The Urgent Need for Change and The Superior Path Forward

PRIVET CASE STUDY: BOARD REPRESENTATION AT

GREAT LAKES DREDGE & DOCK (GLDD)

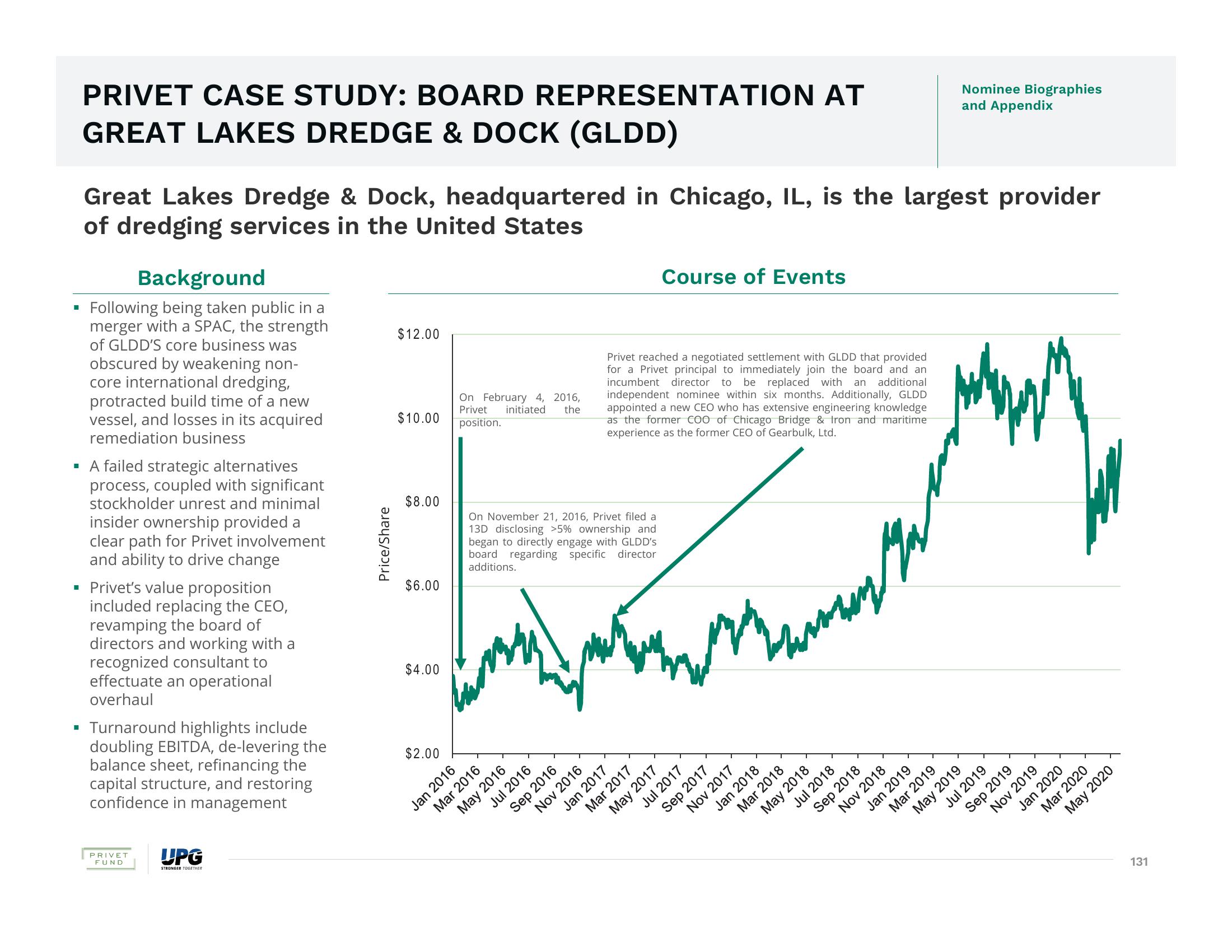

Great Lakes Dredge & Dock, headquartered in Chicago, IL, is the largest provider

of dredging services in the United States

Background

Following being taken public in a

merger with a SPAC, the strength

of GLDD'S core business was

obscured by weakening non-

core international dredging,

protracted build time of a new

vessel, and losses in its acquired

remediation business

▪ A failed strategic alternatives

process, coupled with significant

stockholder unrest and minimal

insider ownership provided a

clear path for Privet involvement

and ability to drive change

Privet's value proposition

included replacing the CEO,

revamping the board of

directors and working with a

recognized consultant to

effectuate an operational

overhaul

▪ Turnaround highlights include

doubling EBITDA, de-levering the

balance sheet, refinancing the

capital structure, and restoring

confidence in management

PRIVET

FUND

UPG

STRONGER TOGETHER

Price/Share

$12.00

$10.00

$8.00

$6.00

$4.00

$2.00

On February 4, 2016,

Privet initiated the

position.

any

Jan 2016

On November 21, 2016, Privet filed a

13D disclosing >5% ownership and

began to directly engage with GLDD's

board regarding specific director

additions.

Mar 2016

May 2016

Jul 2016

Sep 2016

Nov 2016

Course of Events

Privet reached a negotiated settlement with GLDD that provided

for a Privet principal to immediately join the board and an

incumbent director to be replaced with an additional

independent nominee within six months. Additionally, GLDD

appointed a new CEO who has extensive engineering knowledge

as the former COO of Chicago Bridge & Iron and maritime

experience as the former CEO of Gearbulk, Ltd.

Jan 2017

Mar 2017

May 2017

Jul 2017

Sep 2017

Nov 2017

Jan 2018

versche

Mar 2018

May 2018

Jul 2018

Sep 2018

Jan 2019

Nov 2018

Mar 2019

Nominee Biographies

and Appendix

May 2019

Jul 2019

Sep 2019

Nov 2019

Jan 2020

Mar 2020

May 2020

131View entire presentation