NVIDIA Investor Presentation Deck

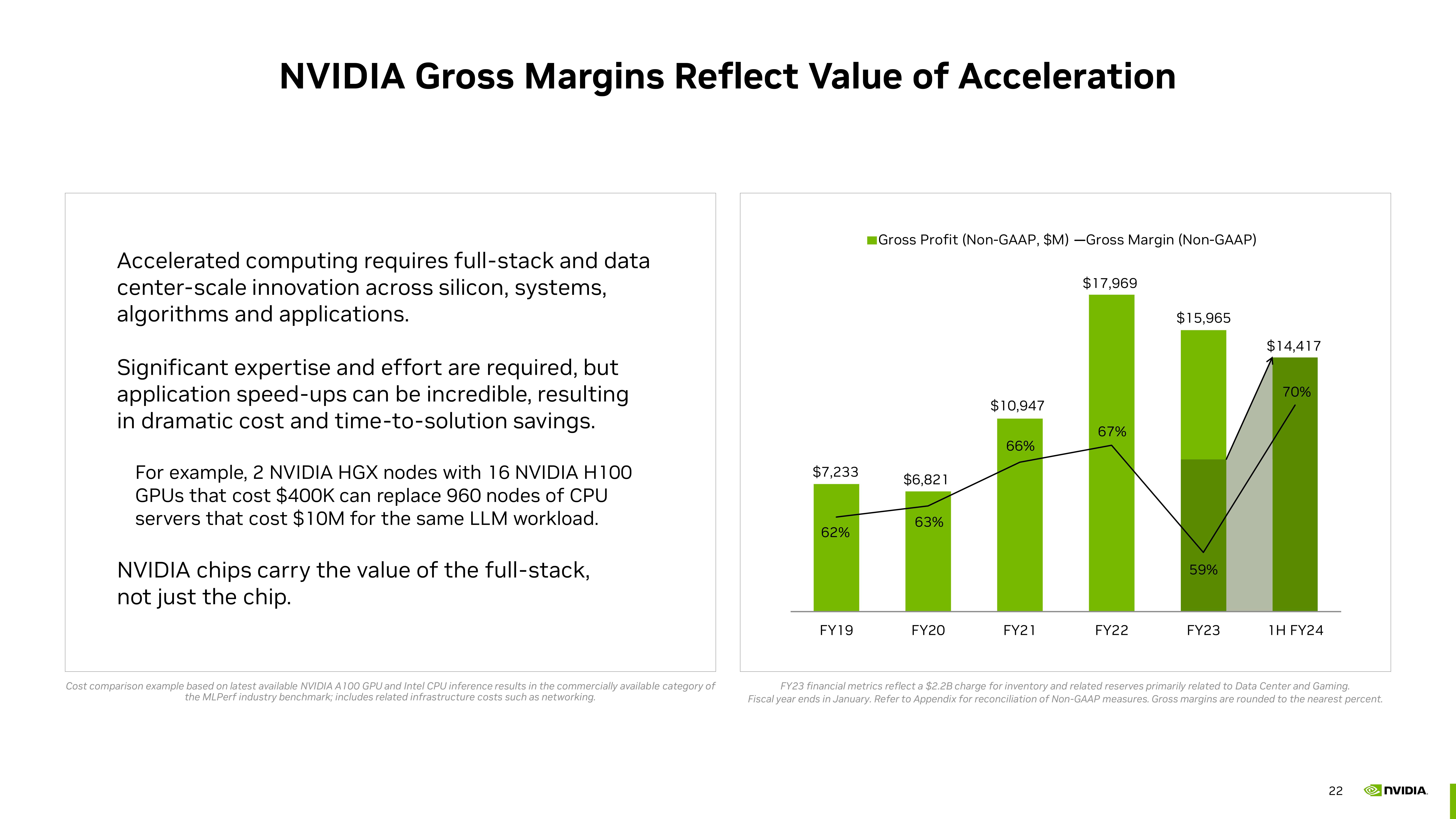

NVIDIA Gross Margins Reflect Value of Acceleration

Accelerated computing requires full-stack and data

center-scale innovation across silicon, systems,

algorithms and applications.

Significant expertise and effort are required, but

application speed-ups can be incredible, resulting

in dramatic cost and time-to-solution savings.

For example, 2 NVIDIA HGX nodes with 16 NVIDIA H100

GPUs that cost $400K can replace 960 nodes of CPU

servers that cost $10M for the same LLM workload.

NVIDIA chips carry the value of the full-stack,

not just the chip.

Cost comparison example based on latest available NVIDIA A 100 GPU and Intel CPU inference results in the commercially available category of

the MLPerf industry benchmark; includes related infrastructure costs such as networking.

$7,233

62%

FY19

Gross Profit (Non-GAAP, $M) -Gross Margin (Non-GAAP)

$6,821

63%

FY20

$10,947

66%

FY21

$17,969

67%

FY22

$15,965

59%

FY23

$14,417

70%

1H FY24

FY23 financial metrics reflect a $2.2B charge for inventory and related reserves primarily related to Data Center and Gaming.

Fiscal year ends in January. Refer to Appendix for reconciliation of Non-GAAP measures. Gross margins are rounded to the nearest percent.

22

NVIDIAView entire presentation