Silicon Valley Bank Results Presentation Deck

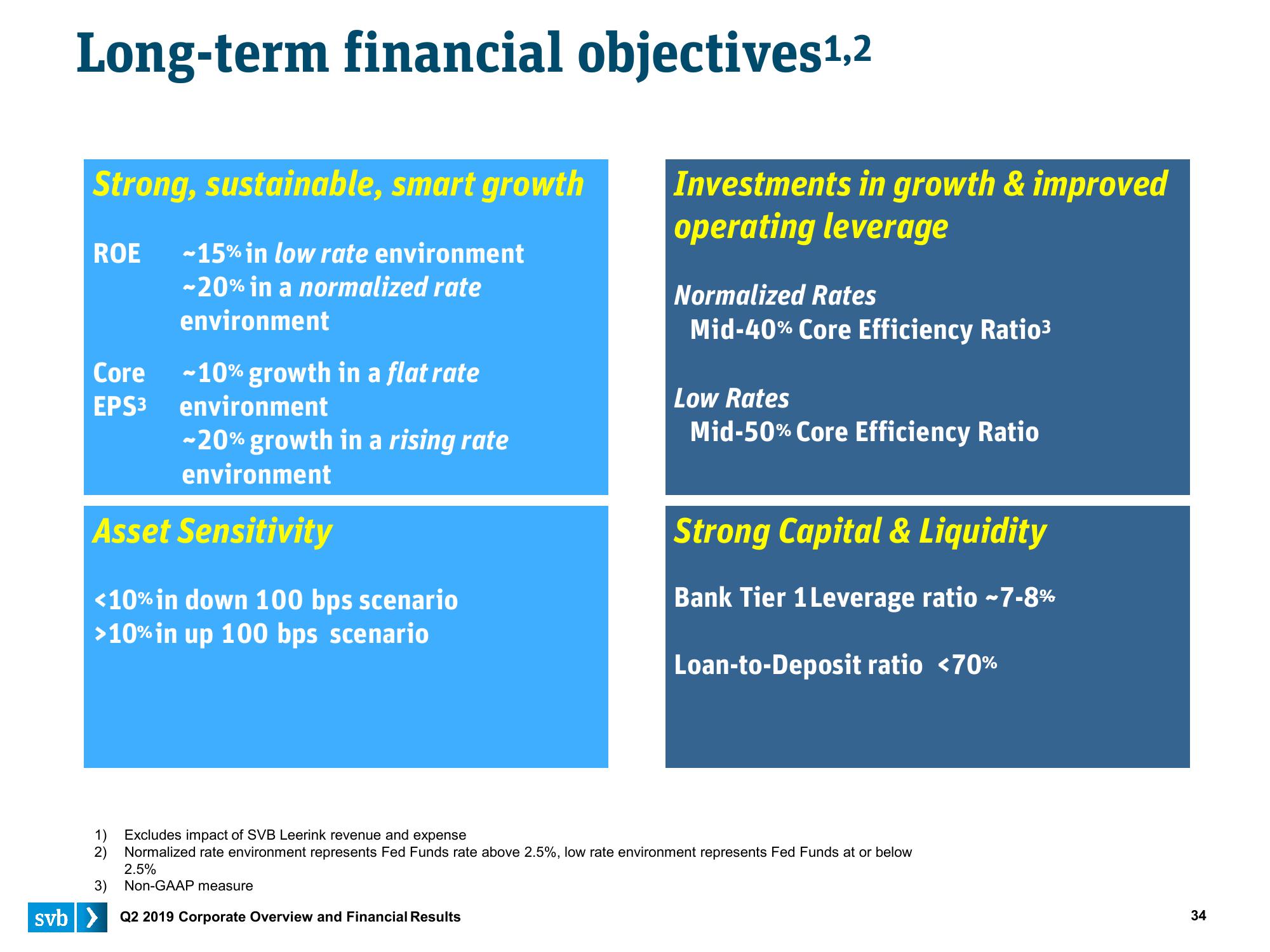

Long-term financial objectives ¹,2

Strong, sustainable, smart growth

ROE -15% in low rate environment

~20% in a normalized rate

environment

Core ~10% growth in a flat rate

EPS³ environment

-20% growth in a rising rate

environment

Asset Sensitivity

<10% in down 100 bps scenario

>10% in up 100 bps scenario

1)

2)

3)

Investments in growth & improved

operating leverage

Normalized Rates

Mid-40% Core Efficiency Ratio³

Low Rates

Mid-50% Core Efficiency Ratio

Strong Capital & Liquidity

Bank Tier 1 Leverage ratio ~7-8%

Loan-to-Deposit ratio <70%

Excludes impact of SVB Leerink revenue and expense

Normalized rate environment represents Fed Funds rate above 2.5%, low rate environment represents Fed Funds at or below

2.5%

Non-GAAP measure

svb> Q2 2019 Corporate Overview and Financial Results

34View entire presentation