Nikola Results Presentation Deck

NIKOLA.

PAGE

.

14

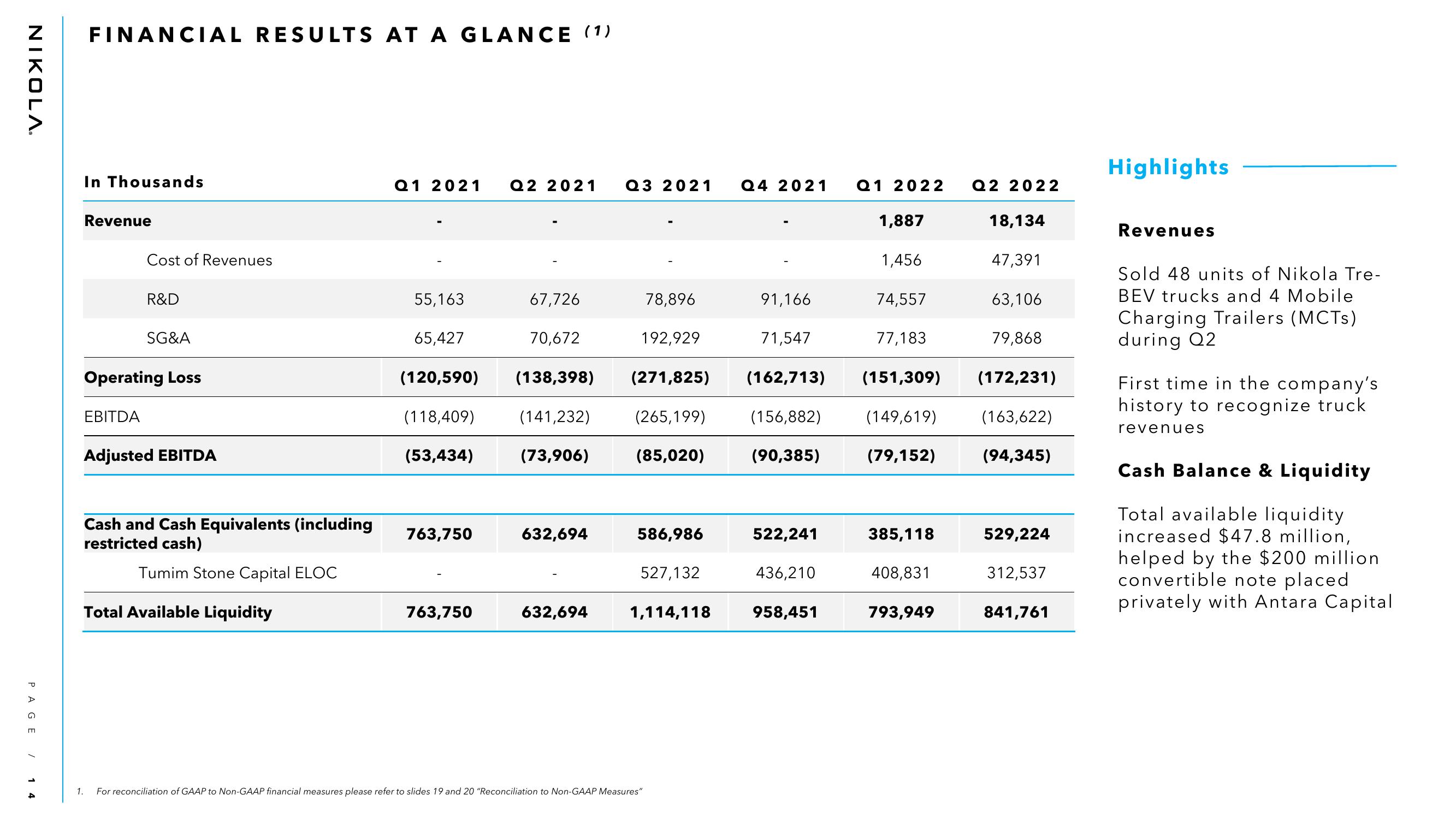

FINANCIAL RESULTS AT A GLANCE (1)

In Thousands

Revenue

Cost of Revenues

EBITDA

R&D

SG&A

Operating Loss

Adjusted EBITDA

Cash and Cash Equivalents (including

restricted cash)

Tumim Stone Capital ELOC

Total Available Liquidity

Q1 2021 Q2 2021 Q3 2021 Q4 2021

55,163

67,726

78,896

65,427

70,672

192,929

(120,590) (138,398) (271,825)

(118,409)

(141,232)

(265,199)

(53,434)

(73,906)

(85,020)

763,750

763,750

632,694

632,694

586,986

527,132

1,114,118

1. For reconciliation of GAAP to Non-GAAP financial measures please refer to slides 19 and 20 "Reconciliation to Non-GAAP Measures"

522,241

Q1 2022

436,210

958,451

1,887

91,166

71,547

(162,713) (151,309)

(156,882)

(149,619)

(90,385)

(79,152)

1,456

74,557

77,183

385,118

408,831

793,949

Q2 2022

18,134

47,391

63,106

79,868

(172,231)

(163,622)

(94,345)

529,224

312,537

841,761

Highlights

Revenues

Sold 48 units of Nikola Tre-

BEV trucks and 4 Mobile

Charging Trailers (MCTS)

during Q2

First time in the company's

history to recognize truck

revenues

Cash Balance & Liquidity

Total available liquidity

increased $47.8 million,

helped by the $200 million

convertible note placed

privately with Antara CapitalView entire presentation