Bank of America Investment Banking Pitch Book

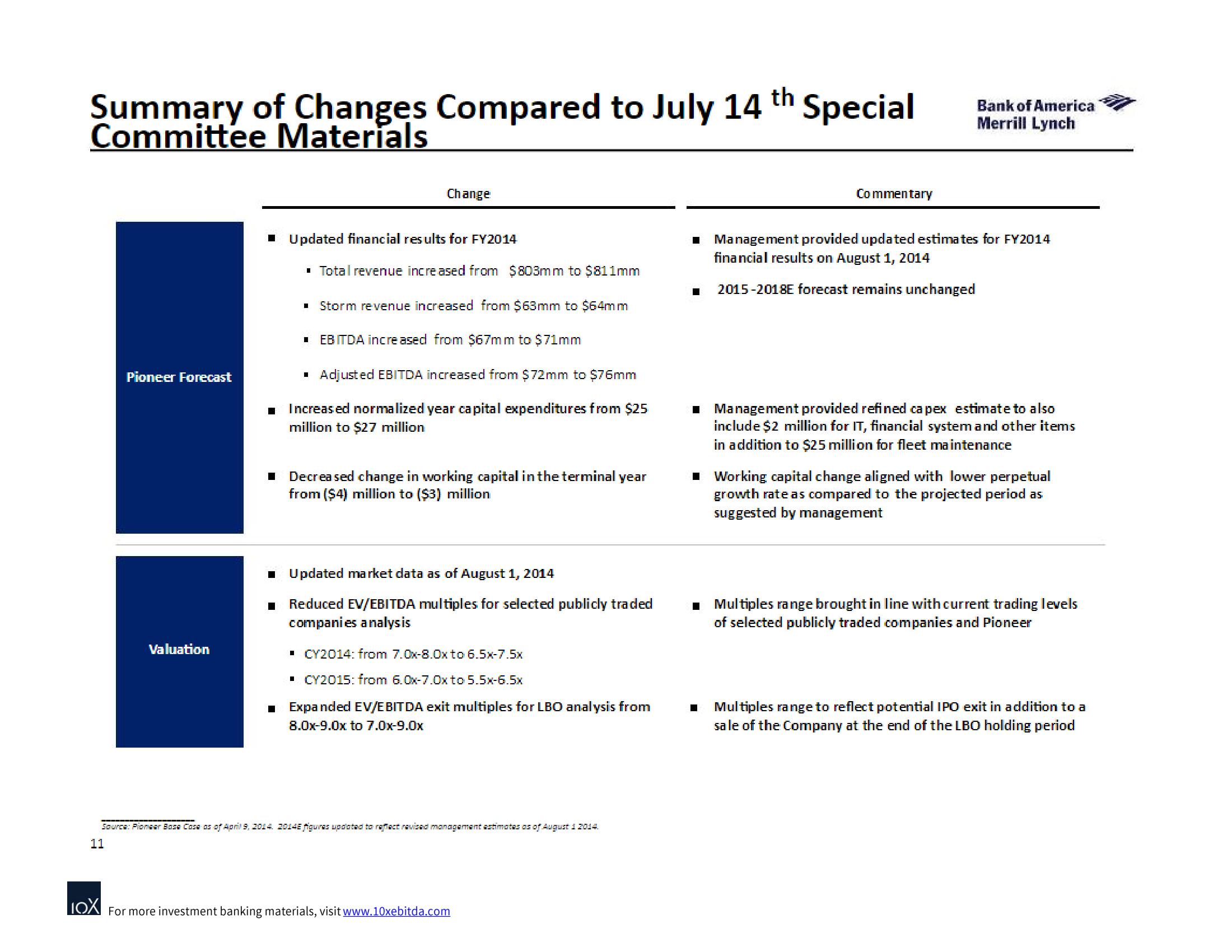

Summary of Changes Compared to July 14 th Special

Committee Materials

Pioneer Forecast

Valuation

Change

■ Updated financial results for FY2014

▪ Total revenue increased from $803mm to $811mm

■ Storm revenue increased from $63mm to $64mm

■ EBITDA increased from $67mm to $71mm

I Adjusted EBITDA increased from $72mm to $76mm

Increased normalized year capital expenditures from $25

million to $27 million

Decreased change in working capital in the terminal year

from ($4) million to ($3) million

■ Updated market data as of August 1, 2014

■ Reduced EV/EBITDA multiples for selected publicly traded

companies analysis

▪ CY2014: from 7.0x-8.0x to 6.5x-7.5x

■ CY2015: from 6.0x-7.0x to 5.5x-6.5x

Expanded EV/EBITDA exit multiples for LBO analysis from

8.0x-9.0x to 7.0x-9.0x

Source: Pioneer Bose Cose as of April 9, 2014. 2014E figuras updated to reflect revised management estimates as of August 1 2014.

11

IOX For more investment banking materials, visit www.10xebitda.com

Commentary

Bank of America

Merrill Lynch

■ Management provided updated estimates for FY2014

financial results on August 1, 2014

1 2015-2018E forecast remains unchanged

■ Management provided refined ca pex estimate to also

include $2 million for IT, financial system and other items

in addition to $25 million for fleet maintenance

■ Working capital change aligned with lower perpetual

growth rate as compared to the projected period as

suggested by management

■ Multiples range brought in line with current trading levels

of selected publicly traded companies and Pioneer

Multiples range to reflect potential IPO exit in addition to a

sale of the Company at the end of the LBO holding periodView entire presentation