decline was primarily related to the pension that went from overfunded to $2B underfunded

576

15.0%

183

(2,040)

MMI annualized 14% net returns during Mr. Lande's tenure - but wouldn't it be more

productive if management and the Board focused on Alere's performance?View entire presentation