Credit Suisse Results Presentation Deck

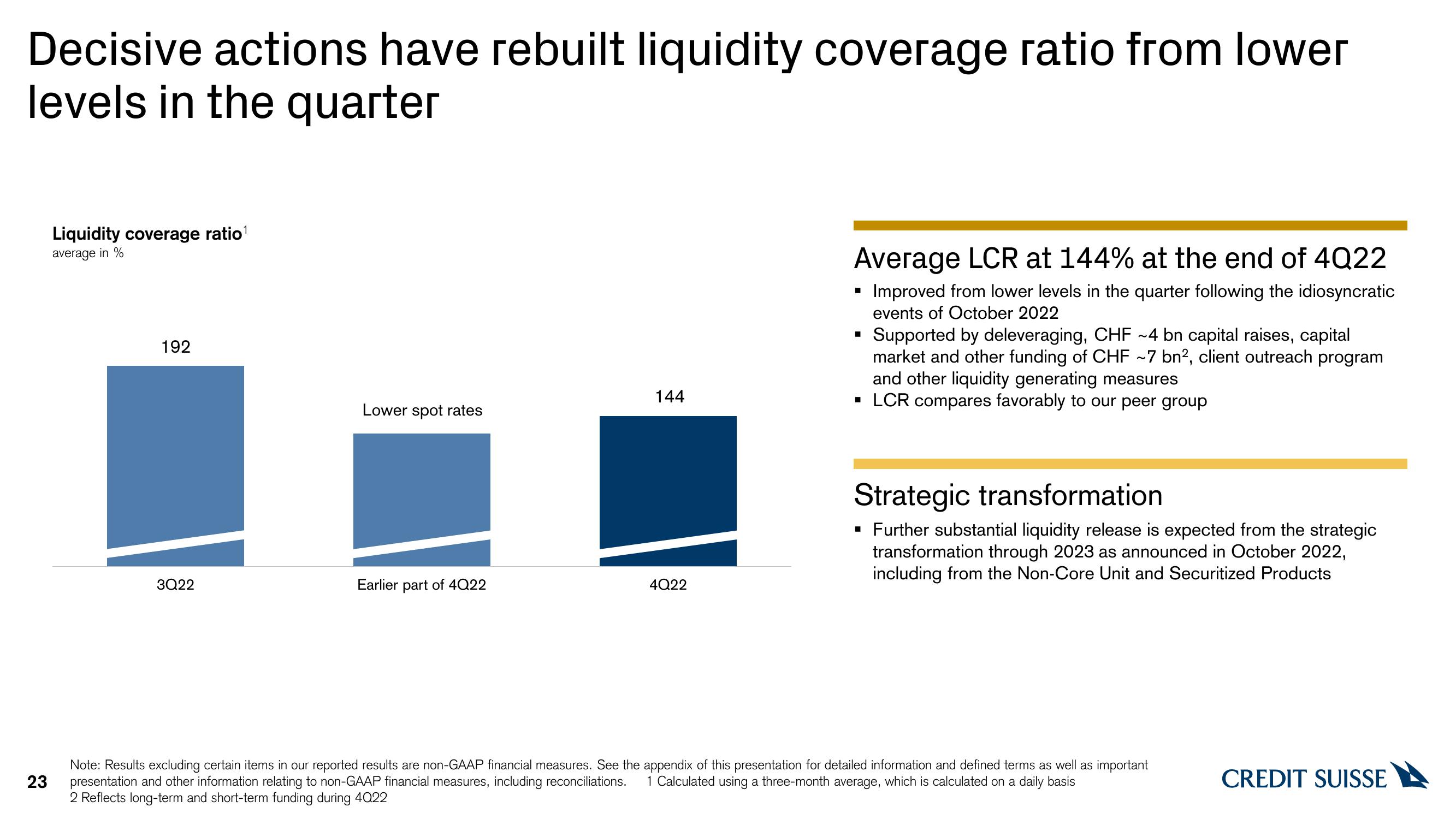

Decisive actions have rebuilt liquidity coverage ratio from lower

levels in the quarter

23

Liquidity coverage ratio¹

average in %

192

3Q22

Lower spot rates

Earlier part of 4Q22

144

4Q22

Average LCR at 144% at the end of 4Q22

▪ Improved from lower levels in the quarter following the idiosyncratic

events of October 2022

Supported by deleveraging, CHF ~4 bn capital raises, capital

market and other funding of CHF ~7 bn², client outreach program

and other liquidity generating measures

▪ LCR compares favorably to our peer group

■

Strategic transformation

▪ Further substantial liquidity release is expected from the strategic

transformation through 2023 as announced in October 2022,

including from the Non-Core Unit and Securitized Products

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Calculated using a three-month average, which is calculated on a daily basis

2 Reflects long-term and short-term funding during 4022

CREDIT SUISSEView entire presentation