Altus Power Investor Presentation Deck

Cash Generation Reinvested Into Additional Growth

●

●

●

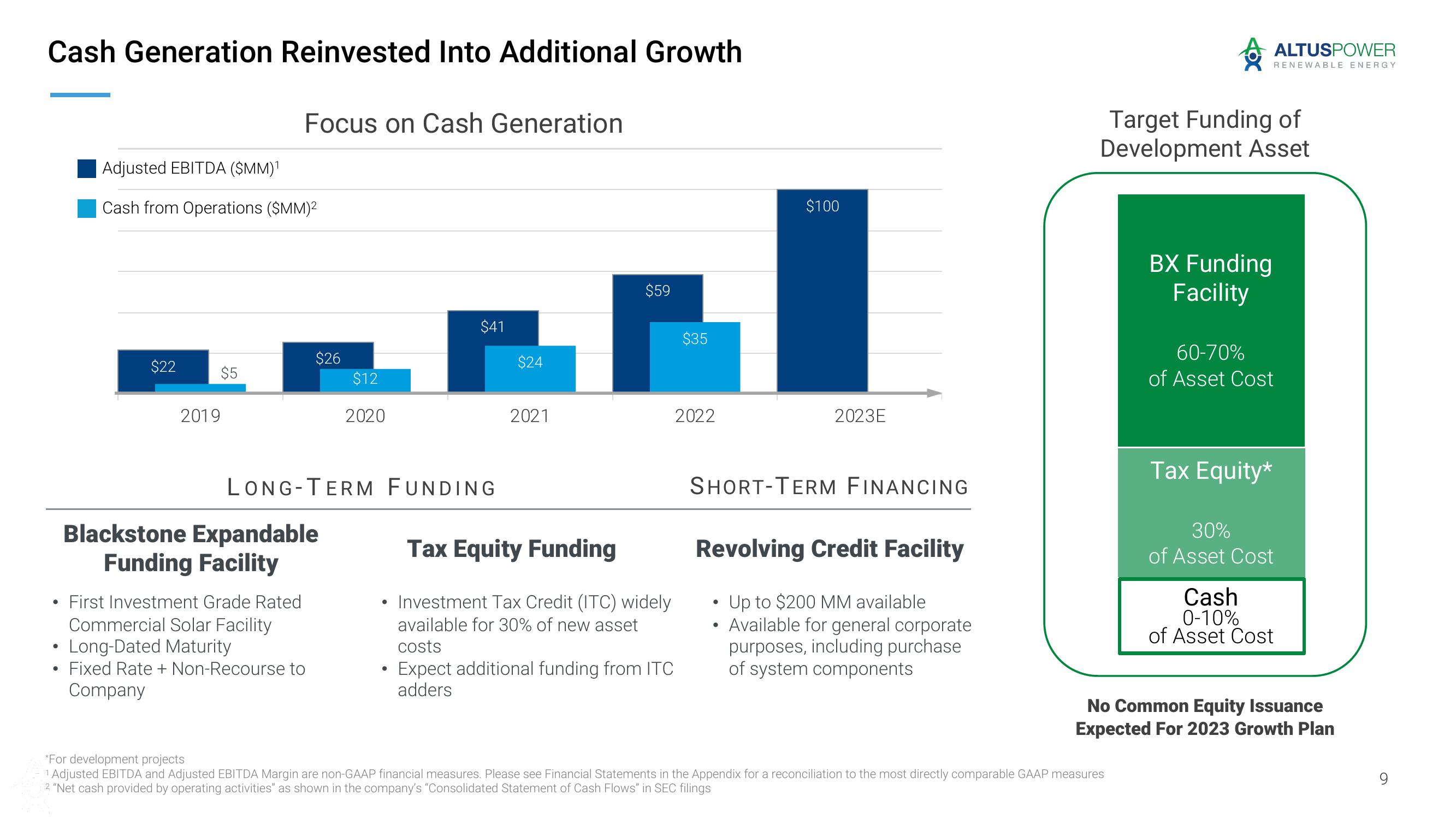

Adjusted EBITDA ($MM)¹

Cash from Operations ($MM)²

$22

$5

Focus on Cash Generation

2019

$26

Blackstone Expandable

Funding Facility

First Investment Grade Rated

Commercial Solar Facility

Long-Dated Maturity

Fixed Rate + Non-Recourse to

Company

$12

2020

LONG-TERM FUNDING

●

$41

●

$24

2021

$59

$35

2022

Tax Equity Funding

Investment Tax Credit (ITC) widely

available for 30% of new asset

costs

Expect additional funding from ITC

adders

$100

SHORT-TERM FINANCING

●

2023E

Revolving Credit Facility

Up to $200 MM available

Available for general corporate

purposes, including purchase

of system components

●

Target Funding of

Development Asset

BX Funding

Facility

*For development projects

1 Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures. Please see Financial Statements in the Appendix for a reconciliation to the most directly comparable GAAP measures

2 "Net cash provided by operating activities" as shown in the company's "Consolidated Statement of Cash Flows" in SEC filings

ALTUSPOWER

RENEWABLE ENERGY

Tax Equity*

60-70%

of Asset Cost

30%

of Asset Cost

Cash

0-10%

of Asset Cost

No Common Equity Issuance

Expected For 2023 Growth PlanView entire presentation